25th Jun 2025. 9.07am

Regency View:

BUY Keller Group (KLR)

- Value

- Income

Regency View:

BUY Keller Group (KLR)

Keller’s foundations hold firm as breakout beckons

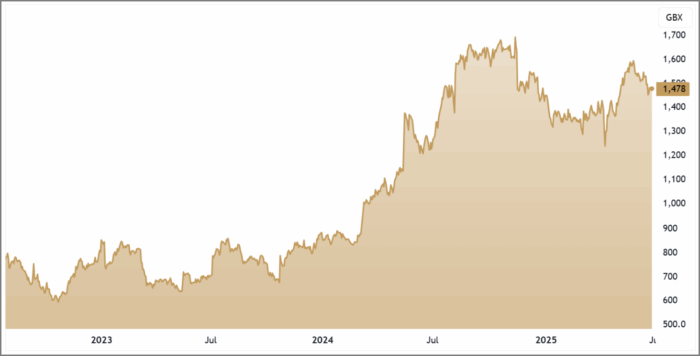

After a big run in 2024, Keller shares have spent much of this year cooling off, letting the steam escape after a strong trending phase and giving prices a chance to settle. That’s not a bad thing. Think of it as a reset before the next leg higher.

Now, with short-term momentum pointing higher and the business firing on all cylinders, Keller looks like it’s setting up for the next move in its long-term uptrend. The valuation remains undemanding, the balance sheet is bulletproof, and despite a leadership transition, operational execution hasn’t missed a beat.

Building from the bottom up

Keller is the world’s largest specialist geotechnical contractor, a company that gets the ground ready to build on. Whether it’s stabilising soil, sinking piles, or improving ground conditions in complex environments, Keller is among the first boots on the ground at the start of any major build.

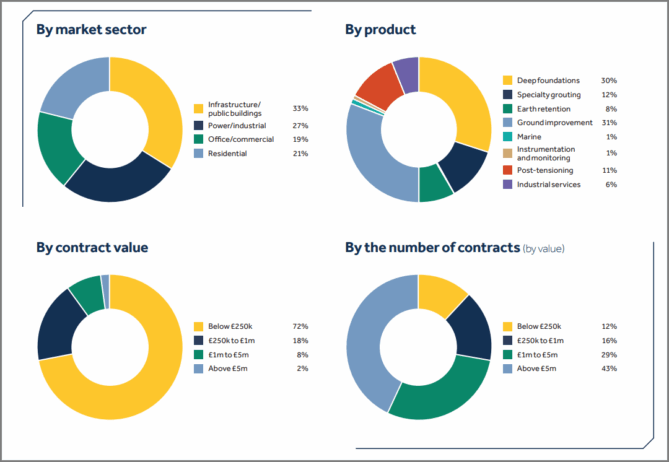

It operates in 170 branches across five continents with over 1,100 rigs and 1,650 engineers. But what sets it apart is the product diversity. From deep foundations and earth retention to specialist grouting and instrumentation, Keller provides full-spectrum engineered solutions. That breadth makes it a true one-stop shop in a fragmented market, with a scale advantage few competitors can match.

Cash flow, confidence and construction cycles

The numbers tell a strong story. Revenue hit £2.99 billion in 2024, with earnings per share forecast to grow another 4.1% in 2025. Return on equity is a punchy 25.7%, and margins have climbed to nearly 7%. Free cash flow surged to 240p per share, while the dividend yield stands at 3.64% and is growing steadily, supported by a near four times dividend cover.

The balance sheet is pristine. Net debt has dropped to £127 million and net debt to EBITDA stands at just 0.1 times. A £25 million buyback is already in motion, further supporting shareholder returns. Despite modest revenue growth this year, Keller continues to generate serious cash and deliver for investors.

Global groundwork with local precision

North America remains Keller’s engine room, accounting for 60% of revenue. Trading here has stayed strong, supported by infrastructure projects and better execution in the foundations and industrial divisions. Residential demand at Suncoast is softer, but offset elsewhere by the steady performance of Moretrench Industrial.

In Europe, residential and commercial markets remain weak but infrastructure demand has held up. A previously challenging project in the region is now tracking operationally to plan. Meanwhile, the APAC division continues to deliver, aided by Keller’s involvement in the massive Neom development in Saudi Arabia.

What ties it all together is Keller’s hybrid model. Local teams operate with agility and market knowledge, while global resources can be deployed wherever needed. This decentralised but connected structure gives Keller the resilience to ride through market cycles without sacrificing efficiency or margins.

A foundation for the future

Leadership change is on the horizon. Michael Speakman is stepping down as CEO for health reasons after leading a significant operational turnaround since 2019. His successor, James Wroath, joins from Wincanton with a reputation for driving cultural and operational transformation. With the platform already strong, Wroath has the opportunity to scale Keller’s next phase of growth.

Operationally, Keller’s systems are firing. Product-specific teams, in-house manufacturing, and one of the lowest accident rates in the industry all feed into a value proposition that clients trust. With over 5,500 contracts a year and a model built on repeat business, this is a company built for endurance.

Momentum breakout could signal new leg higher

After climbing sharply throughout 2024, the share price finally paused for breath, entering a retracement phase as some of the heat came out of the market. We took profits on two tranches during that strong run, and since then, prices have slowly worked back toward the longer-term moving averages.

Now though, things are looking up. Keller has broken above the descending retracement line and pulled back to retest it cleanly. This classic technical pattern often signals trend continuation. While the fundamentals alone justify holding the stock, it’s reassuring to see short-term momentum once again aligning with the long-term trend. The stage looks set for the next move higher.

Value beneath the surface

At 1,476p, the shares are still trading 13% below their 52-week high. Yet the valuation remains undemanding. A forward PE of 7.1, EV to EBITDA of just 3.75, and a price to free cash flow ratio of six all indicate that the stock remains undervalued by the market.

This is a company with 20 % returns on capital, a growing dividend, limited leverage, and a strong record of execution. Add in exposure to long-term infrastructure trends, a refreshed leadership team, and a technical setup that’s just turned bullish, and the investment case is both simple and compelling.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.