24th May 2023. 8.58am

Regency View:

BUY easyJet (EZJ)

- Growth

Regency View:

BUY easyJet (EZJ)

easyJet ready for take-off

After three years of travel restrictions and soaring energy costs, sun-seekers are making up for lost time and travel numbers are fast approaching pre-pandemic levels.

Early bookings suggest Italy, Spain, Greece and Portugal could receive record tourism revenues this year.

And, according to recent forecasts from the World Travel & Tourism Council (WTTC), by the end of 2023, nearly half of the 185 countries in its report will have either fully recovered to pre-pandemic levels or be within 95% of full recovery.

Budget European airline, easyJet (EZJ) is gearing up for a big summer, the period in which it makes the majority its profits. And with the shares trading more than 80% below their May 2021 highs, we believe the stock has much further to fly.

Travel recovery tailwinds

“Travel is the only discretionary expense people are prepared to maintain or increase”.

The words of easyJet CEO Johan Lundgren as he talked about the pent-up demand for travel and tourism.

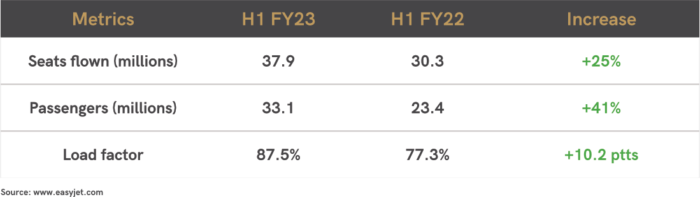

easyJet’s recent half-year report revealed a sharp improvement across all key metrics versus the same period last year (see table below).

Half year revenues surged 79% on a like-for-like basis to £2.69bn, while revenue per seat (RPS) jumped from £47.61 (H1 22) to £66.46 (H1 23).

There was also a notable jump in ancillary revenue (charges for cabin bags, leisure bundles, duty-free etc), climbing 83% on last year’s first half to £940m.

Headline losses before tax narrowed to -£415m versus -£545m in H1 22, and easyJet looks well positioned heading into its profit-making second half of the year.

Bookings have returned to “normalised” levels and revenue per seat is set to rise by 20% in the third quarter, with costs per seat expected to be flat.

Second-half capacity will also increase by 9% and is expected to reach pre-pandemic levels by easyJet’s September year-end.

And the rollout of an on-air WiFi system, plus a new service allowing customers to order directly to their seat, should both drive further growth in ancillary revenue.

Holiday division delivers stunning growth

A real standout from easyJet’s half-year numbers was the rapid growth of its Holiday division…

The initial UK launch last year has been a huge success, with customer numbers increasing three-fold to 600,000 in 12-months, generating £173m in incremental revenue.

At current growth rates, easyJet’s UK holidays business is on track to deliver full year profits of more than £80m and its medium-term profit target of £100m is set to be achieved earlier than expected.

There is significant scope for a full-scale rollout and easyJet plan to start selling holiday packages for 2024 in Switzerland this summer, with France and Germany likely to follow next year.

“Our multi-currency technology platform enables easy and rapid expansion into other source markets” read easyJet’s half-year statement.

“We already have a leading leisure network from Geneva and Basel to destinations including the Balearics, Canaries and Greece, where Switzerland’s package holiday market of 1.1 million customers provides an opportunity for easyJet holidays to continue its rapid growth” it continued.

Technical turnaround

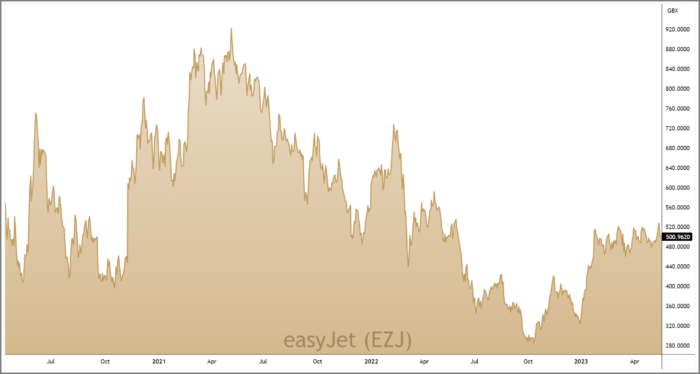

As the pandemic hit, easyJet lost more than 70% of its market cap in less than a month, taking the shares from £12 to £3.50.

This was followed by a vaccine-led recovery rally which saw the shares hit highs of £9 in May 2021.

However, the energy supply squeeze and subsequent cost of living crisis saw easyJet’s share price steadily trend lower from May 2021 to November 2022, taking prices all the way back to March 2020 lows.

Downtrends of this nature take considerable time and effort to turn around, but since the turn of the year we have seen a clear recovery…

The shares have formed an inverted head and shoulders reversal pattern (see chart below) at the March 2020 lows.

This was followed by a strong rally at the turn of the year, and since then prices have stabilised into a tight consolidation range (blue box).

Given easyJet’s much improved outlook, we believe a retest of the May 2021 highs at £9 is more than realistic – that’s some 80% above current prices.

Expect further earnings upgrades

easyJet has strong financials and we believe the stock offers growth at a reasonable price.

Cash outstrips debt by a ratio of 22:1, meaning it has a very different looking balance sheet compared to the likes of International Consolidated Airlines (IAG) or Tui Travel (TUI).

It’s also forecasted to grow earnings and revenue by 23% and 7.5% per annum respectively. And return on equity (ROE) is forecast to be 13.9% in 3 years.

The stock trades on a forward Price to Earnings (PE) multiple of 10.6, which looks attractive relative to forecast earnings per share (EPS) growth of 23.1%.

Consensus analyst estimates for easyJet’s FY23 earnings have seen a 73% rise over the past quarter and, given the strong tailwinds in the European travel sector, we expect more upgrades in the coming weeks.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.