12th Apr 2023. 8.56am

Regency View:

BUY Centamin (CEY)

- Value

Regency View:

BUY Centamin (CEY)

Centamin ready to ramp up production

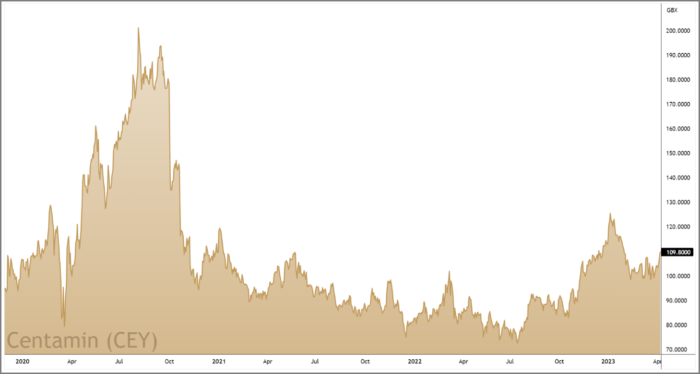

The gold market is starting to glisten again; a market that was dead and lifeless last year now has a healthy spring glow to it.

A glance at gold’s price chart (right) will show you that spot prices are back within touching distance of all-time highs.

There are multiple catalysts driving this rally:

We’re nearing the top of the Fed’s tightening cycle, causing the US dollar to weaken and, as gold is priced in dollars, this is a tailwind for the precious metal.

A potential credit crunch has weakened the outlook for global economic growth, making investors nervous and driving them towards gold as a safe haven.

And, finally, worsening diplomacy between the US and China, fuelled by the war in Ukraine, is also making gold’s safe haven properties look even more attractive.

With these catalysts unlikely to fade anytime soon, we went on the hunt for a gold miner that could meet our criteria for quality and growth…

Centamin (CEY) is an Egyptian gold production and exploration business. It’s planning to ramp up production, has strong financials and the stock trades on a significant discount to Fair Value.

Sukari set for 500,000oz

Centamin’s primary asset is the Sukari gold mine, located in Egypt’s Eastern Desert.

Sukari is a low cost, bulk tonnage open pit and a high-grade underground operation.

It is Egypt’s first large-scale modern mine; served by smooth tarmac roads, off-grid solar power and a 25km water pipeline fed by the Red Sea.

Centmain recently upgraded Sukari’s resource estimate and life of mine to 11.11m ounces (oz) and 14 years respectively.

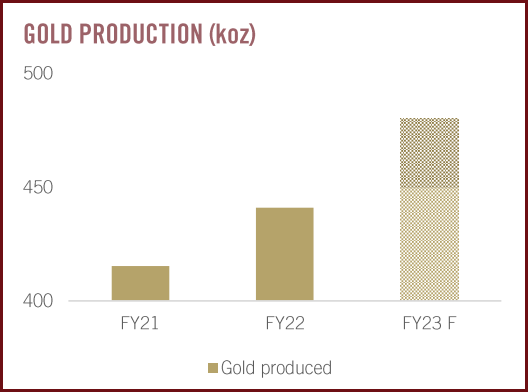

Last year’s production at Sakari climbed 6% to 441,000oz, but all-in sustaining costs (AISC) jumped 13% due to inflationary headwinds.

Centamin is building a new plant at Sukari and starting expansion work on the underground section of the mine.

Production guidance for this year is 450,000-480,000oz, climbing to a target at 500,000oz the following year, while AISC is expected to stay within the $1,250-$1,400 range.

“We spent the past year successfully progressing our reinvestment plan and remain on track to consistently return Sukari to production levels towards 500,000 ounces (oz) per annum from 2024,” said chief exec Martin Horgan.

There is also “significant exploration upside” at Sukari and, more broadly, across Egypt (Centamin have 3,000km2 of new exploration licenses).

Another of Centamin’s exploration assets is the Doropo project in the Ivory Coast…

Centamin began extensive exploration at Doropo in late 2015, building to a Mineral Resource Estimate of 5Moz in 2021.

Following positive outputs of a scoping study completed in 2021, Doropo is being progressed through pre-feasibility (PFS) which is currently at the “imminent completion” stage. This may prove to be a catalyst for a re-rating when published in the next couple of months.

Discount to Fair Value

Centamin trades on a forward price to earnings (PE) ratio of 12.5 which is one of the more expensive valuations in the Metals & Mining sector, but the stock makes up for this on quality, projected earnings growth, and discount to Fair Value.

Quality wise, Centamin has an operating margin north of 20% and a debt-free balance sheet with net cash of $102m.

Earnings per share (EPS) is forecast to grow by 45% over the next year, giving Centamin a very reasonable price to earnings growth ratio (PEG) of 0.4.

And using a discounted cashflow model, Centamin’s share price has a Fair Value of £1.87 – indicating that the shares are more than 40% undervalued.

Fair Value is an estimate of what the share price is worth today, based on the cashflows the company is expected to generate in the future. It’s far from a perfect tool, but any discount below 20% is worth noting.

Multiple levels of support create buffer

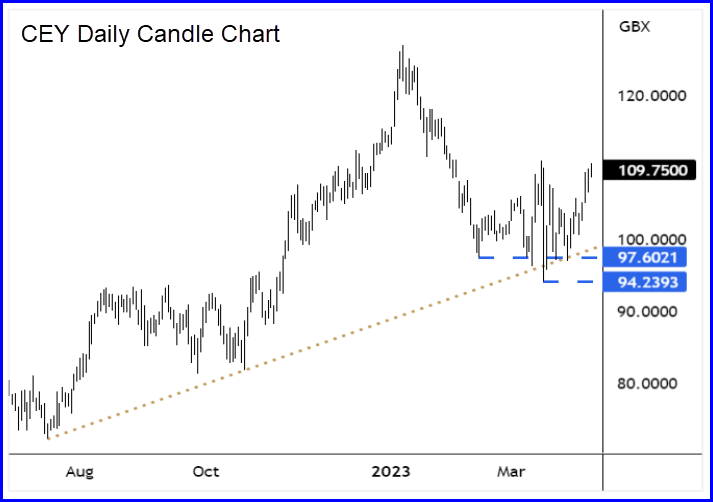

Centamin’s share price looks well positioned to break higher…

Recent price action has seen the shares pullback to a medium-term ascending trendline (gold dotted line).

Buyers have stepped in at the trendline to hammer out a series of swing lows, which has created a solid base of support.

This base of support at 97p-94p, along with the ascending trendline, helps to provide a short-term buffer when timing our entry.

And, backed by a strong underlying gold price, we would now expect the shares to break higher in-line with the dominant trend.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.