15th Mar 2023. 8.58am

Regency View:

BUY Glencore (GLEN)

- Income

Regency View:

BUY Glencore (GLEN)

Mining for market-beating dividend income

The FTSE 100 is forecast to pay investors a record £86bn in dividends this year.

This may seem surprising given the gloomy economic outlook, but dividends historically tend to hold up far better than earnings during recessions.

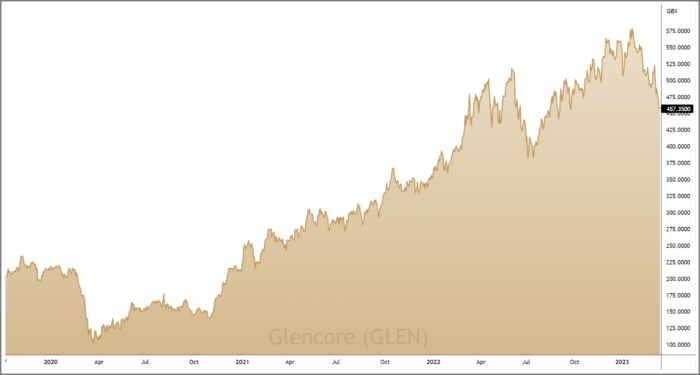

And with the FTSE’s New Year rally running out of steam in recent weeks, we’re going to turn our attention to one of the most attractively priced income stocks in the market, Glencore (GLEN).

Glencore is one of those rare stocks that trades on a top-quartile forward dividend yield and a single digit forward PE.

Fresh off the back of a bumper 2022, the mining giant offers immediate income without having to pay over the odds. And with the stock going ex-dividend in May, we’re keen to add this high yield FTSE 100 stalwart to our stable of income stocks.

Dividend doubled including ‘top-up’ payout

In its current form, Glencore is essentially a coal producer and commodities trading company.

Although Glencore has 35 global mining operations and generates significant earnings from industrial metals; copper, zinc and nickel, these are currently dwarfed by its coal earnings and commodities ‘marketing’ or trading.

Coal, for good reason, is about as fashionable a novelty tie, but Glencore chief, Gary Nagle’s decision to take a “non-linear” approach to decarbonisation has paid off.

In 2021, when BHP and Anglo American were dumping their dirty coal assets, Glencore snapped up their stakes of the vast Cerrejon coal complex in Colombia.

The energy crisis which followed Russia’s invasion of Ukraine has seen demand for coal rise sharply, causing a 243% surge in Glencore’s coal profits and driving a 60% jump in total adjusted earnings (EBITDA) last year (FY22).

This bumper set of earnings has seen Glencore’s net debt levels fall dramatically, and this has opened the door for higher shareholder payouts…

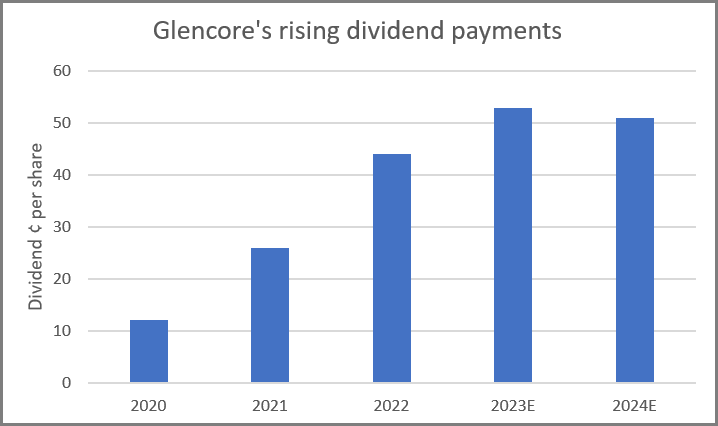

In February’s FY22 numbers, Glencore hiked its base dividend by 69% to 44¢ per share. This will be paid in in two equal tranches of 22¢ in H1 and H2 2023 with the stock going ex-dividend for the first tranche on 4th May.

Glencore also announced 4¢ per share special dividend and $1.5bn in share buybacks – effectively doubling shareholder payouts on 2021.

The divided hikes put Glencore on a forward yield of 9.26%, making it one of the top two biggest dividend payers in the mining sector and top quartile across the wider market.

Dividend cover is very comfortable and consensus estimates for FY23 are for the dividend to climb again before dropping back as Glencore makes the transition away from coal and towards copper, nickel, cobalt and related recycling.

Valuation buffer lets income potential shine

When it comes to buying income stocks, it’s important not to be too distracted by the neon flashing dividend yield.

Total return is the ultimate goal here and this means paying close attention to valuation.

Glencore scores well on a forward valuation basis relative to both its mining peer group and the wider market.

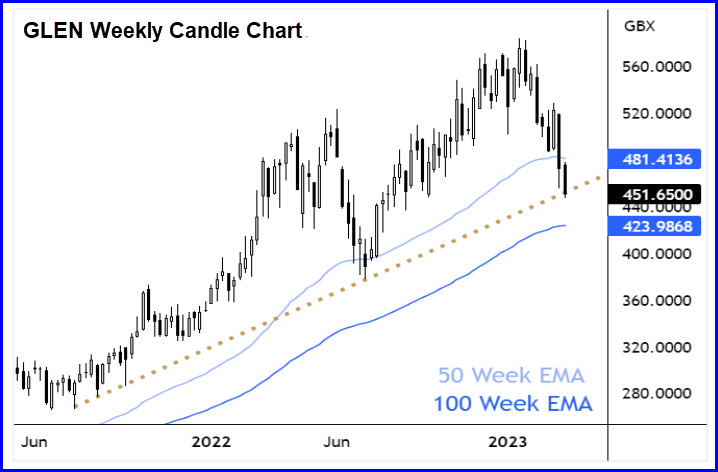

Recent price action has seen the shares undergo deep retracement, taking prices back to a zone of long-term support created by the 50 and 100 week moving averages and an ascending trendline.

This pullback has put Glencore on a forward PE of just 6.6, which is cheaper than Rio Tinto, Anglo American and BHP Billiton.

Granted, the cheaper valuation reflects Glencore’s heightened exposure to coal, but based on discounted cashflow analysis the stock is some 40% undervalued. And consensus analyst price targets are more than 20% above the current share price.

This discounted valuation, combined with the improvement in Glencore’s balance sheet, means income investors have a reasonable buffer which should allow long-term shareholders to collect a chunky dividend without seeing too much capital depreciation.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.