27th Sep 2023. 9.02am

Regency View:

Buy Computacenter (CCC)

- Growth

Regency View:

Buy Computacenter (CCC)

Computacenter’s cashflow catches the eye

In the quest for identifying top-tier stocks poised for long-term returns, the adage holds true: “Cash is the undisputed king.”

Cashflow is a mirror reflecting a company’s ability to meet operational expenses, fuel future expansion, and reward shareholders with dividends. It serves as a litmus test of a company’s resilience in the face of economic turbulence, showcasing its prowess in weathering adversity and charting a course toward sustainable growth.

Enter Computacenter (CCC), a leading tech solutions provider, which, in the past six months, has witnessed a remarkable 14-fold surge in its net cash inflow from operating activities. Profits are rising, Computacenter’s balance sheet is getting stronger and shareholder payouts are increasing.

Navigating tech excellence: Computacenter’s three pillars of service

Computacenter operates as a comprehensive tech services and solutions provider, primarily catering to large corporate clients and public sector organisations. Their core business revolves around three primary service lines, each designed to address specific tech needs.

1. Tech Sourcing: Computacenter work closely with tech vendors to facilitate the procurement of hardware and software solutions. This includes structuring commercial arrangements, managing integration processes, and handling supply chain logistics, ensuring that clients obtain the right tech solutions efficiently.

2. Professional Services: Computacenter’s professional services encompass tech consulting, strategy development, and the practical implementation of solutions to drive digital transformation. This is particularly valuable for client’s seeking guidance in selecting, deploying, and integrating tech effectively.

3. Managed Services: Maintaining and managing the IT infrastructure and operations for their clients. This ongoing support is crucial for ensuring the seamless operation of tech systems while optimising costs. It includes services such as user support, digital operations management, and infrastructure maintenance.

Computacenter generates revenue through fees associated with their three service lines. Their overarching goal is to assist clients in achieving digital transformation, improving operational efficiency, and optimising tech investments, ultimately delivering long-term value.

Computacenter’s catalysts for growth

Here are some key catalysts for growth:

- Digital transformation demand: As businesses increasingly prioritise digital transformation to stay competitive, there is a growing demand for tech services and solutions. Computacenter, with its expertise in helping clients navigate digital transformation, is well-positioned to benefit from this trend.

- Remote work and hybrid work models: The shift to remote and hybrid work models has amplified the need for robust IT infrastructure and support. Computacenter’s managed services can address the IT requirements of organisations adapting to these new work models.

- Cybersecurity concerns: The rising frequency and sophistication of cyber threats have made cybersecurity a top priority for businesses. Computacenter’s services in this area can experience growth as organisations seek to fortify their defences.

- Cloud adoption: The migration to cloud computing continues to accelerate. Computacenter’s expertise in cloud solutions and services can attract clients looking to leverage the cloud for scalability and flexibility.

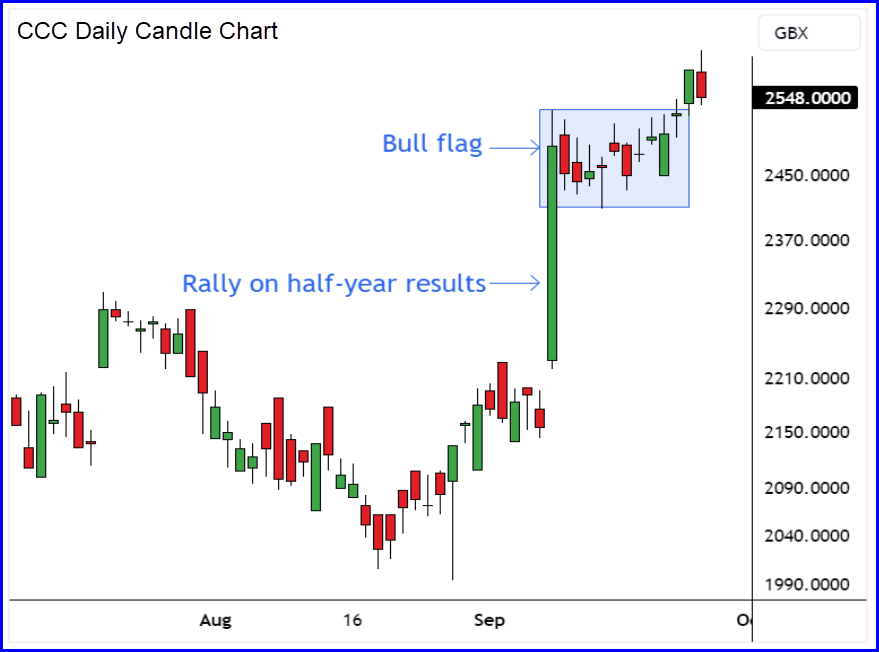

Bull flag forms after strong half year results

Computacenter’s share price surged higher at the start of the month following a bullish set of half-year results. The company reported strong revenue growth of 27% for the six months ending June 30, reaching £3.58bn compared to £2.83bn the previous year.

Profits rose by 14% to £122.8m, net cash inflow surged to from £8.1m to £116.5m, and shareholders saw a 2.3% increase in dividends to 22.6p per share.

Computacenter delivered growth across all its core service lines:

- Tech Sourcing: Revenue in this segment rose by 33.5% to £2.77bn.

- Professional Services: Revenue increased by 11.8% to £333.7m.

- Managed Services: Revenue grew by 6.3% to £482.8m.

Additionally, the reduction in inventory levels and strong cash generation positioned the company for a promising second half of the year and long-term growth prospects.

Price action following the results day rally has seen the shares consolidate near recent highs in a tight trading range. This high and tight consolidation is known as a bull flag and signals a continuation of the recent bullish price momentum.

Discount to Fair Value

Describing Computacenter as a high-quality stock would be an understatement. The company boasts an impressive 19-year track record of growth in adjusted diluted earnings per share.

It consistently achieves a Return on Equity (ROE) of over 20%, and its trailing twelve-month free cash flow stands at a robust £273m. This strong cashflow has allowed Computacenter to maintain a rock-solid, debt-free balance sheet, with a substantial net cash position exceeding £300m.

Despite these compelling fundamentals, Computacenter’s shares are currently trading at a discount. When Computacenter’s substantial future cashflows are modelled it produces an estimated Fair Value of £38.27 some 34% above current prices.

It is also worth noting that Computacenter has a responsible approach to dividend payments, allocating 40% of its profits for this purpose and 26% of free cashflow. This prudent dividend policy reduces the risk of unsustainable pay-outs and we would expect Computacenter’s dividend to continue to steadily rise.

Overall, we believe Computacenter’s bullish short-term momentum and high quality fundamentals make them a strong addition to our FTSE Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.