Regency View:

BUY Centrica (CNA)

Buying the biggest player in a consolidating market

All markets are cyclical…

A boom-and-bust roller coaster in which the growth phase can be a free for fall for new entrants and the consolidatory cull is a brutal bloodbath.

In recent years, there perhaps hasn’t been a better example of this Darwinian model than in the UK domestic energy market…

Between 2011 and 2018, the number of suppliers serving residential UK customers surged from 14 to 70.

The ensuing battel for new customers squeezed profit margins, leading many weak hands to cut costs on hedging, leaving them over exposed when the post-pandemic energy crisis hit – leading to a brutal consolidation…

Since the start of last year, 30 companies serving more than 2.8 million customers have gone bust.

Just as in nature, last players standing are left to take the spoils, and in today’s report we’re going to outline why the market’s dominant player, British Gas owner Centrica (CNA) looks perfectly positioned to clean up.

Centrica’s security puts them in pole position

British Gas have long been the largest player in the UK multi-utility market.

This worked against them during the boom years, but in the consolidatory phase, it’s been hugely beneficial…

British Gas took on a quarter of the initial 2.8 million energy crisis customers as a Supplier of Last Resort.

A further 1.6 million customers will become available once the special administration period for Bulb’s parent Simple Energy ends.

For British Gas, the cost of acquiring new customers will be significantly lower then in the past. And the significant jump in Ofgem’s price cap earlier this month will see Centrica’s margins widen.

Across the market, customer confidence has been shaken due to the mismanagement of client money. And this lack of trust puts Centrica in pole position as the market continues to consolidate…

The British Gas brand is strong, and Centrica have been at the forefront of segregating client money – allowing it to appear squeaky clean relative to the competition.

And whilst Centrica will have to work hard to retain the newly acquired customers, switching levels are currently low due to the dwindling competition.

Brand new balance sheet makes Centrica a different beast

Long seen as a bloated behemoth, Centrica has completed a stunning turnaround during the last two years…

Chris O’Shea was promoted from CFO to CEO in 2019 and he has overseen a major restructuring that involved key asset sales and a withdrawal from its upstream energy activities.

Last year, Centrica sold its US energy services business, Direct Energy brought for $3.6bn (£2.7bn). This was followed in January with the announcement that a $1.08bn (£800mn) fee had been agreed for the sale of the Norwegian assets of upstream business Spirit Energy.

Centrica’s balance sheet now has flipped from being debt laded to cash rich…

February’s Final Results (FY21) saw Centrica’s balance close with a net cash position of £0.7bn compared to net debt of £3.0bn at the start of 2021.

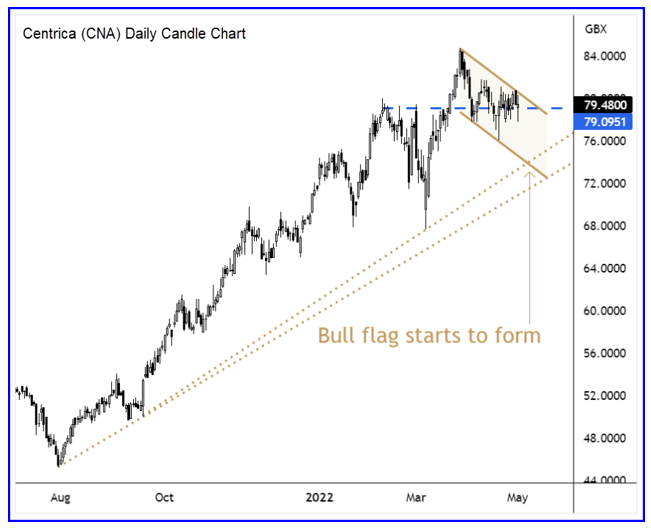

Bullish flag starts to form

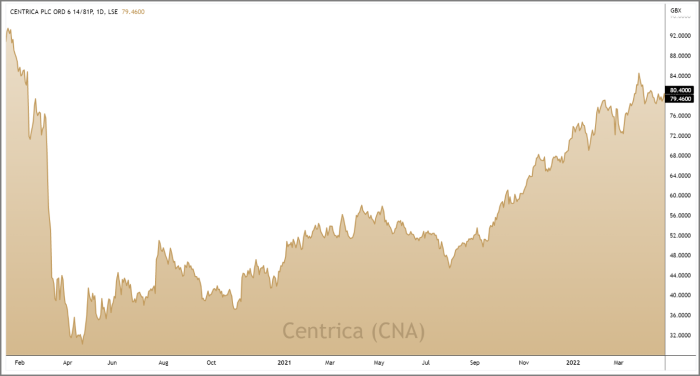

On the price chart, Centrica’s share price has plenty of bullish momentum…

The shares have carved out a powerful uptrend since the start of the energy crisis last autumn. And a series of steepening trendlines signals that momentum is increasing.

Recent price action has seen the shares undergo a steady pullback – forming a small descending channel or ‘bull flag’ pattern (see chart right).

The location and nature of this flag formation signals that the shares are going through an ‘accumulation phase’ ahead of a with trend ‘mark-up’. Hence, we’re looking to position ourselves within this consolidation phase to achieve favourable levels of risk reward.

Value for money

We believe Centrica’s share price offers good value money despite the recent uptrend…

The shares are trading on a forward Price to Earnings multiple of 6.4 which is the most attractive in the Multiline Utilities sector.

Centrica also score well across several other value metrics…

Price to free cashflow is just 4.1 and enterprise value to adjusted earnings (EV to EBITDA) is 2.83 – one of the best in its peer group.

Centrica’s Return on Equity (ROE) is now more than 30%, underlining the turnaround the company has made in the last four years and indicating that it can efficiently uses shareholders’ equity to generate profits.

There is also a growing number of calls for Centrica to reinstate its dividend and should this happen investors are forecast to receive a yield north of 4%.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.