21st Aug 2024. 9.06am

Regency View:

BUY Drax (DRX)

- Value

Regency View:

BUY Drax (DRX)

Drax: Our top pick for utilities diversification

Against a backdrop of rising market volatility, increasing FTSE Investor’s exposure to the utilities sector presents a strategic opportunity for diversification.

Drax Group (DRX) is our top pick from the UK utilities sector due to its strategic positioning in renewable energy, strong financial performance, and attractive valuation.

Drax’s game plan: Leading the renewable revolution

Drax is not just a traditional utility company, it is at the forefront of the UK’s renewable energy transition.

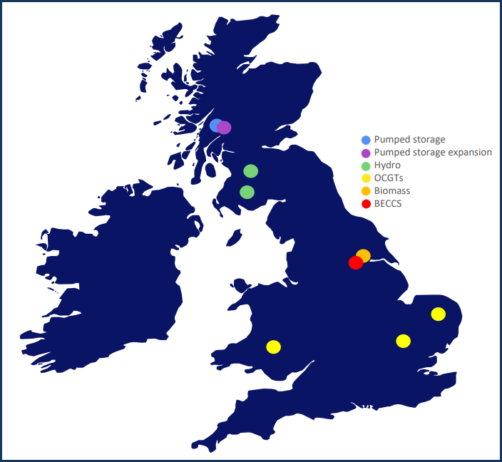

The company’s primary focus is on biomass energy production, with its flagship power station in Yorkshire capable of generating electricity for 5 million homes. Drax’s biomass operations, which involve converting wood pellets into energy, have already made it one of Europe’s largest renewable energy producers.

Drax’s strategy is centred around its Bioenergy with Carbon Capture and Storage (BECCS) technology. BECCS represents a significant advancement in reducing carbon emissions by capturing and storing the CO2 produced during biomass energy generation.

Drax has been investing in this technology as part of its broader ambition to become a carbon-negative company by 2030. This positions Drax as a leader in the renewable energy sector and puts the company at the forefront of the UK’s efforts to combat climate change.

Impact of the new Labour government: A positive shift for Drax

Labour’s commitment to renewable energy and climate change mitigation aligns closely with Drax’s strategic goals, particularly its BECCS project.

The new government’s focus on accelerating the UK’s transition to net-zero emissions bodes well for Drax, as BECCS technology is central to achieving these targets. This alignment increases the likelihood of continued or even enhanced subsidies for Drax’s biomass and BECCS operations, which are vital for the company’s financial health and future growth.

Despite the expiration of key subsidies like the Renewables Obligation Certificates (ROCs) and Contracts for Difference (CfDs) in 2027, Drax has been actively engaging with the Labour government to secure new agreements. Given Labour’s green energy agenda, there is optimism that the government will support the extension or replacement of these subsidies, recognising Drax’s role in the UK’s energy security and environmental goals.

On balance, the Labour government’s policies are expected to create a favourable environment for Drax. The government’s likely support for renewable energy projects, coupled with Drax’s proactive engagement with key policymakers, positions the company well to navigate upcoming challenges and capitalise on new opportunities. This political backdrop adds another layer of confidence to Drax’s long-term investment appeal.

Strong half year results

Drax’s recent half-year results underscore the company’s financial strength and operational resilience. For the first half of 2024, Drax reported a 24% increase in profits, reaching £515 million. This strong performance was driven primarily by its biomass generation, which saw a remarkable 74% increase in cash profits to £393 million, thanks to higher generation levels and favourable power prices.

In addition to strong earnings, Drax announced a new £300 million share buyback program, signalling confidence in its future prospects and commitment to returning value to shareholders. The company’s robust cash flow generation, with free cash flow per share rising to 100p, further highlights its financial health.

Bullish momentum continues

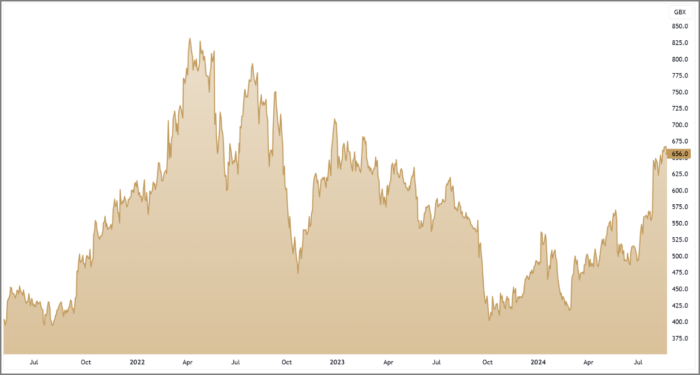

From a technical perspective, Drax’s share price has shown strong upward momentum since March 2024. The 50-day moving average has crossed above the 200-day moving average, a bullish signal often referred to as a “golden cross.”

Following the release of its impressive half-year results, Drax’s shares gapped higher, reflecting a surge in investor confidence. The stock has since been consolidating near its recent highs within a bullish flag pattern—a continuation pattern that typically precedes further upward movement. This technical setup indicates that Drax’s share price is likely to continue its upward trajectory, making it an attractive entry point for investors looking to capitalise on the stock’s momentum.

Valuation: A compelling buy below fair value

Drax is trading significantly below its estimated fair value of 1,781p, suggesting substantial upside potential of over 20%. Additionally, Drax’s price-to-earnings (PE) ratio of 6.1x is well below the industry average, making it an attractive option for value investors.

The company’s strong return on equity (ROE) of 34.6% and operating margin of 14.89% highlight its efficiency and profitability, further supporting its investment case. With a dividend yield of 4.07%, Drax also offers an attractive income stream, backed by strong cash flow and a history of consistent dividend growth.

Overall, we believe Drax offers the stability of a traditional utility with the growth potential of a renewable energy leader. The company’s strategic focus on biomass and BECCS technology positions it at the forefront of the UK’s energy transition, while its strong financial performance and attractive valuation make it a standout choice for investors seeking exposure to renewable energy.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.