21st Jun 2023. 8.57am

Regency View:

BUY JD Sports (JD.)

- Growth

Regency View:

BUY JD Sports (JD.)

JD Sports: Winning the Game of Global Growth

We’re big fans of JD Sports (JD.), a global growth stock with an impressive track record.

The leisurewear retailer has a deepening relationship with Nike and a clear pathway to growth in North America.

They have an ambitious new CEO at the helm and future earnings are set to comfortably outpace the stock’s current valuation.

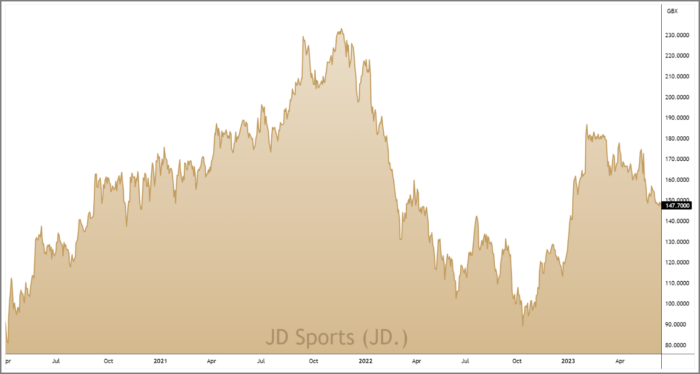

We took profits in February following a strong start to the year, and after a 20% pullback to support and record full-year results, we’re more than happy to buy back in.

Record-breaking performance paves the way for £1bn profit goal

In May, JD released a record set of full year results which showed demand for trendy trainers and hoodies remained strong among young shoppers.

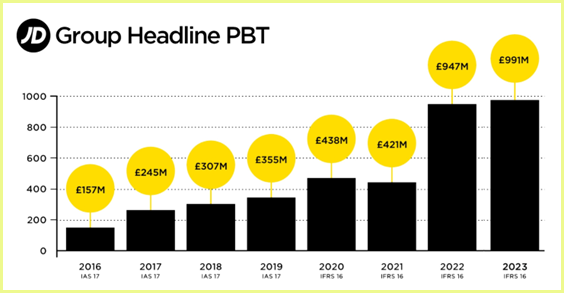

The retailer’s pre-tax profits fell to £440m due to expenses related to acquisitions and selling off smaller brands. However, adjusted profit before tax reached a record £991m, surpassing analysts’ expectations and setting the stage for the company to achieve its first-ever £1bn profit this year (FY24).

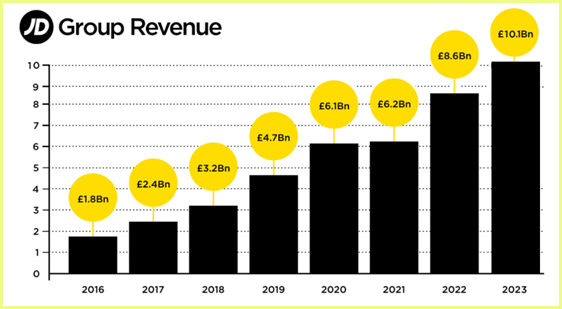

A general consumer shift towards casual leisurewear over formal wear has clearly contributed to the company’s growth, with revenues increasing by nearly 19% to £10bn.

And JD’s international expansion has played a significant role in its record results. The company has strategically expanded its presence in key global markets, establishing a strong foothold in North America, and Asia which delivered revenue growth of 21% and 49% respectively.

This expansion has enabled JD to tap into new customer bases and benefit from the growing popularity of sports fashion worldwide. By adapting its offerings to cater to local preferences and leveraging its brand partnerships, JD Sports has successfully expanded its market share and revenue streams.

One key brand partnership which has strengthened recently is with Nike. JD recently became Nike’s first European retail partner for its Connected Partnership loyalty program, expanding JD’s product range and enhancing the ‘omnichannel’ shopping experience for both companies.

Through the JD mobile app, customers can link their JD and Nike membership accounts, granting them unprecedented access to Nike member-only products, curated collections, exclusive experiences, and early-bird offers.

Schultz shares ambitious growth plan

When Régis Schultz stepped into the role of CEO he had a clear plan for the company’s growth. In February, he shared his goals for the next five years, and they’re pretty ambitious.

First off, he wants JD to achieve double-digit revenue growth every single year. They also want to grab a double-digit market share in key regions, showing that they intend to become a top player in the sports retail industry.

Schultz isn’t stopping there. He’s determined to achieve a double-digit operating margin. This means they want to improve their profitability and make sure they’re running their operations as efficiently as possible.

To support these growth plans, JD is planning to increase its capital expenditure to £500m-£600m each year, and a big chunk of that will go towards opening new JD stores in markets which it hasn’t fully tapped into yet.

Growth at a reasonable price

JD is well positioned to drive growth from a base of financial strength…

Net cash has increased by a rate of 35.4% (CAGR) over the past five years to 1.5bn while net debt has fallen to £870m.

JD’s earnings are expected to grow by nearly 40% over the next 3 years – much faster than the Specialty Retail sector average or the wider market.

This strong earnings growth makes JD’s forward PE of 10.8 look very reasonable, especially for a stock that has a five-year return on equity north of 20%.

The shares are also trading at a 50% discount to estimated Fair Value, which provides further comfort that we’re not overpaying for growth.

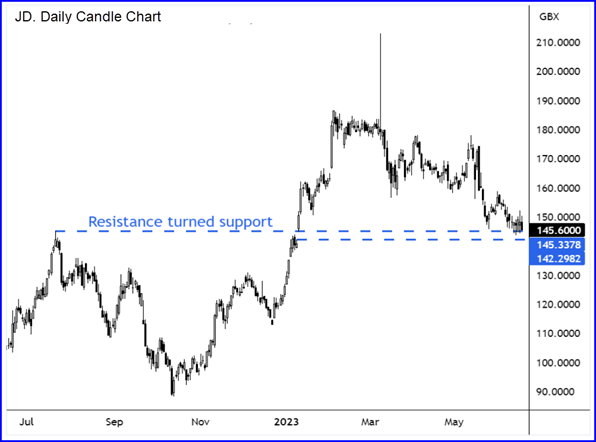

On the price chart, JD have been consolidating after a stellar rally which saw the shares double in value between October 2022 and February 2023.

The current consolidation phase has been choppy and sideways in nature, indicating that buyers are accumulating shares ahead of another leg higher.

And in recent weeks, prices have pulled back to a key area of support created by the July 2022 swing highs and the January 2023 positive gap – creating a short-term technical catalyst for entry.

Overall, JD has demonstrated its ability to drive growth, expand globally, and maintain a strong financial position. With a clear strategy and positive outlook, we believe JD has the potential to be a winning long-term investment choice.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.