30th Nov 2022. 9.00am

Regency View:

BUY Morgan Advanced Materials (MGAM)

- Growth

Regency View:

BUY Morgan Advanced Materials (MGAM)

Smart materials key to our sustainable future

Meeting goals on green-house gas emission reductions, while promoting economic recovery and growth, is one of the biggest challenges facing society today.

Answers are found not only in the choice of energy sources but also in the development of more energy efficient technologies.

In both cases smart materials are likely to play an extremely important role, enhancing the performance and durability of renewable energy installations and significantly reducing the energy consumption of buildings, appliances and vehicles.

Morgan Advanced Materials (MGAM) are at the forefront of designing materials to make the world more sustainable, and to improve the quality of life.

From seals used in blood pumps and fire protection in cars, to carbon brushes in wind turbines and ceramic rollers used to make thin-film solar panels. Morgan’s diverse range of smart materials are creating a safer, more sustainable future.

The stock has high quality financials, trades on an eye catching forward valuation, and has plenty of momentum following a market-beating trading update earlier this month.

Broad-based growth across a diverse product range

To say Morgan’s range of products are diverse is somewhat of an understatement. Its product base is broadly segmented into two global divisions:

1. Thermal Products

Morgan’s thermal products are used in high-temperature industrial processing of metals, petrochemicals, cement, ceramics and glass, and by manufacturers of equipment for automotive, marine, aerospace, and domestic applications in insulation and fire protection.

This is Morgan’s fastest growing division with Thermal Ceramics and Molten Metal Systems growing +10.7% and +17.4% respectively in the nine months to end September.

2. Carbon and Technical Ceramics

This division covers electrical carbon products which are used in a vast array of industries such as rail, wind power generation and mining.

It also covers seals and bearings products used in pumps for industrial and domestic use and advanced carbon/graphite, silicon carbide, alumina and zirconia materials to engineer lightweight, low-friction bearings.

And Morgan’s technical ceramics products are used in selected segments of the electronics and semiconductor, energy, healthcare, industrial, petrochemicals, security and transport markets.

Whilst not as fast growing as Thermal Products, each subdivision within the Carbon and Technical Ceramics division is experiencing healthy levels of growth this year:

Electrical Carbon +7.2%, Seals and Bearings +6.9%, Technical Ceramics +13.0% in the nine months to end September.

Gap and go

Earlier this month Morgan released a market-beating Q3 trading update which raised full-year expectations.

Morgan said it expects full year organic constant-currency growth to be in the range 7-9%, above previous guidance.

It also expects full year adjusted operating profit to be marginally above the top end of current analysts’ forecasts.

Morgan’s CEO Pete Raby said:

“We are delivering robust revenue growth, despite the challenging environment, and improving profitability, with inflation continuing to be more than offset by pricing and continuous improvement activity”.

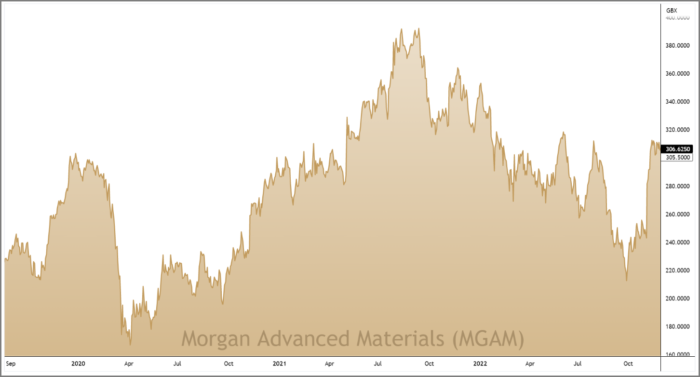

The bullish trading update caused the shares to gap higher – creating a burst of upwards momentum which saw the shares break and close above the descending trendline (gold dotted line) which has been in place since the turn of the year.

Price action following the break of trendline has seen the shares consolidate sideways in a small range.

This form of ‘high and tight’ consolidation signals upside continuation, which alongside Morgan’s upcoming investor day on 6th December means we have two short-term catalysts in place.

Materially undervalued

The attraction of Morgan’s valuation centres around quality…

A five-year average Return on Equity of 22% proves that the business can effectively deploy shareholder capital to generate growth at attractive rates.

And a five-year average gross profit margin greater than 30% is evidence of a clear and sustained competitive advantage.

Investors aren’t being asked to pay a high premium for Morgan’s quality. The stock trades on a forward Price to Earnings (PE) ratio of 9.8, which is one of the most attractive valuations in the Machinery, Equipment & Components sector.

A Price to Sales ratio of just 0.87 and an Enterprise Value to Adjusted Earnings (EV/EBITDA) of 6.36 serves to support the case that Morgan is attractively priced.

And on a discounted cashflow basis, the stock is trading at a 27% discount to Fair Value of £4.26.

Given Morgan’s unique position within the smart materials market and its ability to benefit from thematic tailwinds, we believe the stock looks attractively priced for those with a long-term outlook.

Morgan also adds some exciting mid-cap momentum to our list of FTSE Investors open positions.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.