13th Nov 2024. 8.59am

Regency View:

BUY Playtech (PTEC)

- Growth

Regency View:

BUY Playtech (PTEC)

Press play on Playtech’s quality and momentum

Quality and momentum—two factors we look for when adding stocks to our select list of FTSE investor open positions—and Playtech (PTEC) has them in spades…

With solid financial health and a growing presence in key markets, Playtech has become a standout performer in the online gambling sector. Playtech’s strong momentum is reflected in its share price performance this year, while its impressive quality is demonstrated by its solid fundamentals and strategic market positioning.

A leader in gaming technology

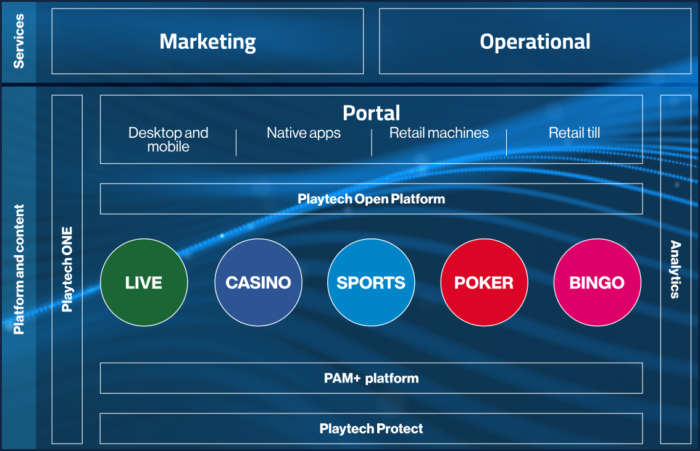

Playtech is a global leader in providing software and technology solutions for the online gambling and gaming industry. The company offers a suite of products across multiple segments, including casino, sports betting, poker, and live gaming.

Playtech’s business model is anchored in providing high-quality, innovative solutions to both B2B and B2C clients, with its B2B division seeing significant success across Europe, North America, and the emerging markets of South America and Asia.

A key highlight for Playtech is its strong B2B presence. The company collaborates with a vast array of operators, delivering customisable platforms and services that meet the diverse needs of the online gambling sector.

Playtech’s strategic focus on operational efficiency and its investment in cutting-edge technology has allowed it to maintain a strong competitive edge in a highly fragmented industry. With its services ranging from gambling software solutions to live casino technology, Playtech is deeply embedded in the fabric of the global gaming ecosystem.

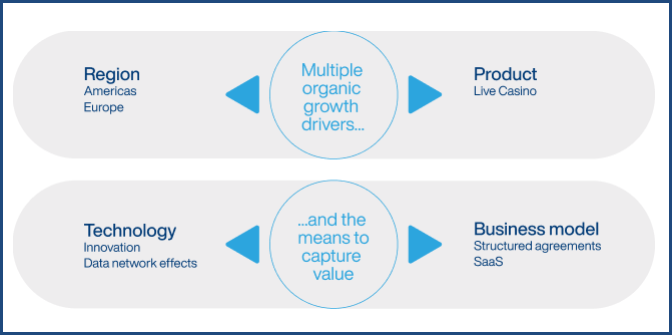

Expanding into untapped markets

One of Playtech’s most exciting growth stories lies in its expansion into untapped markets. This includes significant opportunities in North America, where the legalisation of online sports betting and casino gaming has opened up new doors for Playtech’s software and technology solutions.

Playtech is also expanding its footprint in South America, with a growing presence in Colombia, where online gaming is beginning to gain significant traction. Playtech’s ability to adapt its offerings to meet the regulatory and consumer demands in these diverse markets positions the company well for continued growth. This international diversification not only enhances Playtech’s revenue base but also reduces its dependence on any single region, offering a balanced approach to growth.

Strong momentum: An uptrend fuelled by catalysts

Playtech’s share price has demonstrated an impressive uptrend since the summer, driven by a series of positive developments and strategic moves. The shares have carved out a bullish series of higher swing highs and higher swing lows. And the 50-day moving average (MA) has remained consistently above the 200-day MA, signalling sustained positive momentum.

In August, Playtech’s shares surged by as much as 22%, following news of the potential sale of its Italian unit, Snaitech, to Flutter Entertainment for 2.3 billion euros. This move was seen as a positive step in streamlining Playtech’s operations and focusing more heavily on its core business, a strategy that was well received by the market. The sale further validated Playtech’s strategic direction and allowed the company to sharpen its focus on growing its B2B division, which has been a key driver of its earnings growth.

Following the August surge, Playtech’s shares continued to rise in September, after a trading update revealed that the company’s earnings were expected to surpass consensus expectations for the full year. The strong performance of Playtech’s B2B division, particularly in North America and Colombia, helped to sustain this upward momentum. Recent price action has seen the shares consolidate sideways within an ever-tightening range, forming a bullish flag pattern that sets the stage for another potential breakout.

Solid financials: A strong foundation for growth

Playtech’s financial profile reflects a high-quality company with strong fundamentals. The company’s balance sheet remains robust, with ample liquidity and low debt levels, which provides flexibility to invest in its growth initiatives. Playtech’s diversified revenue streams, particularly from its B2B division, offer a solid foundation for sustainable earnings growth.

In terms of valuation, Playtech’s forward P/E ratio of 14 looks reasonable, particularly considering its high-quality business model and strong market position. The shares are currently trading at a significant 41% discount to our estimate of their fair value, suggesting that there could be upside potential as the company continues to execute on its growth strategy.

Overall, we believe Playtech offers a compelling combination of quality, momentum, and growth potential. With its growing presence in unpenetrated markets, and a solid financial position, the company is well-placed to continue delivering value to shareholders. And with shares trading at a discount to their fair value and strong momentum supporting the uptrend, Playtech is a stock worth watching.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.