5th Feb 2025. 8.59am

Regency View:

BUY OSB Group (OSB)

- Value

- Income

Regency View:

BUY OSB Group (OSB)

OSB Group: A high-yield bargain hiding in plain sight

It’s been a while since we added an income play to our list of FTSE Investor open positions, and OSB Group (OSB) looks like a real cracker. The specialist mortgage lender is offering a near 8% dividend yield and trades at just 5.3x forward earnings—levels that suggest deep value in a sector where investors remain cautious.

Yet, with a history of strong profitability, a well-covered dividend, and a consensus price target pointing to over 30% upside, OSB looks primed for a re-rating. The question is: why has the market been so hesitant to reprice it?

A mortgage lender with a competitive edge

Unlike traditional high-street banks, OSB operates in niche mortgage markets, primarily serving buy-to-let landlords, self-employed borrowers, and those with complex incomes. These segments often struggle to access loans from mainstream lenders, giving OSB a natural competitive moat. This specialisation allows the company to charge slightly higher rates, maintaining strong net interest margins.

OSB’s lending operations are spread across two brands, OneSavings Bank and Charter Court Financial Services, which helps diversify its revenue base. It also uses a mix of retail deposits and wholesale funding, keeping its cost of capital competitive.

The balance sheet remains robust, with cash reserves of £3.73bn and a tangible book value per share of 565p—far above the current share price of around 404p. This means investors are effectively buying OSB at a 30% discount to its book value, a rare disconnect for a profitable, dividend-paying business.

Breaking down the value case

OSB’s valuation stands out in a sector where concerns over mortgage demand have kept many investors on the sidelines. Trading at just 5.3x forward earnings, the stock is priced well below both the sector average and its own historical range, despite delivering a strong set of results.

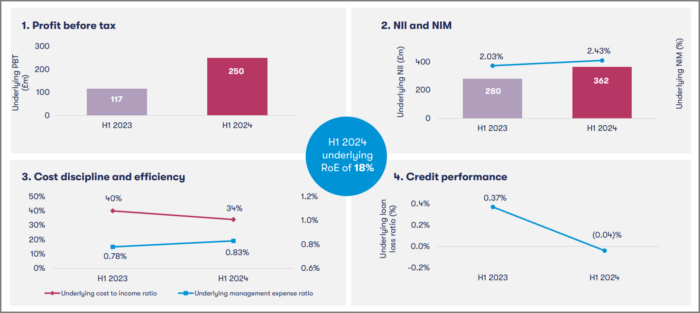

Profitability has been on the rise, with pre-tax profit surging from £117m in H1 2023 to £250m in H1 2024. This sharp increase highlights OSB’s ability to navigate a challenging mortgage market while improving margins. Net interest income (NII) has also strengthened, climbing from 2.03% to 2.43%, reflecting the company’s pricing power and disciplined lending strategy. Meanwhile, operational efficiency has improved, with the underlying cost-to-income ratio falling, demonstrating tighter cost controls and a more profitable lending model.

OSB’s dividend remains well supported, with a cover ratio of over 3x, providing confidence in the sustainability of its near 8% yield. While earnings are expected to dip slightly in 2024 (-0.6%), growth is projected to resume in 2025. The stock also screens as significantly undervalued on multiple metrics, trading at just 0.71x book value and 0.7x free cash flow—levels that suggest the market is pricing in excessive downside risks.

Despite the cautious sentiment around mortgage lenders, OSB’s earnings power remains resilient. The company posted a trailing twelve-month net profit of £402m, with consensus estimates pointing to £320m in 2024 and £301m in 2025. Even with these slightly lower forecasts, OSB continues to generate high returns, delivering an 18% return on equity (ROE) in H1 2024. This ability to generate strong profitability in a tough environment suggests the market may be overlooking OSB’s underlying strength.

Why the market is hesitant

If the numbers look this good, why is OSB trading at such low multiples? There are a few key reasons.

Firstly, the UK mortgage market has been in a prolonged period of uncertainty. Higher interest rates, weak housing transactions, and economic concerns have led investors to avoid mortgage lenders, particularly those with exposure to buy-to-let.

Secondly, December’s downgrade from Peel Hunt added to the pressure. The brokerage moved its rating from ‘add’ to ‘hold,’ citing concerns over sluggish mortgage market conditions and OSB’s recent £1.25bn securitisation deal. The downgrade led to a 7.6% drop in OSB’s share price in a single session, further denting sentiment.

However, it’s important to note that Peel Hunt actually raised its price target from 395p to 414p and acknowledged that OSB’s medium-term return prospects had improved. The downgrade seemed more about short-term concerns than long-term fundamentals.

Momentum turning?

OSB’s share price has been under pressure with the shares currently trading more than 20% below their 52-week highs.

However, the technical picture is beginning to improve. The stock is now trading above its 50-day moving average and is currently retesting its 200-day moving average. And January’s price action formed a higher swing low, suggesting early signs of a reversal.

Additionally, analysts are starting to take notice. The consensus price target sits at 552.9p, implying 31% upside from current levels. While the short-term mortgage environment remains uncertain, any signs of stabilisation could trigger a re-rating.

What could unlock value?

There are a few potential catalysts that could drive OSB’s share price higher over the next 12-18 months:

- Stabilisation in mortgage demand – The UK housing market has been sluggish, but if rate cuts materialise in late 2024 or early 2025, lending activity could pick up.

- Stronger-than-expected earnings – Despite cautious guidance, OSB has a track record of delivering consistent profits. Any upside surprises could shift sentiment.

- Potential share buybacks – With a low valuation and a strong capital position, OSB could return excess cash to shareholders.

- Dividend increases – The current 7.98% yield is already attractive, but a well-covered dividend leaves room for potential increases in the future.

A bargain hiding in plain sight

In a market where income investors are struggling to find well-covered yields above 5%, OSB’s 8% payout stands out. Add in the fact that the stock is trading at a rock-bottom valuation, and the case for a re-rating becomes even stronger.

Mortgage market uncertainty has weighed on the stock, but the company remains fundamentally strong, highly profitable, and well-positioned for a recovery. Patience may be required, but at these levels, OSB looks like a rare opportunity where the downside appears limited, and the upside is waiting to be realised.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.