12th Jun 2024. 9.00am

Regency View:

BUY Premier Foods (PFD)

- Value

Regency View:

BUY Premier Foods (PFD)

Premier Foods: Maintaining margins and gaining market share

Maintaining margins while simultaneously gaining market share is no small feat, especially in the fiercely competitive food industry.

Premier Foods (PFD), however is doing just that. The company’s strategic prowess and operational efficiency is allowing it to keep its top line and bottom line growing.

Brand strength and strategic pricing

Premier Foods success is intricately tied to the strength of its brand portfolio and its strategic approach to pricing. These two pillars not only underpin the company’s profitability but also play a pivotal role in its ability to maintain margins while expanding its market share.

- Brand strength:

Premier Foods boasts a portfolio of iconic brands that have become household names across the UK and beyond. From the beloved Mr Kipling cakes to the comforting flavours of Bisto gravies and sauces, these brands evoke nostalgia and trust among consumers. The company’s extensive brand recognition and loyalty provide a solid foundation for sustaining its market position and driving growth.

Premier Foods has continually invested in revitalising its brands to ensure they remain relevant in a rapidly evolving market. In the fiscal year ending March 30, 2024, the company increased its marketing investment across all major brands, extending its ‘Best Restaurant in Town’ campaign into its second year.

Furthermore, Premier Foods’ product innovation has been instrumental in enhancing the appeal of its brands and capturing new market segments. The introduction of innovative offerings such as Ambrosia Deluxe range and porridge pots has contributed to the growth of the Ambrosia brand, which surpassed £100 million in revenue. These new product launches accounted for a significant portion of the company’s revenue growth in the fiscal year, underscoring the importance of innovation in driving brand success.

- Strategic pricing:

In the face of fluctuating input costs and competitive dynamics, Premier Foods has adopted a strategic pricing strategy that balances the need to protect margins with the imperative to remain competitive in the market. The company leverages its deep understanding of consumer behaviour, market trends, and cost structures to set prices that reflect the value proposition of its products while maximizing profitability.

In the fiscal year ending March 30, 2024 (FY24), the company successfully implemented targeted price adjustments on select product ranges, allowing it to offset rising input costs without compromising market competitiveness. These pricing initiatives contributed to the company’s ability to maintain a trading profit margin of 16%, in line with the prior year, despite cost pressures.

By carefully calibrating its pricing strategies, the company can optimise revenue and profitability while safeguarding its market share and brand reputation.

Discounted valuation

Unlike its brands, Premier Food’s share price does not command a premium valuation…

Using a Discounted Cash Flow (DCF) model, analysts have calculated Premier Foods’ fair value based on its projected future cash flows. The results indicate that the stock is trading at approximately 46.2% below its estimated fair value. This substantial discount suggests that Premier Foods’ current market price does not fully reflect its growth prospects and earnings potential.

Premier Foods’ earnings are forecast to grow at a steady pace of 5.29% per year, further bolstering its investment appeal. This consistent earnings growth trajectory underscores the company’s resilience and ability to deliver value to shareholders over the long term.

In addition to its solid earnings growth outlook, Premier Foods has demonstrated robust financial performance in recent years. In FY24, the company reported a 15.1% increase in headline revenue, reaching £1,122.6 million. And trading profit surged by 14% to £179.5 million, reflecting the company’s ability to effectively manage costs and drive operational efficiency.

Pullback creates buying opportunity

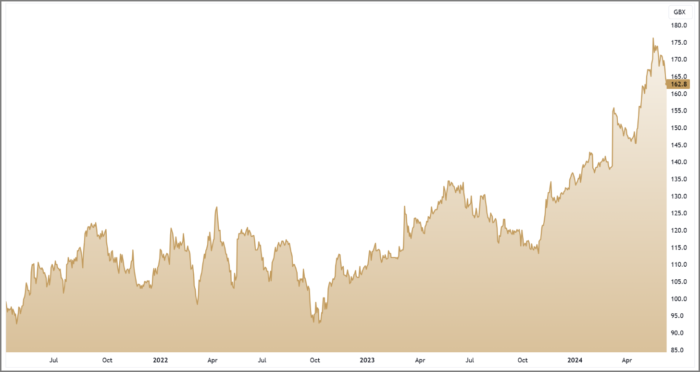

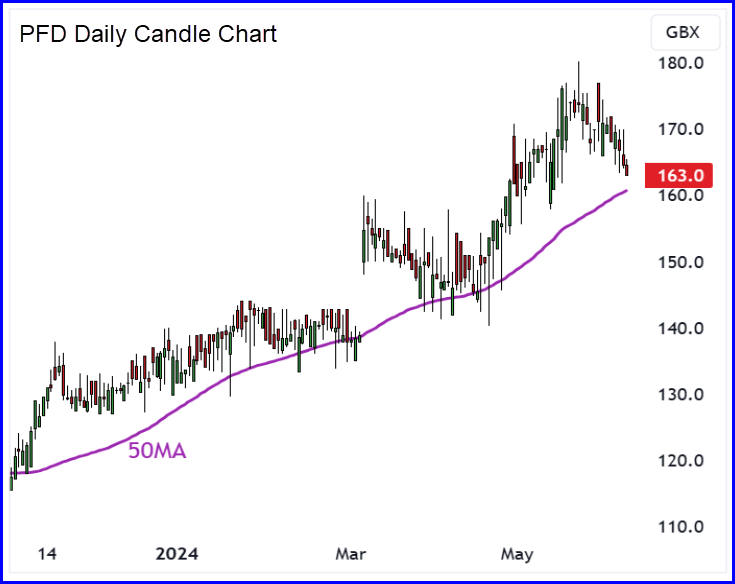

The shares have been trending higher since the turn of the year, fuelled by a series of market beating trading updates and broker upgrades.

Recent price action has seen the shares pull back from a trend highs – a move that is in step with the wider market.

This pullback has taken prices back towards the 50-day simple moving average (50MA) which is an area that has provided dynamic trend support over the last year.

We believe Premier Food’s pullback has created an attractive opportunity to position ourselves within the trend at attractive levels of risk/reward.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.