17th Apr 2024. 9.01am

Regency View:

BUY Centrica (CNA)

- Value

- Income

Regency View:

BUY Centrica (CNA)

Centrica: Where quality meets value

When it comes to pinpointing stocks that intersect value and quality, you’ll struggle to look past Centrica (CNA).

The energy company is a dominant market leader that amassed a pile of cash and new clients following the energy crisis. This has created a shiny debt free balance sheet and the potential for steadily rising dividend payments. The shares trade on a single digit earnings multiple and have retraced almost half their energy crisis gains – creating a low value entry point into a high-quality stock.

A remarkable turnaround in 2023

In 2023, Centrica experienced a year of exceptional success and transformation, marking a significant turnaround from previous challenges…

- Financial triumphs

Centrica’s financial results for 2023 were nothing short of extraordinary. The company reported a remarkable surge in pre-tax profits, soaring to £6.5 billion from a £383 million loss in the previous year. This impressive turnaround was primarily driven by £3.6 billion in re-measurement gains, including strategic hedge purchases, which substantially bolstered Centrica’s bottom line.

British Gas Energy experienced an unprecedented tenfold increase in profits, reaching £751 million. This impressive growth was attributed to an industry-wide one-off recovery of around £500 million in prior period costs.

Despite facing reduced volatility compared to previous years, Centrica’s trading unit continued to demonstrate resilience, delivering a robust adjusted operating profit of £774 million. This resilience in the face of changing market dynamics speaks volumes about Centrica’s ability to adapt and thrive in challenging environments.

- Strategic initiatives

Centrica’s success in 2023 can be attributed not only to its financial performance but also to its strategic initiatives aimed at driving growth and efficiency. The company’s diversified business portfolio, which encompasses renewable and thermal power generation, energy retail, trading, and storage, proved to be a key strength.

CEO Chris O’Shea’s leadership played a pivotal role in steering Centrica through a transformative year. O’Shea’s strategic vision and decisive actions positioned the company for success, despite uncertainties in the energy sector.

Bold targets for 2026

Centrica is aiming for sustainable profitability by 2026, with ambitious medium-term targets set across its business segments.

British Gas Residential Energy Supply is targeting an operating profit of approximately £800 million, demonstrating the company’s dedication to optimising its residential energy supply business.

Meanwhile, British Gas Services & Solutions aims for an operating profit ranging from £150 million to £250 million, reflecting Centrica’s strategic emphasis on expanding its service offerings and solutions to generate additional revenue streams and enhance profitability.

Centrica Energy Business Energy Supply is focusing on achieving an operating profit ranging from £100 million to £200 million. Similarly, Bord Gáis is targeting an operating profit ranging from £250 million to £350 million.

In addition to these ambitious financial targets, Centrica possesses substantial material medium-term infrastructure. This includes 1.2GW of nuclear capacity, 242 billion cubic feet (bcf) of gas reserves, and 54 billion cubic feet (bcf) of gas storage capacity. These assets not only underscore Centrica’s robust infrastructure but also position the company for sustainable growth and operational stability in the medium term.

50% retracement: A technical perspective

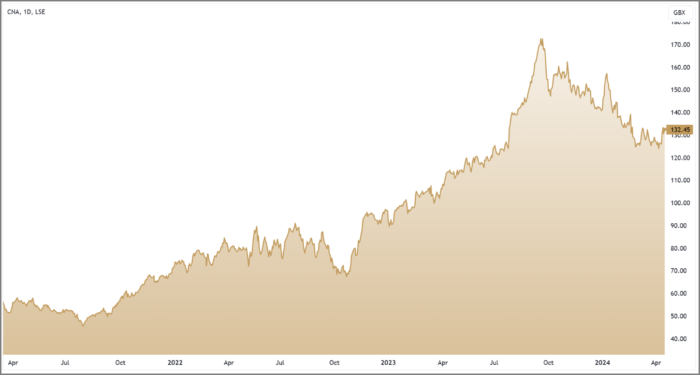

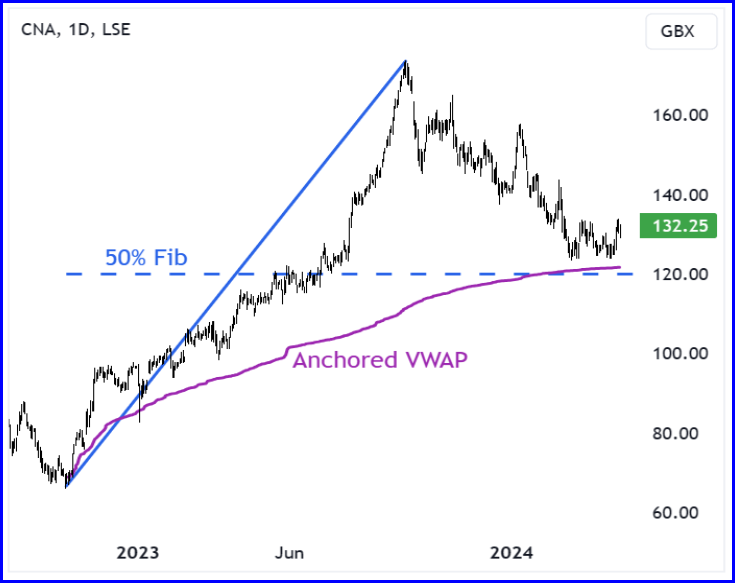

From October 2022 to September 2023, Centrica’s share price more than doubled as energy markets went into meltdown following Russia’s invasion of Ukraine.

Six months on from reaching highs of 172p, Centrica’s share price as undergone a deep pullback and whilst energy prices have fallen more than 70%, geopolitical tensions remain elevated. Centrica’s share price has retraced almost 50% of their Oct 22- Sep 23 rally – this retracement level is a closely watched by investors.

The 50% retracement level also coincides with the volume weighted average price (VWAP) anchored to the Oct 22 low. This level shows the true average price of the ‘smart money’ who invested in Centrica prior to the mega rally.

This confluence of technical indictors has created an area in which the shares should find a base of support, and this is reflected in Centrica’s recent price action – forming a small double bottom reversal pattern this month.

Quality and value intersection

With exceptional profits in FY23, Centrica have amassed a cash pile of £6.7bn which sits on their debt free balance sheet.

Dividend payouts have remains relatively modest at 2.67p per share (FY23), but these payouts are forecast to more than double during the next two years. The shares go ex-dividend on 30th May 2024 and we expect our position in Centrica to generate steady levels of income.

In terms of valuation, the stock trades on a forward price-to-earnings multiple of 7.2. This ranks Centrica first out of the UK’s listed multiline utilities providers. Centrica also claim sector top spot for best value Price to Free Cashflow (2.9), Price to Sales (0.21), and Enterprise Value to Adjusted Earnings (0.66).

Given the pullback from highs, the quality of Centrica’s financials and the heightened levels of geopolitical uncertainty in energy markets, we are happy to add the stock to our list of FTSE Investor open positions.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.