3rd Apr 2024. 9.03am

Regency View:

BUY easyJet (EZJ) Second Tranche

- Growth

Regency View:

BUY easyJet (EZJ) Second Tranche

easyJet’s tailwind continues with bullish signals and attractive valuation

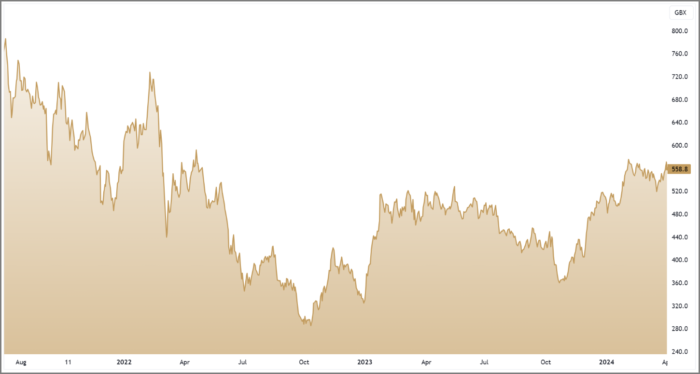

In May last year we recommended buying easyJet (EZJ) due to an anticipated rebound in travel demand post-pandemic and the potential for further growth in its successful Holiday division.

Almost a year later and easyJet has delivered a series of market-beating trading updates, the shares have broken above a key level of resistance, and its valuation remains highly attractive.

With prices breaking higher from a small bull flag pattern we are going to snap up a second tranche ahead of the release of easyJet’s half year earnings later this month.

easyJet’s strong Q1 paves the way for a promising first half

In January, easyJet delivered a market-beating Q1 trading update which highlighted several factors that reinforced our investment thesis:

- Positive performance metrics:

The update revealed a 14% increase in passenger growth compared to the previous year, indicating the company’s ability to attract and retain customers even amidst challenging market conditions.

Additionally, easyJet reported a 3% rise in revenue per seat and a significant 6% growth in ancillary revenue, reflecting its successful revenue diversification strategies and strong operational performance.

- Outlook for financial year:

Furthermore, the trading update provided a positive outlook for the financial year ahead, with easyJet projecting optimism despite external challenges. Despite facing headwinds such as the conflict in the Middle East, the company demonstrated its confidence in mitigating losses, with expectations of mid-single-digit growth in revenue per seat for Q2.

Additionally, easyJet remained committed to disciplined capacity expansion, aiming for approximately 9% growth for the full year, signalling its proactive approach to capitalising on emerging opportunities and market demand.

- Strong momentum in summer 2024 bookings:

The trading update also highlighted strong momentum in summer 2024 bookings, with robust demand observed during the traditional turn of the year sales period.

Sector rival, Jet2– a stock we hold in our AIM Investor portfolio has also reported strong trading update with a 20.5% increase in on-sale seat capacity but strong forward bookings. Summer 2024 seat capacity rose by 12.5%, with encouraging forward bookings indicating improved load factors compared to the previous year.

This sector-wide positive booking trend, coupled with easyJet’s solid operational performance, provides a strong foundation for revenue generation and profitability in the upcoming quarters.

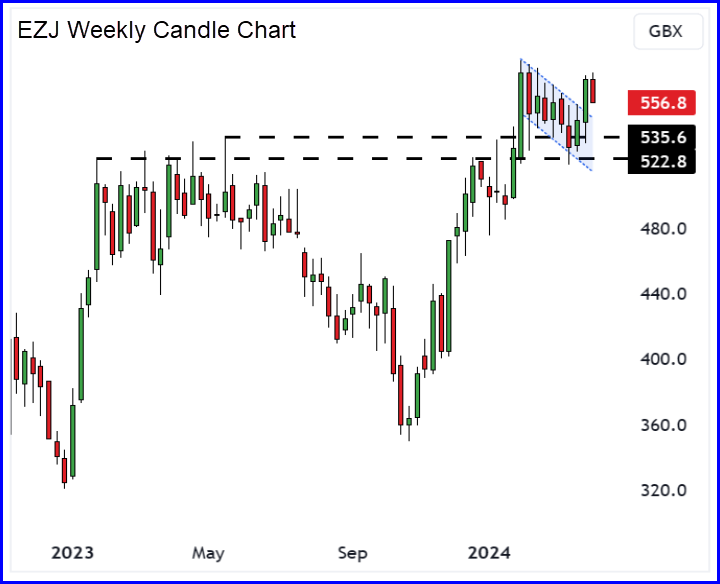

Technical timing: easyJet’s break & retest pattern

The break & retest price pattern embodies a key tendency of uptrends – broken resistance turning to support.

easyJet’s share price broke through a key area of resistance in January as investors priced-in the improved outlook published in the Q1 trading update.

If we view this breakout on the weekly candle chart (right), we can see that following the breakout prices have consolidated sideways within a tight descending channel – forming a classic bull flag.

Having retested the broken resistance area, easyJet’s share price has regained momentum and broken decisively higher last week. Last week’s break higher confirms the break & retest pattern, it also confirms the bull flag breakout and creates a short-term technical catalyst for our second tranche buy.

Valuation remains attractive

easyJet’s valuation remains very reasonable despite the strong performance of its share price during the last twelve months.

The shares trade on a forward PE of 8.5 which compares favourably to double-digit forecast growth in earnings per share (EPS) of 21.1%.

A price-to-book ratio of 1.55 and an enterprise value to adjusted earnings (EV to EBITDA) ratio of 3.81 compares well to sector peers. And a well-covered dividend yielding 2.5% on a forward basis gives this growth stock a nice amount of additional income.

easyJet’s impressive cash generation capabilities underscore its financial strength, while its debt-free balance sheet further solidifies its position as a high-quality stock. This solid financial foundation instils confidence, providing a cushion against the economic uncertainties and geopolitical shocks that are so prevalent in the travel sector.

In summary, easyJet’s consistent delivery of strong trading updates, coupled with its attractive valuation metrics and positive technical indicators, reaffirm our conviction in this market leader’s growth story.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.