6th Dec 2023. 9.01am

Regency View:

BUY Norcross (NXR)

- Value

- Income

Regency View:

BUY Norcross (NXR)

Norcros: Navigating UK’s property revival

Amidst the autumn earnings fervour, a prevailing theme emerged—renewed optimism in the UK housing market.

Bolstered by encouraging trading updates from industry giants like Persimmon and Taylor Wimpey, investors are growing increasingly confident that the UK property market has bottomed out. Recent data from mortgage heavyweights Halifax and Nationwide offer further evidence, showing consecutive month-on-month house price increases—a trend we’ve not seen since the spring.

The crux of this turnaround lies in the Bank of England’s pivotal decision to halt interest rate hikes. This move has injected stability into borrowing costs, easing the financial burdens that once deterred aspiring homeowners. This resurgent confidence has set housebuilding stocks ablaze, their values skyrocketing in recent weeks.

As we patiently wait for a pullback in the hottest housebuilding stocks, other property-related stocks further down the value chain are also picking up momentum, Norcros (NXR), a kitchen and bathroom design specialist is one of them.

Diverse brand portfolio in the UK and South Africa

Norcros operate primarily in the UK and South Africa. Their portfolio comprises of a range of market-leading brands, each specialising in different aspects of bathroom and kitchen products, catering to both residential and commercial applications.

In the UK, Norcros operates under several reputable brands including Triton, Merlyn, Vado, Croydex, Abode, Johnson Tiles, and Grant Westfield. These brands enjoy a strong market position and recognition for their innovation, contemporary designs, and trusted quality.

In South Africa, Norcros manages a group of complementary businesses such as Tile Africa, Johnson Tiles South Africa, TAL, and House of Plumbing. These operations leverage a shared manufacturing and administrative site near Johannesburg, allowing them to maximise operational synergies and market presence.

In terms of revenue split, Norcros’ UK businesses generate just of 70% of group revenue, and almost 90% of group operating profit.

Norcros’ strategic blueprint: Fragmented markets, targeted expansion

Norcros is navigating a highly fragmented UK bathroom market where no single player reigns supreme. Within these fragmented sub-market segments lies an array of opportunities for Norcros to further strengthen its position.

Their strategy is twofold: first, capitalise on their existing channel and product positioning for organic growth. By leveraging their robust channels and well-received products, Norcros aims to organically expand its market share.

Secondly, they’re eyeing the potential for strategic acquisitions. By acquiring complementary businesses, Norcros is seeking to solidify its foothold in this fragmented market, fostering both growth and consolidation. This approach isn’t just about scaling up; it’s a calculated move to strategically align themselves in key segments, taking advantage of the market’s openness for consolidation.

Interim Results reveal growing market share

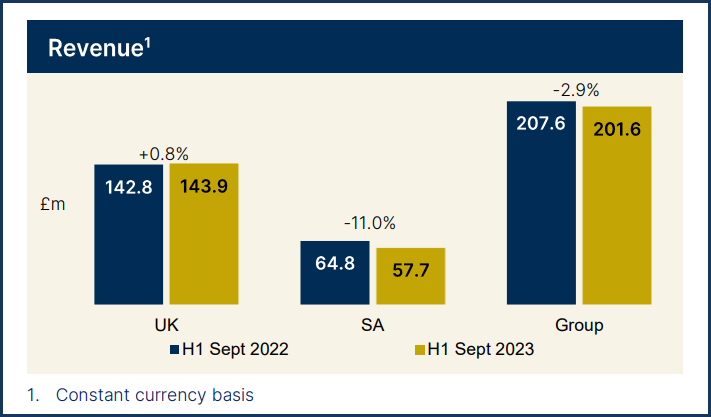

Norcros recently released its interim financial results for the period ending 30 September 2023, and showed high levels of resilience in a challenging market environment.

Despite a reported 8.3% decline in revenue from £219.9 million in 2022 to £201.6 million, the company sustained a strong underlying operating profit of £21.4 million, marking a slight 2.7% decrease from the previous year’s £22.0 million. Underlying operating profit margin improved from 10.0% to 10.6%, underlining the company’s capacity to maintain profitability amid revenue pressures.

An impressive aspect of Norcros’ results was the increase in market share which CEO, Thomas Willcocks said was “driven by successful new product launches and best in class service levels”. “We continue to expect full year underlying operating profit to be in line with market expectations” added Willcocks.

Furthermore, Norcros exhibited exceptional cash generation, totalling 121% of underlying earnings (EBITDA). With a low leverage ratio of 1.0x underlying EBITDA, the company demonstrated prudent financial management, positioning itself strongly within the market.

Renewed price momentum

Investors responded positively to Norcros’ resilience and strategic direction in navigating challenging market conditions while simultaneously increasing its market share.

The shares have rallied with strong momentum during the last month, snapping a descending trendline (gold dashed line) that had been in place for over a year.

The price momentum has also driven the shares above several key moving averages, the 50-day moving average (MA), 100-day MA and now the shares are flirting with the 200-day MA. We are also starting to see the 50-day MA cross above the 100-day MA for the first time since January.

There is now significant scope for the shares to rally towards the February swing highs at 228p – some 35% above current prices.

Sector-leading value metrics and income potential

In terms of forward valuation, Norcros is much cheaper than many of its sector peers. The stock trades on a forward price-to-earnings multiple of 5.4 – ranking first in the Homebuilding & Construction Supplies sector.

The stock also scores highly across a number of other value metrics including a Price to Book Value of 0.7, Price to Free Cashflow of 4.9, Price to Sales of 0.35 and Enterprise Value to EBITDA of 5.39.

Alongside Norcos’ attractive value comes substantial income. The stock current trades on a forward dividend yield of 6.18% – one of the best yields in its sector. And whilst Norcos’ dividend track record is unstable, the current dividend is covered more than 1.5x by earnings – making the payout look sustainable.

In summary, Norcros provides us with a cheap foothold in the fast-recovering UK property sector and we expect the stock to flourish as investors regain confidence.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.