1st Jun 2022. 8.55am

Regency View:

BUY Moneysupermarket.com (MONY)

- Value

- Income

Regency View:

BUY Moneysupermarket.com (MONY)

Cost-of-living crisis to drive credit card comparisons

With UK inflation hitting a 40-year high last month, the cost-of-living crisis continues to deepen.

To cope with the anaconda-like squeeze of rising costs, low-income households are turning to expensive forms of lending…

Figures from the Bank of England showed credit card borrowing jumped by £1.5bn in February to £59.5bn – the highest since records began.

And whilst price comparison sites haven’t been of use during the energy crisis, they are playing a pivotal role in helping cash-strapped customers save money on insurance, broadband, loans and credit card deals.

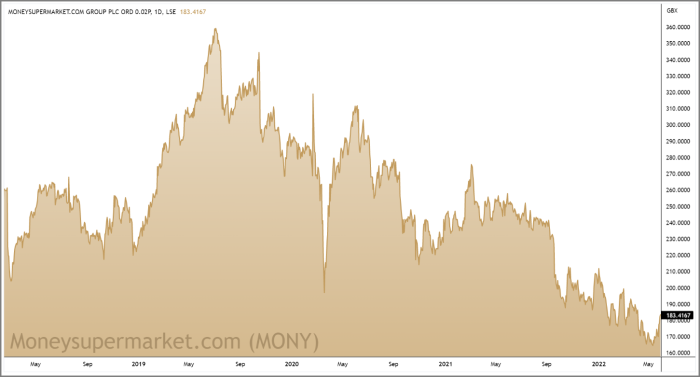

Moneysupermarket.com (MONY) has been unloved and ignored by investors in recent years, the shares are currently 50% below their July 2019 highs.

Reasons for the underperformance include demand for motor insurance and travel dropping sharply during the pandemic, and an inability to make money on energy switching with so few firms willing to offer a quote.

However, we’re seeing evidence that these headwinds are easing, especially in car insurance and travel, leaving Moneysupermarket’s collection of market leading brands looking seriously undervalued.

Strong brands set to shine in cost-of-living crisis

As Moneysupermarket CEO, Peter Duffy put in his last update:

“With cost-of-living increases adding pressure to consumer budgets, our distinctive brands remain well positioned to help households save money in a broad range of areas.”

Whilst this is typical CEO bluster, we would tend to agree with him…

Moneysupermarket has six strong brands, three of which look tailor made to help customers fight the cost-of-living crisis…

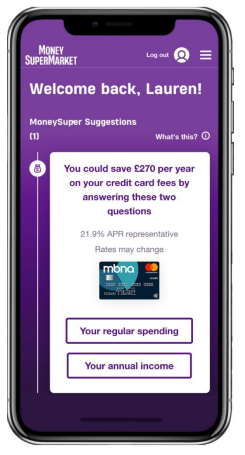

MoneySuperMarket

The broad price comparison site has over 10 million active users.

£158.7m of the Group’s £316.7m (FY21) revenue comes from insurance. And with the economy fully reopened, and car insurance premiums dropping, demand for car insurance comparison is increasing.

There’s also significant cross-sell headroom with 19% of active users enquiring in two or more channels. And Moneysupermarket’s launch of its ‘MoneySuperSeven’ initiative that aims to help people make savings on multiple household bills is designed to capitalise on these cross-selling opportunities.

MoneySavingExpert

Money Saving Expert is the most recommended UK brand according to YouGov and is central to Moneysupermarket’s key marketing message of ‘helping to save households money’.

Money Saving Expert provides the group with a low-cost customer acquisition engine where saving money is front and centre of the brand.

The website has 8.2 million weekly email subscribers, up from 7.5 million in 2020.

90% of its revenue comes from Money and Home Services sectors. And with the cost of credit card debt soaring, we expect Money Saving Experts popularity to continue to mushroom.

Quidco

Recently acquired Quidco, a cashback ‘earn as you spend’ offering has added to group revenue growth.

It provides marketing services for nearly 5,000 merchants, allowing its users to gain cashback on retail, travel and switching services.

Quidco has very strong app engagement and an average of 11 purchases per transacting member per annum.

The cashback market is growing and profitable, with significant headroom for further growth. There’s also significant scope for Quidco to benefit from Moneysupermarket’s tech, data, CRM and switching services.

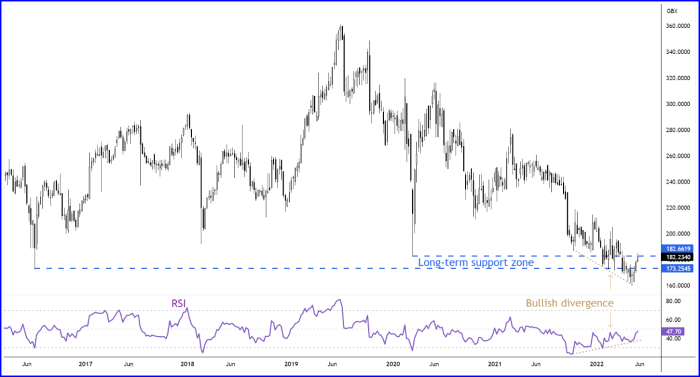

MONY moves into key support zone

Sell-offs in quality, cash generating stocks create opportunities and technical analysis can be a helpful tool to time your entry.

Moneysupermarket’s share price has undergone a prolonged period of underperformance in recent years, but during the last two months we’re seeing some technical clues that a bottom may be forming…

Recent price action has seen the shares move down into a major area of long-term support created by the March 2020 and June 2016 spike lows (see chart below).

Whilst we have seen some response to the support zone, the most compelling signal has been ‘bullish divergence’ on the Relative Strength Index (RSI)…

The RSI index is a measure of momentum that usually mirrors pirce. However, in recent weeks we’ve seen Moneysupermarkets share price continue to make lower swing low, but the RSI has started to make higher swing lows – diverging from price.

This is known as bullish divergence and can signal that the shares have become oversold and are ready to hammer out a bottom.

Income & Value

The sell-off in Moneysupermarket’s share price has left the shares looking too cheap to ignore…

The shares trades on forward Price Earnings (PE) multiple of 12.6, one of the cheapest in Software & IT Services sector.

This forward PE also look attractive when compared to forecast earnings per share (EPS) growth of 20.8% – giving the stock a Price to Earnings Growth (PEG) ratio of 0.8 (where anything less than 1 is considered good value).

The shares also score well across a number of other value metrics including Price to Free Cashflow (16.2), Enterprise Value to Adjusted Earnings (9.81) and dividend income…

A forward dividend yield of 5.1% puts Moneysupermarket in the top quartile of London’s main market. And whilst the dividend is only covered 0.98 times by earnings, the company has a solid balance sheet and is highly cash generative – meaning the dividend is forecast to rise from 11.7p per share (FY21) to 12.2p per share (FY23).

On balance, we believe the shares offer attractive levels of income and value. And with the shares back at a long-term support zone, long-term investors should be well rewarded.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.