Regency View:

BUY Experian (EXPN)

Big data boom to keep Experian top of its tree

Big data, data so large that traditional data processing methods just can’t handle it.

We’re talking about zettabytes – a billion terabytes of data! Capturing and drawing insights from big data is perhaps the most powerful line of business on the planet and its dominated by only a handful of big tech kingpins.

When you think of a big tech kingpin, no doubt Apple, Amazon, Meta and Google spring to mind, but UK-listed Experian (EXPN) should be seen in the same bracket.

Experian is the world’s leading global information services company and collects data on 1.4 billion people and 191 million businesses.

Its broad-based data and analytics platform for business and consumer markets is amassing a goldmine of financial data.

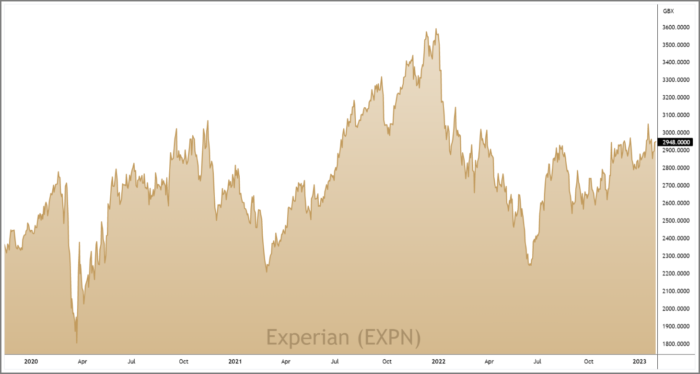

The stock performs well at all points of the business cycle and after a 40% sell-off from its 2021 highs, we believe Experian’s high-quality defensive characteristics are worth paying for.

North American data powerhouse

You’ll probably know Experian as the company that runs your personal credit score, but in reality, the business is much more…

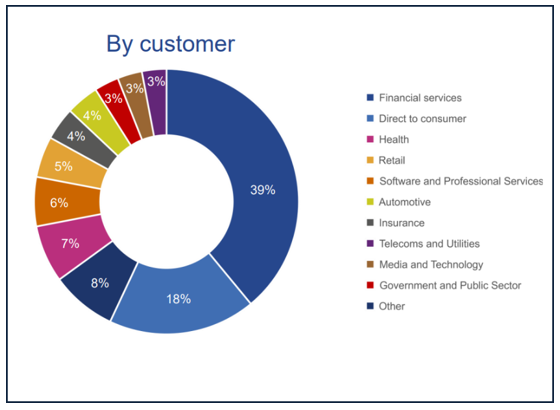

Experian’s direct to consumer business is just 18% of group revenue with nearly 40% coming direct from high margin B2B sales in the financial services market.

The beauty of Experian’s B2B financial services model is that much of its data is given to it for free, by banks, because they need a broader picture of their customers’ overall financial position.

Experian combines the banks’ data to come up with credit scores, which are then sold back to the banks.

When banks are doing well Experian benefit too, and with banking being one of the best performing sectors in recent months, this is a strong tailwind for Experian.

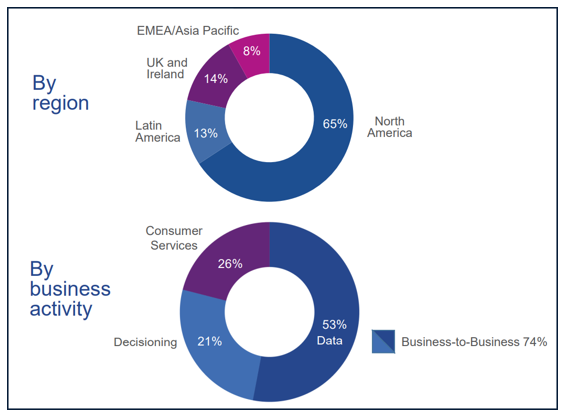

The business earns about two thirds of its sales in the States, and it reports in dollars as a result.

Revenues in the year to March 2023 are forecast to be around $6.82bn with net profit of approx. $1.2bn.

Experian has exposure to high-growth emerging markets, with 14% of group revenue coming from Latin America.

Recent Q3 numbers revealed that Latin America delivered organic revenue growth of 16% – more than double the growth in Experian’s other regions.

B2B organic revenue growth in Latin America was 11% and Consumer Services delivered organic revenue growth of 40% with Experian’s free consumer memberships in Brazil rising to 78m.

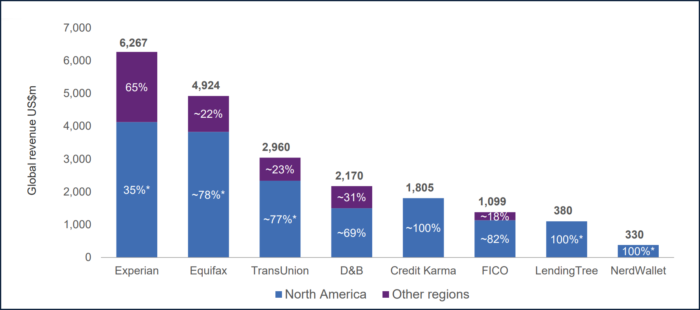

If we look at the consumer credit sector as a whole, Experian is the clear market leader, comfortably beating its nearest competitors Equifax and TransUnion (see chart below).

This dominance means more data, and more data leads to better insights, creating a virtuous cycle which should keep Experian top of its tree for years to come.

Open Banking gives growth a boost

Open Banking is an initiative designed to create competition and drive efficiency within the banking industry.

It allows third-party financial service providers open access to consumer banking, transaction, and other financial data from banks and non-bank financial institutions through the use of application programming interfaces (APIs).

Open Banking has been around in the UK for a few years, but is in its relative infancy globally and growing fast. According to the OBIE over 26.6m Open Banking payments had been made at the end of 2021, an increase of more than 500% in 12 months.

Experian uses Open Banking as part of its ‘Boost’ service, helping customers improve their credit scores by giving access to more data.

Boost only pulls positive payment history, which means it won’t report any negative information that could lower customers credit scores. Users also have the option to exclude any payments they don’t want to be added to their file.

Experian’s ability to swiftly capitalise on the Open Banking initiative through data-driven product innovation is a great example of why Experian is well positioned to continually evolve its offering and maintain its market dominance.

High quality cash compounder

When it comes to investing in quality UK stocks, Experian is the poster boy.

The business has a picture-perfect track record of delivering profitable year-on-year revenue growth and the stock has a stellar 5-year average Return on Equity of 29.3% (CAGR).

Operating margin has averaged around 20% over the last five years which serves to underline its dominant position within the financial data market.

Being a low capital expenditure high margin business, Experian is hugely cash generative with £140m free cashflow in 2022 (FY).

This cash generation helps to maintain a healthy balance sheet which has net debt relative to underlying cash profit of less than 2 times, well within Experian’s targets.

In our opinion, Experian’s global dominance, high earnings visibility and defensive characteristics fully justify the stocks forward PE ratio of 25.

Experian is not the sort of stock you can pick up on a low PE.

It’s the sort of stock you tuck away in your portfolio and forget about, safe in the knowledge that it’s a cash compounder.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.