15th May 2024. 9.00am

Regency View:

BUY ITV (ITV)

- Value

- Income

Regency View:

BUY ITV (ITV)

ITV: A drama of resilience and triumph

Much like one of its dramas, the storyline of ITV’s share price throughout this year has arced from despair to redemption, tracing a narrative of resilience and digital prowess.

Challenging prelude: ITV’s 2023

In the opening scenes of this narrative, ITV’s share price found itself at a crossroads, grappling with macroeconomic headwinds and industry-specific hurdles that cast shadows over its prospects.

The company faced a myriad of challenges, including a 15% downturn in linear advertising revenue in 2023, which contributed to a modest 2% decline in total revenue, amounting to £3.6 billion.

The evolving media landscape, intensified competition, and shifting consumer preferences presented formidable obstacles to ITV’s traditional linear advertising model, creating a daunting backdrop for the company’s journey ahead.

A pivotal plot twist: ITV’s impressive digital performance

March marked a decisive turn in ITV’s narrative, revealing a surprising and pivotal plot twist: the company’s impressive digital performance.

In the unveiling of its Full Year results, ITV reported a staggering 19% growth in digital revenues, underscoring the company’s strategic focus on digital transformation.

This growth was fuelled by the success of ITVX, the company’s digital streaming platform, which experienced a surge in digital viewing and revenues. ITVX’s performance not only exceeded expectations but also solidified its position as a formidable player in the digital entertainment landscape.

Promising signs: Q1 trading update insights

In May, ITV released a strong Q1 trading update which revealed positive signs for the year ahead, marking a significant milestone in the company’s journey towards recovery and growth.

The trading update highlighted several encouraging developments across key areas. Total advertising revenue saw a 3% growth in Q1, with Q2 advertising revenue projected to increase by around 12%.

Additionally, ITVX continued to deliver strong performance, with a 16% growth in streaming hours and a 14% increase in digital advertising revenues in Q1.

Furthermore, ITV Studios, while experiencing a 16% decline in total revenue in Q1, showed resilience amidst challenges, with a robust pipeline of programs heavily weighted towards the second half of the year including the Euro 2024 football championships.

This bodes well for ITV’s revenue prospects in FY24, with total ITV Studios revenue expected to be broadly flat for the year, supported by strong demand for quality content and strategic delivery phasing.

‘Smart money’ supporting ITV’s share price

Amidst the turmoil, institutional buying or ‘smart money’ emerged as a driving force behind ITV’s share price, underscoring investor confidence in the company’s turnaround efforts.

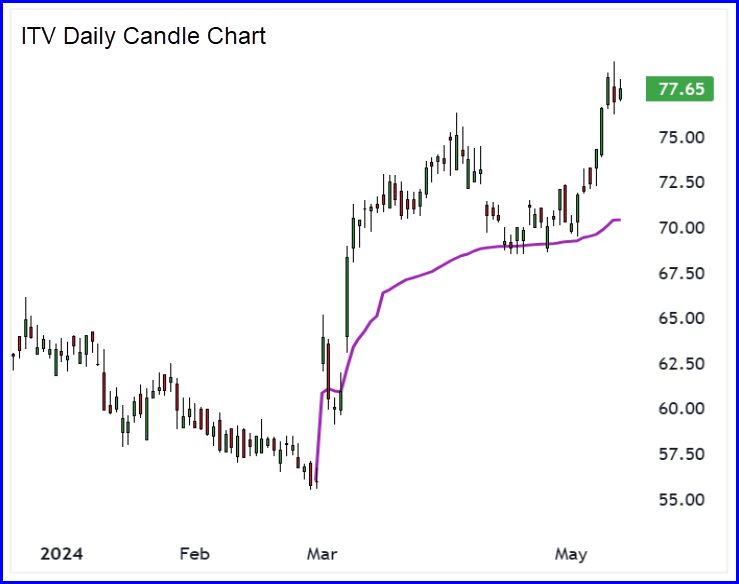

Having been languishing near long-term lows from Jan-Feb, the shares burst higher at the start of March. If we anchored a volume weighted average price (VWAP) to the March lows, we can see that the ‘smart money’ who bought in March have been supporting the stock’s recovery.

On multiple occasions we have seen the shares find support at the anchored VWAP. This has created a bullish series of higher swing lows that is starting to establish a new uptrend. We expect the anchored VWAP to continue to provide support over the short term.

Value and income: A compelling proposition

Against the backdrop of a market at all-time highs, ITV’s valuation remains undemanding. The shares currently trade on a forward earnings multiple of 8.4 – this is cheap relative to the Media & Publishing sector, and cheap relative to the wider market. The forward earnings multiple also looks cheap relative to forecast earnings per share growth of 15.8%.

Alongside its value metrics, ITV also offer an attractive level of dividend income with a forward yield of 6.6%. Whilst ITV’s dividend track record is relatively rocky, dividend cover for the current year is tracking at a solid 1.77 – indicating that shareholder payouts are unlikely to drop in the near term.

As the next chapter unfolds for ITV, we expect the shares to maintain their recent momentum, buoyed by the company’s solid digital performance and promising outlook. With a strategic focus on efficiency, innovation, and delivering value for shareholders, ITV is well-positioned to script a successful narrative in 2024.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.