1st Mar 2023. 9.00am

Regency View:

BUY Smith & Nephew (SN.)

- Value

Regency View:

BUY Smith & Nephew (SN.)

Smith & Nephew starting to turn a corner

When it comes to value plays, we’re not ones for catching falling knifes.

We like to wait for inflection points, sweet spots of opportunity where the market has recognised improved performance, but valuations remain deeply discounted.

A great example of this is medical device maker Smith & Nephew (SN.)…

Smith & Nephew have underperformed in recent years as the pandemic caused a reduction in routine operations along with a global supply chain crisis.

However, having just published an upbeat set of Final Results, the business looks to have turned a corner both in the boardroom and on the price chart – a sweet spot of opportunity that the long-term investor can capitalise on.

An innovative market leader

Smith & Nephew is a FTSE 100 stalwart and a household name.

As such you’re probably already aware that they’re a global market leader in developing and producing medical devices.

What you might not be aware of is that Smith & Nephew are at the cutting edge of innovation in the three core segments they operate across:

Advanced Wound Management

Smith & Nephew are the second largest global Advanced Wound Management business.

Advanced Wound Management is a $10.3bn market of which Smith & Nephew have a 14% market share.

Smith & Nephew are leading the field in negative pressure wound therapy (NPWT) – a method of drawing out fluid and infection from a wound to help it heal.

There is a growing body of evidence that NPWT is a superior method of surgical wound healing and it’s an area that Smith & Nephew are keen to scale up and grow.

Orthopaedics

Hip and knee replacements will unfortunately never go out of fashion and Smith & Nephew have captured 11% of this vast global market.

Whilst competition is strong from the likes of US-based companies Stryker, Zimmer Biomet and DePuy Synthes, Smith & Nephew’s innovation around cementless knee systems and robotic surgery are core differentiators.

Sports Medicine

Sports Medicine is a smaller but faster growing market than Advanced Wound Management and Orthopaedics.

Smith & Nephew and US-based Arthrex dominate this market, capturing 27% and 33% of global revenue respectively.

In 2022, Smith & Nephew released a host of innovative new products in the Sport Medicine space.

These included its Reimagine Reconstruction portfolio of solutions to address the full spectrum of ligament injuries. And REGENETEN, an implant designed to supports the body’s natural healing response required to facilitate healing of rotator cuff tears and a market which could address approx. 17m people in the US alone.

Market gives vote of confidence

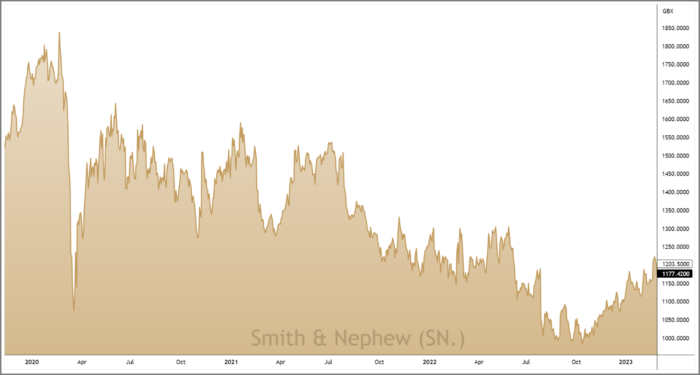

Last week, Smith & Nephew’s share price gapped higher following the publication of their Final Results for FY22.

Whilst the headline numbers for 2022 were nothing to write home about (trading profit was down 3.7% to $901m due to inflation and higher marketing expenditure) Smith & Nephew’s upbeat outlook got the market’s attention…

This year (FY23), Smith & Nephew are targeting underlying revenue growth in the range of 5% to 6% and trading profit margin of at least 17.5%.

And medium-term targets were upgraded with CEO, Deepak Nath targeting revenue growth consistently above 5% and trading profit margins of at least 20% in 2025.

“I believe the drivers of further growth are in place, including leading technologies across all three franchises and a clear path to improved execution in Orthopaedics” said Mr Nath in his closing statement.

“We expect to deliver both faster revenue growth and margin expansion in the coming year, and are setting a solid foundation for our midterm ambitions as we transform to a consistently higher growth company” he added.

Despite continual references to a dreaded “12-point plan” the market enjoyed Mr Nath’s comments and the shares were one of the FTSE’s top performers last week.

The market’s strong vote of confidence should not be underestimated, and recent price action has seen the shares break above a long-term descending trendline, signalling that the shares have finally started to turn a corner.

Deep discount to Fair Value

Smith & Nephew’s financials and valuation indicate that the stock offers reasonably priced quality.

The stock trades on a forward PE of 16.7 which is middling for its peer group, but compares well to forecast earnings per share (EPS) growth of 147.8%.

Debt levels are well covered by earnings and cashflows and the stock is currently trading at a 31.5% discount to Fair Value.

Fair Value is theoretical and based on projected cashflows and a number of assumptions, but it gives long-term investors a fighting chance of gauging when a stock is undervalued.

The shares also come with a 2.61% forward dividend yield which is nearly 2 times covered by forecasted free cash flows. Dividends are of course not guaranteed, but should Smith & Nephew deliver on its plans for more profitable growth, investors are likely to see this pay-out rise.

Given the stability of Smith & Nephew’s end markets, we believe picking the stock up when it is trading at historically low levels (60% headroom to 2020 highs) is likely to be a smart move over the long term.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.