29th Mar 2023. 9.00am

Regency View:

BUY Rentokil Initial (RTO)

- Growth

Regency View:

BUY Rentokil Initial (RTO)

Rentokil offers resilient revenue growth

In a month which has seen a major bank need a bailout, the FTSE tumble more than 700 points, and UK inflation hit double figures, defensive stocks are starting to look attractive.

And there’s no better stock to beef up our defensive coverage than rat-catcher Rentokil Initial (RTO).

Just like cockroaches scuttling through nuclear fallout, demand for Rentokil’s pest control services are insulated from pandemics and banking meltdowns.

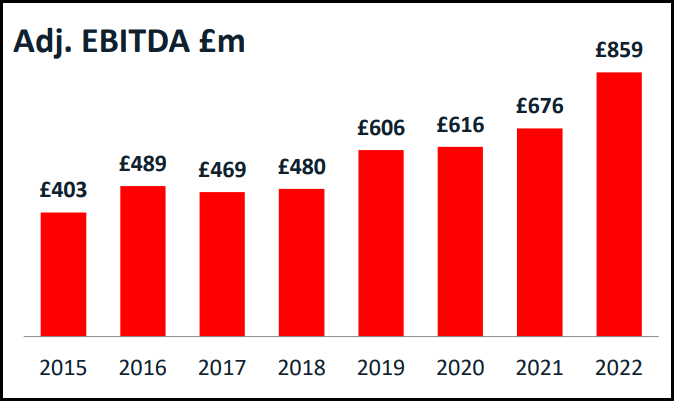

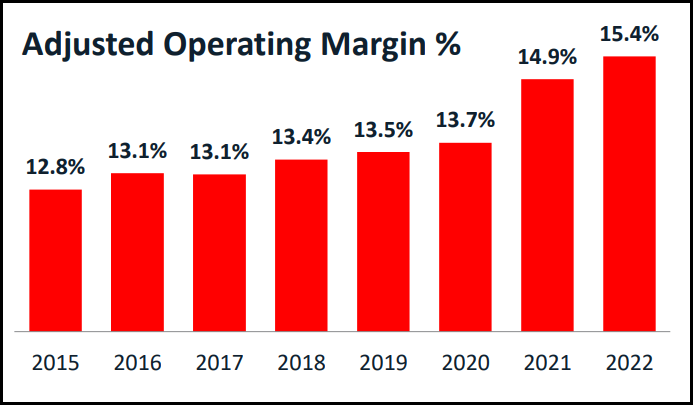

Rentokil’s revenue growth is unrelenting and operating margins are increasing due to slick integrations of smart acquisitions.

Strong and growing pest control market

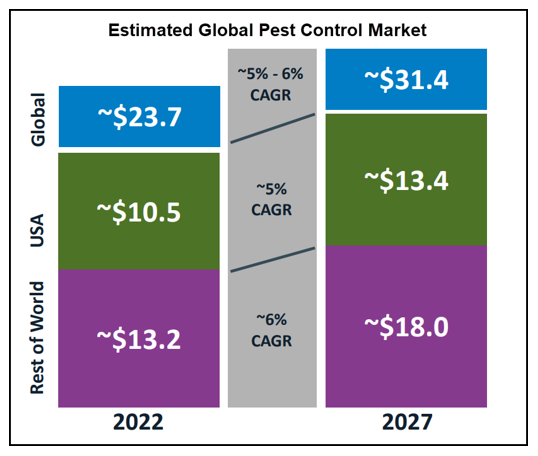

Rising global population, increasing urbanisation and higher sanitation standards are just some of the long-term factors which are driving global demand for pest control.

It’s a market that is growing at a compound annual rate of ~6% (CAGR) and estimated to be worth ~$31.4bn by 2027.

More than two-thirds of Rentokil’s £3.5bn (FY22) total revenue comes from pest control with a roughly 50/50 split between commercial and residential services.

The business comfortably achieved organic growth of 6.6% last year. And a highly fragmented market has created a rich hunting ground, with 52 bolt-on acquisitions in 2022 taking total revenue growth to 19.1% (FY22) and delivering a 22.7% jump in operating profit.

Key acquisition delivers quicker than expected cost savings

The US is the world’s biggest pest control market, worth around $10bn of which 20% is dedicated to the control of termites.

Termites, can cause irreparable damage to wood-framed buildings and these little critters are active in 49 states across the US.

Marry this with the fact that 92% of new homes in the US are wood-framed and it’s not hard to see why termite control is a key strategic market for Rentokil and the driving force behind the landmark acquisition of Terminix.

Terminix is the number one termite control specialist in the US and Rentokil acquired the business for $5.4bn in December 2021.

The Terminix mega-deal completed in October 2022, and whilst the integration remains in progress, Rentokil’s recent Full Year Results suggest it is off to a very strong start…

Cost synergies from the Terminix tie up amounted to $13mn (£10.7mn), well ahead of guidance, and the management anticipates a further $60mn in 2023, leading to a total saving of $200mn by 2025.

“Early progress on integration has been excellent” said Rentokil CEO, Andy Ransom.

“We continue to offset inflation with pricing and the early headway made in delivery of Terminix acquisition benefits” he added.

Rentokil lifted its medium-term forecast for organic revenue growth to at least 5%, up from a previous range of 4-5%.

Breakout creates technical catalyst

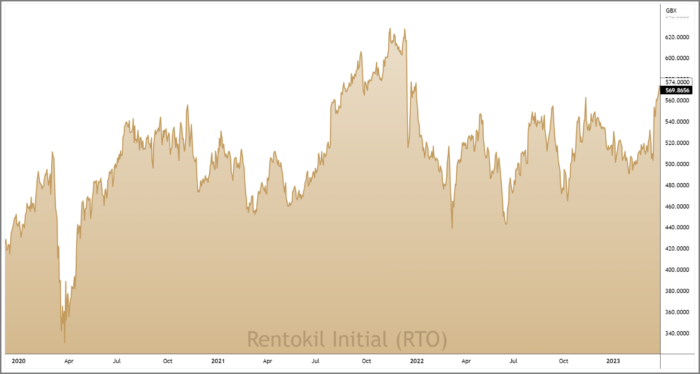

The market’s reaction to Rentokil’s recent results saw the shares surge higher towards a key resistance zone at 553p – 562p.

This resistance zone had been in place for the last year as Rentokil’s share price chopped sideways with investors distracted by more aggressive growth stocks linked to the reopening of China.

Importantly, Rentokil’s share price has finally broken and held above the resistance zone – opening the door for a retest of the December 2021 highs, some 15% above current prices and creating a technical catalyst to time our entry.

Defensive growth worth paying for

Given Rentokil’s defensive growth characteristics, this is not the type of stock that trades on a bargain basement valuation.

Investors are being asked to pay more than twenty times forward earnings, but this looks reasonable given Rentokil’s revenue and profit trajectory.

Adjusted earnings (EBITDA) jumped 27.1% to £859m last year on the back of sustained revenue and margin growth.

And with earnings per share (EPS) forecast to grow 33% next year, Rentokil’s forward price to earnings (PE) ratio of 23.7 is not expensive.

The business is highly cash generative with free cashflow of £374m (FY22) – representing 92% adjusted free cashflow conversion.

Rentokil’s modest, well covered dividend yield of 1.32% also has potential to increase steadily and dovetail nicely with its growing recurring revenues.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.