30th Oct 2024. 9.04am

Regency View:

BUY Mitie Group (MTO)

- Growth

Regency View:

BUY Mitie Group (MTO)

Mitie: Mastering market leadership

We believe that investing in market leaders should represent a core part of any investment portfolio.

These companies tend to have significant competitive advantages that allow them to outperform over the long term.

Recent examples of FTSE Investors’ market leaders’ strategy include Auto Trader, Balfour Beatty, Experian, and Trainline, and Mitie Group (MTO) adds nicely to this list.

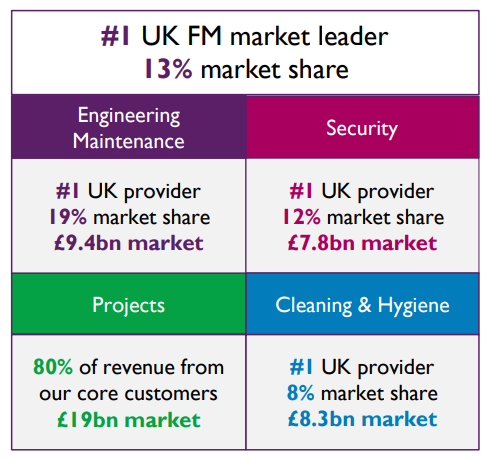

The UK’s #1 FM provider

Mitie is the UK’s premier facilities management (FM) provider, holding a commanding position in a market worth £19 billion.

The company operates across several key sectors, including engineering and maintenance, security, and cleaning and hygiene. With a notable market share of 13% in FM and being the top provider in several segments, Mitie is strategically positioned to leverage its expertise and resources to capture further growth.

At the heart of Mitie’s business model is its focus on sustainability and technology. The company integrates advanced technologies into its service delivery, enhancing operational efficiency while minimizing environmental impact.

Mitie’s commitment to sustainability is reflected in its initiatives to reduce carbon emissions across its operations and those of its clients. By utilising data analytics and smart technology, the company can optimise resource allocation, ultimately providing better services while fostering a greener future.

What sets Mitie apart is its robust client relationships, with 80% of its revenue stemming from core customers. This high level of repeat business underscores the trust and reliability Mitie has cultivated over the years. Coupled with its position as a market leader in multiple FM sectors, Mitie has built a formidable barrier to entry for competitors, ensuring its continued dominance in the industry.

A vision for growth: Strategies and opportunities

Mitie has laid out an ambitious growth strategy that aims to expand its market presence and service offerings.

The company is focused on increasing its footprint in the booming health and social care sector, which presents significant opportunities for facilities management services.

Recent acquisitions, including the integration of the health-focused service provider Interserve and the technology-driven cleaning company Blue Diamond, exemplify Mitie’s buy-and-build strategy. These acquisitions not only broaden Mitie’s service portfolio but also enhance its operational capabilities, allowing it to capture a larger share of this growing market.

Additionally, Mitie is capitalising on the increasing demand for sustainable and efficient solutions, investing in technology that enhances operational efficiency and reduces environmental impact. The company is actively pursuing innovation in energy management, integrating renewable energy solutions into its service offerings, and focusing on smart buildings technology.

Furthermore, Mitie aims to broaden its service lines, targeting sectors such as energy management and digital transformation. By leveraging its existing capabilities and exploring new avenues for growth, Mitie is well-positioned to achieve a forecasted earnings growth rate of 7.58% per year, building on the impressive 38.6% growth it achieved over the past year.

Quality at a discount to fair value

Mitie’s financial profile reflects a high-quality stock that is reasonably priced relative to its intrinsic value and its sector peers.

Currently, the stock is trading at approximately £1.20, significantly below our estimated fair value of £1.93. This gap suggests substantial upside potential. With earnings projected to grow by 25% over the next couple of years, Mitie is expected to generate robust cash flow, likely bolstering its share valuation further.

The company’s financial metrics are compelling. With a forward P/E ratio of 10.0—below the average for the Professional & Commercial Services sector—Mitie presents an appealing valuation. The dividend yield of 3.75% signifies a commitment to returning value to shareholders and underscores the company’s strong cash generation capabilities. Additionally, Mitie’s return on equity stands impressively at 28.9%, reflecting the effectiveness of management in utilizing capital to generate profit.

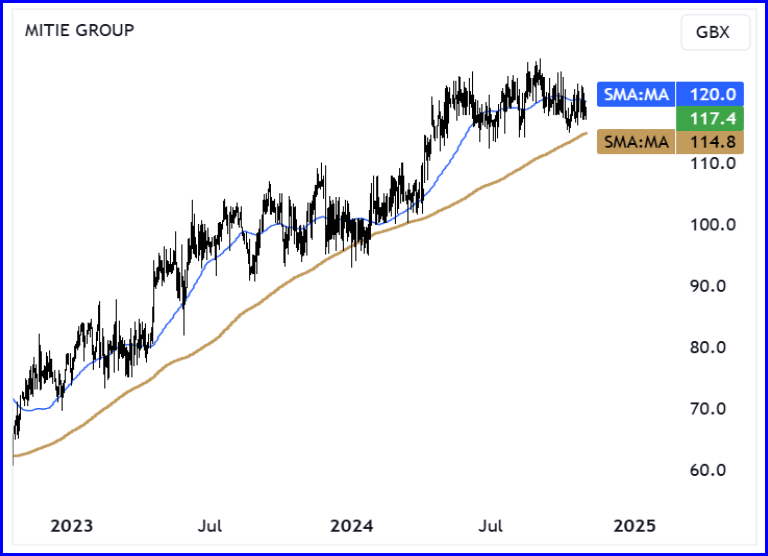

Powerful long-term uptrend

From a technical standpoint, Mitie shares are currently locked in a powerful long-term uptrend, with the 50-day moving average consistently above the 200-day moving average since mid-2022.

Recent price action has entered a prolonged period of sideways consolidation, establishing a zone of horizontal support between 115p and 112p.

This consolidation phase has taken prices back to the long-term dynamic support of the upward-sloping 200-day moving average, which typically acts as a reliable indicator of potential bullish reversals.

In summary, Mitie is not just a leader in facilities management; it represents a unique blend of stability, growth potential, and favourable financial metrics. We believe shareholders can expect to benefit from its market leadership and strategic initiatives aimed at capturing further market share in a rapidly evolving industry.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.