7th Feb 2024. 8.59am

Regency View:

BUY Clarkson (CKN)

- Growth

- Income

Regency View:

BUY Clarkson (CKN)

Clarkson: A maritime powerhouse

Sticking with our theme of earnings season winners, this week we have Clarkson (CKN)…

Clarkson is a maritime solutions provider which recently said it will comfortably beat market expectations. The business has exceptionally high-quality financials, generating plenty of free cashflow and delivering consistently profitable growth.

Clarkson’s multifaceted maritime business model

Clarkson serves as a comprehensive solution provider across various facets of the maritime sector. With a headquarters located in St. Katharine’s Dock on the edge of the City of London, the company operates on a global scale, connecting key players in the shipping and offshore industries.

Clarkson’s business model covers five key areas:

1. Shipbroking:

Shipbroking is the core of Clarkson’s business. It involves acting as an intermediary between buyers and sellers of vessels, facilitating the transportation of commodities globally. Clarkson earns commissions or fees for brokering deals, whether it’s the sale or chartering of ships. The company’s extensive network and market expertise position it as a go-to broker in the maritime industry.

2. Research:

Informed decision-making is crucial in the maritime sector. Clarkson provides research services, collating information on global merchant shipping and offshore markets. Revenue is generated through subscriptions, consultancy services, and data feeds. Clients pay for access to valuable insights and market intelligence provided by Clarkson’s research arm.

3. Financial Services:

Recognizing the financial complexities of the industry, Clarkson offers financial services to ocean-going transportation companies, providing support and administration. Fees and commissions are earned through financial transactions, including assistance with financing, insurance, and other financial aspects related to maritime activities.

4. Technology:

Technology is at the forefront of Clarkson’s operations. The company integrates technology into all aspects of its business to drive positive change and innovation. While specific details may not be publicly disclosed, revenue is likely generated through the development and provision of technological solutions tailored to the maritime industry’s needs.

5. Port Services:

Port services involve various activities related to port operations, contributing to the broader logistics chain in maritime trade. Clarkson earns revenue through the provision of port services, which may include vessel agency, cargo handling, and other logistics-related activities.

Charting a course for growth: US dominance and sustainable frontiers

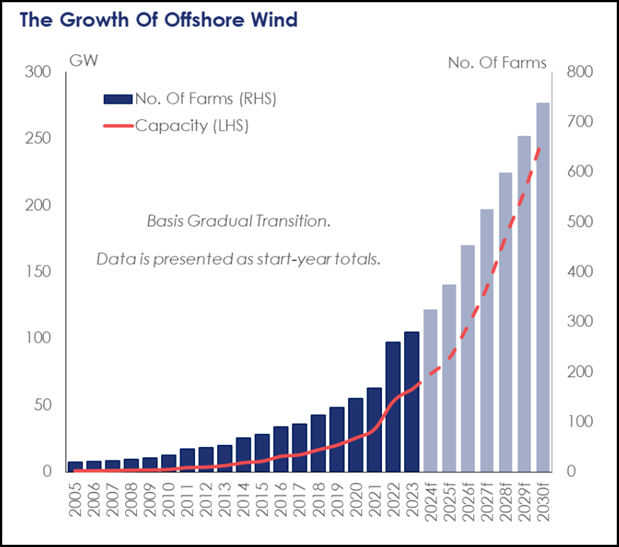

Clarkson has strategically positioned itself as a significant player within the United States. With a focused approach towards the US wind market, the company has aligned with the US government’s commitment to renewable energy.

The transition towards sustainable energy forms the bedrock of Clarkson’s growth strategy. Clarkson’s research forecasts an investment exceeding $25 billion in the next decade for vessels catering to the wind industry. Already having secured over $1 billion in wind vessel transactions, Clarkson perceives this as a pivotal avenue for future growth.

Alongside renewables, Clarkson is also benefiting from the resurgence of the US Oil & Gas industry. The company plays a pivotal role in oil shipping and Clarkson has become an indispensable support system in this sector. Having a strong foothold in renewables and traditional energy allows the business to comfortably adapt the ever-changing dynamics of the energy market.

Exceptional cash generation

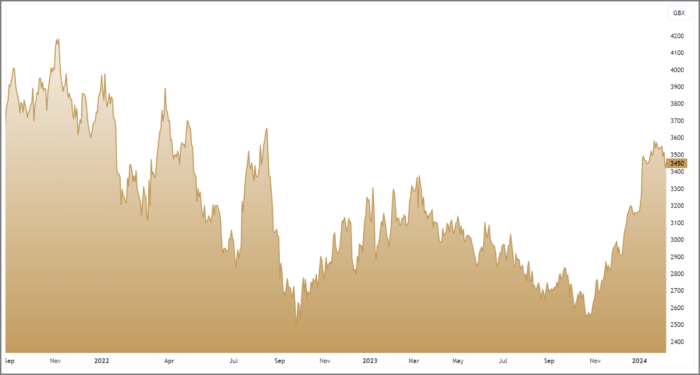

Over the past five years, Clarkson has delivered an impressive 13.3% compound annual growth rate (CAGR) in revenue. Profitability echoes this strength, with a robust 17.3% CAGR in net profit over the same five-year period.

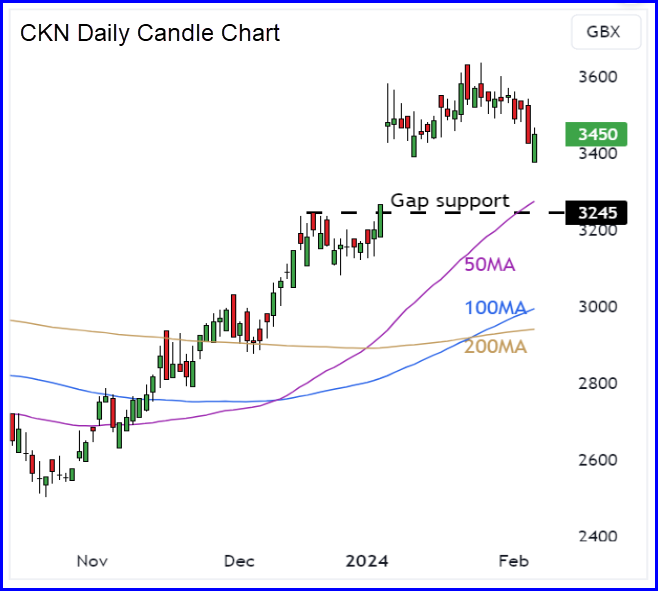

A recent strong trading update in January served as a bullish catalyst, causing Clarkson’s shares to gap higher. Bullish price gaps of this nature tend to provide long-term support, especially within the context of a strong uptrend.

Clarkson’s has exceptional cash generation, with an operating cash flow of £523 million (TTM). Over 90% efficiently flows into free cash, showcasing the company’s ability to convert operational success into tangible financial strength.

A debt-free balance sheet, fortified with £286 million in cash (TTM) underlines Clarkson’s quality. It also backs a dividend of 94p which is covered more than 2.9 times by earnings. And whilst the stock’s forward PE of 13.9 is high relative to its peer group, we believe this valuation reflects Clarkson’s quality.

Clarkson are set to release full year earnings on Monday March 4th, and given January’s positive trading statement we expect these earnings to provide another positive catalyst to propel the shares higher.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.