2nd Oct 2024. 9.31am

Regency View:

BUY Kingfisher (KGF)

- Value

Regency View:

BUY Kingfisher (KGF)

Kingfisher’s catalysts align to drive the shares higher

If you’ve followed our research for a while, you know we like to combine catalysts—merging earnings catalysts with technical catalysts and emerging sector themes.

Kingfisher (KGF), the owner of the well-known B&Q and Screwfix chains, is a prime example of this approach. The company has recently released a set of results that exceeded market expectations, all against the backdrop of a recovering housing sector.

With its shares showing impressive relative strength and forming a small bull flag pattern, we believe Kingfisher is a high-quality addition to our list of open FTSE Investor positions.

Half-year results show resilience

Earlier this month, Kingfisher shared its half-year results, and while the performance was mixed, it ultimately showcased the company’s resilience in a tough retail landscape.

Sales dipped by 2% year-on-year to £6.76 billion, largely driven by weaker performance in Kingfisher’s French operations, where like-for-like sales fell by a notable 7.2%. Yet, amidst this backdrop, the company managed to deliver an impressive adjusted pre-tax profit of £334 million, comfortably surpassing the consensus estimate of £286 million.

How did they pull this off? Well, the strong profit performance in a challenging sales environment can be traced back to strategic initiatives that Kingfisher implemented in recent months. Cost-cutting measures have played a crucial role, enabling the company to optimise its operations and boost profitability.

By streamlining processes and honing in on operational efficiency, Kingfisher successfully reduced expenses and improved gross margins. This positive shift resulted from a blend of competitive pricing strategies and disciplined promotional activities that kept customers engaged without eroding profit margins.

One of the standout features of the trading update was the company’s revised guidance for the rest of the fiscal year. Kingfisher raised its full-year free cash flow forecast to between £410 million and £460 million, up from the previous range of £350 million to £410 million. The adjusted profit before tax guidance was lifted to a range of £510 million to £550 million, signalling a strong belief in their ability to deliver strong results despite headwinds in specific segments.

Well positioned for a housing market recovery

Kingfisher is strategically placed to thrive as the housing sector begins to show signs of recovery. Several factors contribute to this promising outlook:

First and foremost, Kingfisher’s core businesses, B&Q and Screwfix, have a long-standing reputation for meeting the needs of both DIY enthusiasts and professional tradespeople. This dual focus on both retail and trade customers gives Kingfisher a unique advantage, allowing it to capture a broader customer base during a housing market upswing.

Another critical aspect is Kingfisher’s strong online presence. Kingfisher has successfully adapted its business model to cater to the digital consumer. With online sales accounting for a significant 18% of revenue, the company is well-prepared to capitalise on increased online shopping habits, particularly as consumers seek convenience while shopping for home improvement supplies.

Furthermore, the signs of a recovering housing market, particularly in the UK, suggest increased consumer confidence and spending. As property values rise and housing demand strengthens, homeowners are likely to invest more in home improvements and renovations.

Lastly, Kingfisher’s ongoing restructuring efforts in France and Turkey are setting the stage for improved performance in these regions. By focusing on operational efficiency and enhancing the customer experience, the company is not only addressing current challenges but also positioning itself for growth as market conditions improve.

Financial strength and momentum

Kingfisher has demonstrated impressive financial resilience, particularly with its ability to generate robust free cash flow, even in a market that’s been anything but predictable. Despite the challenges posed by fluctuating consumer demand, Kingfisher’s revenue stability underscores the company’s operational strength. The firm’s strong free cash flow outlook signals not only its capacity to manage costs effectively but also its readiness to continue rewarding shareholders.

In terms of valuation, Kingfisher’s forward price-to-earnings (P/E) ratio of 17x compares favourably to the broader specialty retail sector average of 18.8x. Adding to this, Kingfisher has a well-covered dividend yield of 3.83%, giving income-focused investors another reason to keep the stock on their radar.

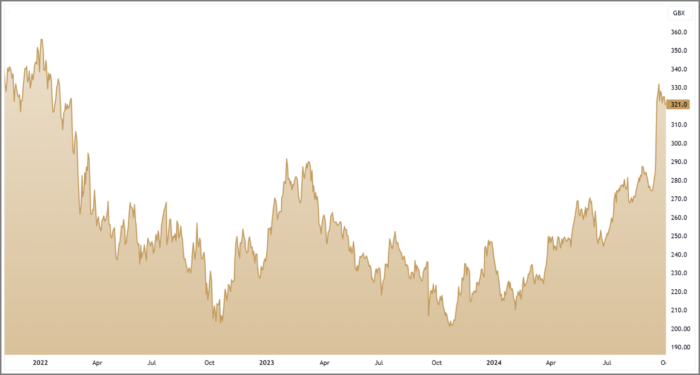

Kingfisher’s share price has shown strong bullish momentum throughout the year. The shares have consistently traded above the upward-sloping 50-day moving average, which has maintained its position above the 200-day moving average since April. Following the recent half-year report the shares surged to new trend highs, creating a burst of bullish momentum. This price action was marked by a subsequent period of consolidation, with a series of small-range candles. This high and tight consolidation suggests a reluctance for the shares to pull back, reflecting accumulating demand among buyers and signalling further potential upward movement.

This combination of quality, value, and momentum makes Kingfisher a strong contender for investors looking to capitalise on both defensive and growth strategies.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.