22nd Nov 2023. 9.00am

Regency View:

BUY Hunting (HTG)

- Value

Regency View:

BUY Hunting (HTG)

Unearthing value: Hunting’s pursuit of profitability

In an era dominated by green initiatives, the energy industry might seem an unlikely investment hub.

However, rising geopolitical tensions and a relentless pursuit of energy security have ignited a surge in drilling activities across the globe. Governments, despite their environmental commitments, are prioritising stability in energy supply, propelling heightened drilling in regions spanning the US, UK, Norway, France, Australia, and Canada.

This surge in drilling not only sustains but also elevates the pivotal role of companies like Hunting (HTG). As a key supplier of advanced technological products to the oil and gas sector, Hunting finds itself in a prime position to capitalise on this rising demand.

A niche offering with robust revenue streams

Hunting’s niche lies in Oil Country Tubular Goods (OCTG), forming the backbone of the company’s revenue generation. These specialised steel components, including casing, tubing, and drill pipes, serve as critical elements throughout the life cycle of oil and gas wells.

Crafted with precision and engineered to endure extreme conditions, these OCTG products play multifaceted roles within drilling operations. Casing, for instance, provides structural support to prevent well collapse and isolate different geological formations. Tubing facilitates the transportation of oil and gas from the well to the surface while housing essential production-controlling devices. Drill pipes transmit drilling fluid and torque during the drilling process.

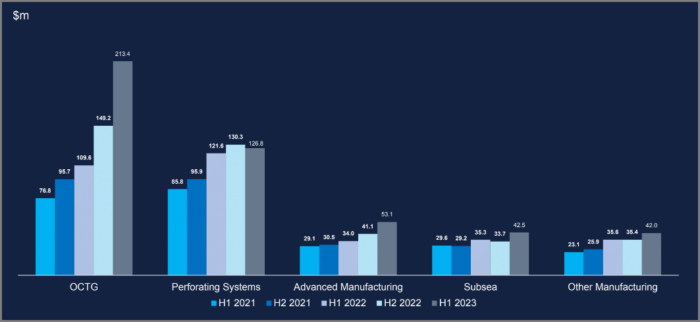

As global drilling activities intensify in the wake of rising geopolitical tensions and the pursuit of energy security, demand for Hunting’s high-quality, patented products has surged. Hunting’s OCTG revenue has more than doubled during the last five reporting periods, from $76.8m in H1 2021 to $213.4m in H1 2023. Additionally, Hunting’s Perforating Systems, designed to facilitate efficient oil and gas extraction, have seen a similar if less dramatic rise in revenues.

Record order book and rising margins charts path to profitability

After grappling with a period marred by financial setbacks, Hunting is undergoing a transformative shift toward profitability…

Hunting’s Half Year 2023 order book stood at a record $529.7m. The substantial order book underlines the confidence customers place in Hunting’s capabilities and products.

The continuous influx of orders has coincided with an increase in operational efficiency. Hunting has nearly doubled its adjusted earnings (EBITDA), soaring from $23.6 million in the first half of 2022 to $48.7 million during the same period in 2023. Moreover, their EBITDA margin surged significantly, climbing from 7% to 10%.

These substantial leaps reflect Hunting’s enhanced ability to generate earnings from its core business activities. The convergence of an expanding order book and improved operational efficiency sets a promising course for the company’s journey toward sustained profitability.

Hunting’s valuation: underpriced potential

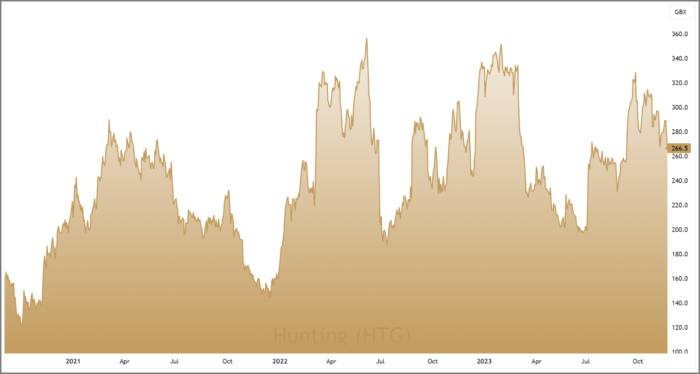

Hunting’s share price gapped higher in July following the release of a market-beating set of half-year 2023 results. Since then, prices have been broadly trending higher with recent price action consolidating in a choppy range.

Despite the near 40% rally from its summer lows, Hunting remain, in our opinion, underpriced. The shares trade on a forward price-to-earnings (PE) multiple of 10, which looks very reasonable given forecast growth in earnings per share (EPS) north of 70% – putting Hunting on a Price-to-Earnings-Growth ratio of just 0.2.

The shares also trade at a significant discount to a Fair Value per share of £6.23 – this estimate takes into account Hunting’s forecasted cashflows and indicates that there is scope for a re-rating should the company continue to deliver.

On the balance sheet, Hunting maintains a net debt-to-equity ratio of 6.5%, a level considered satisfactory, indicating prudent management of its financial obligations. Hunting also has a strong ability to service its debt, with interest payments covered by adjusted earnings at a solid ratio of 10.3 times.

Overall, we believe Hunting has the potential to add value and diversification to our FTSE Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.