26th Jun 2024. 8.59am

Regency View:

BUY HSBC (HSBA)

- Value

- Income

Regency View:

BUY HSBC (HSBA)

HSBC: Change at the top should give bottom line a boost

With HSBC’s CEO Noel Quinn set to retire after an intense and transformative five-year tenure, the bank is at a pivotal moment to reinvigorate the company and bolster its already strong bottom line.

The market is buzzing with anticipation, believing that fresh leadership could accelerate HSBC’s strategic pivot towards high-growth markets, particularly in Asia.

Stepping into a new era

Noel Quinn’s legacy at HSBC is marked by significant transformations and bold strategic moves…

After joining the bank in 1987 and rising through the ranks, Quinn took the helm as CEO in 2019. Over his five-year tenure, he steered the bank through the COVID-19 pandemic and executed an extensive restructuring plan. This involved cutting 35,000 jobs and aiming to slash annual costs by $4.5 billion.

His strategy centred on refocusing HSBC’s efforts on Asia, where the bank generates the lion’s share of its profits. Despite the geopolitical tensions between the U.S. and China, Quinn’s leadership saw HSBC streamline its global operations, selling off less profitable units in Argentina, Canada, France, and Russia.

As Quinn steps down, the bank’s chair, Mark Tucker, has emphasised the need for a successor who can galvanise the bank’s 220,000-strong workforce and maintain momentum in Asia. The ideal candidate will possess vast experience in Asian and Middle Eastern markets, aligning with HSBC’s strategic priorities.

Solid Q1 sets the tone

HSBC kicked off 2024 with a robust first-quarter performance, setting a strong foundation for the rest of the year. Pre-tax profits for Q1 were nearly $12.7 billion, slightly surpassing analysts’ expectations of $12.6 billion. This solid performance is noteworthy, especially considering the backdrop of challenging global economic conditions and geopolitical tensions.

One of the standout highlights from the Q1 results was the impressive net interest margin (NIM) increase to 1.63%. This improvement reflects the bank’s ability to capitalise on higher interest rates, which boosted lending profitability. Despite taking a $1.1 billion hit due to the sale of its Argentina business, the bank reported a significant gain of $4.8 billion from the sale of its Canadian business, further solidifying its financial position.

HSBC also announced a new share buyback programme worth up to $3 billion, in addition to a $2 billion buyback announced in February. This move not only signalled confidence in the bank’s financial health but also enhanced shareholder returns.

Golden cross creates bullish backdrop

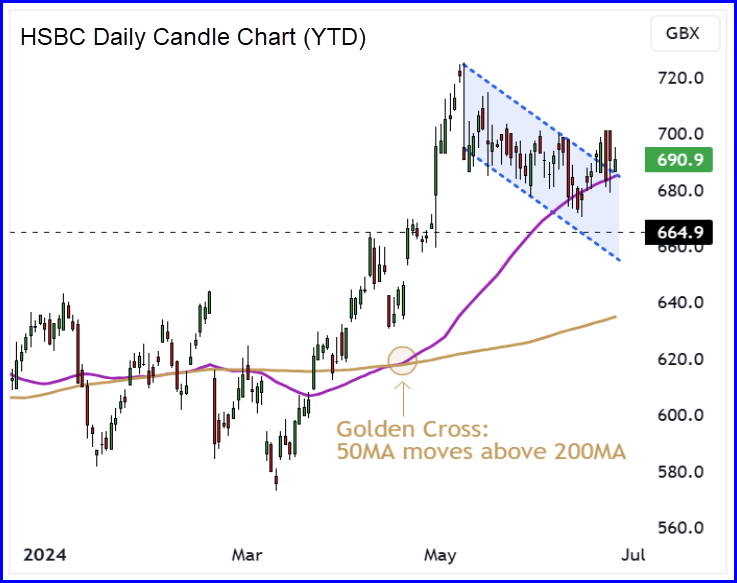

HSCB’s share price surged higher from March to May – taking prices through a key area of resistance at 665p. This upward momentum in HSBC’s stock price coincided with the formation of a ‘golden cross,’ a bullish technical signal.

The golden cross occurs when the 50-day moving average (MA) crosses above the 200-day MA on the daily candle chart. This event is interpreted as a strong indicator of long-term momentum, suggesting a shift towards a bullish market sentiment. For HSBC, this technical development underscores increasing investor confidence and optimism about the bank’s prospects.

Recent price action has seen the shares retrace and revert back towards the short-term mean of the 50 day MA – forming a small descending retracement channel in the process. The shares now look perfectly poised to resume their long-term uptrend.

Valuation: Healthy ratios and tasty dividends

When it comes to valuation, HSBC stands out with its impressive financial ratios and attractive dividend policy, making it a standout choice for those seeking income and value…

- Healthy financial ratios

HSBC’s financial health is reflected in its robust financial ratios. The bank’s return on equity (ROE) is a solid 9.2%, indicating efficient use of shareholders’ equity to generate profits. Additionally, the bank’s cost-to-income ratio stands at 56%, showcasing its operational efficiency. A lower cost-to-income ratio means HSBC is effectively managing its operating costs relative to its income, leaving more room for profitability and growth.

The shares are currently trading on a forward PE ratio of 7 and have a discount to estimated fair value of 53%. The attractive valuation is even more compelling considering HSBC’s strong earnings growth, which has averaged 28% per year over the past five years. This growth rate indicates that the bank’s earnings are increasing at a healthy pace, justifying a higher valuation in the future.

A strong balance sheet further enhances HSBC’s valuation appeal. The bank boasts a Common Equity Tier 1 (CET1) ratio of 14.6%, indicating a solid capital buffer that protects against potential financial shocks. This strong capital position ensures that HSBC is well-equipped to withstand economic downturns and continue its dividend payments even in challenging times.

- Tasty dividends

For income-focused investors, HSBC’s dividend policy is a key highlight. The bank offers a generous dividend yield of 6.2%, which is well above the average yield in the financial sector. Earlier this year, HSBC announced a 31 cents per share dividend, including a first interim dividend of 10 cents per share.

HSBC’s dividend payout ratio, which measures the proportion of earnings paid out as dividends, is a comfortable 50%. This ratio indicates that the bank retains enough earnings to reinvest in its operations and support future growth, while also rewarding shareholders with substantial dividends.

With Noel Quinn’s transformative legacy and a strategic focus on Asia, HSBC is well-positioned for continued growth and profitability. The upcoming leadership change represents an opportunity to further strengthen its market position and enhance shareholder value. The bank’s strong financial performance, bullish technical indicators, and healthy financial ratios make it a compelling buy for investors seeking value and income.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.