16th Aug 2023. 8.58am

Regency View:

BUY Bytes Technology (BYITS)

- Growth

Regency View:

BUY Bytes Technology (BYITS)

Bytes Technology leveraging recurring revenue for sustainable growth

Transition to cloud computing and the critical importance of cybersecurity have emerged as two of the most stable and enduring investment themes in today’s rapidly evolving technological landscape.

Amidst this transformative backdrop, Bytes Technology (BYITS) stands out as a prime contender to harness these themes for sustained growth.

Bytes has a comprehensive portfolio of software products tailored to capitalise on the transition to cloud-based solutions and the heightened demand for robust cybersecurity.

The company generates plenty of cash from its substantial recurring revenue base and we believe Bytes offers investors a growth story worth paying a premium for.

Dual-brand approach enables tailored solutions

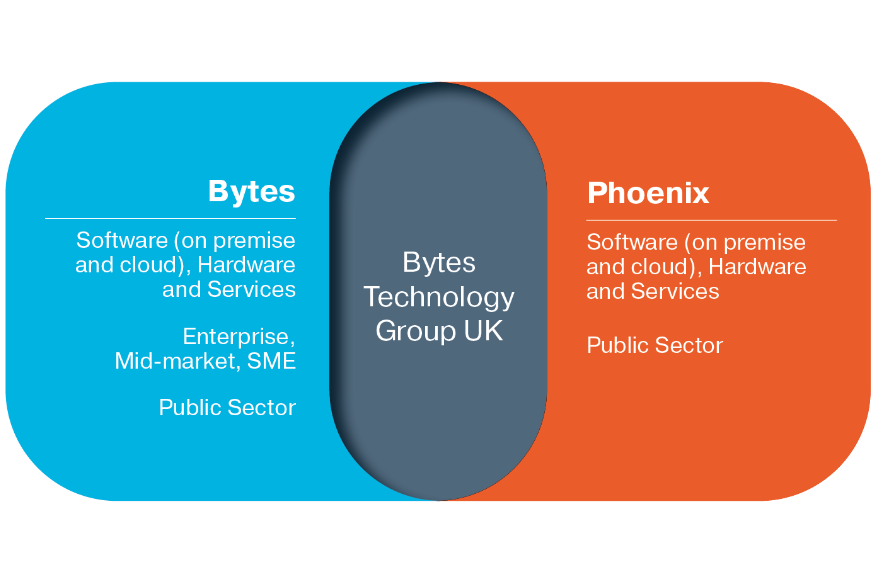

Bytes operates through two leading brands, Bytes Software Services (BSS) and Phoenix Software, each strategically focused to address specific market segments.

BSS caters to both private sector and public sector customers, while Phoenix Software zeroes in on public sector clients. This dual-brand approach enables Bytes to tailor their solutions and services to meet the distinct needs of a wide array of customers.

Bytes positions itself as a trusted partner, providing vital support to Chief Information Officers (CIOs) and IT departments. This approach fosters enduring partnerships that drive recurring business and create plenty of upsell opportunities.

Recurring revenue: The backbone of financial stability

A standout feature of Bytes’ business model is the high level of recurring revenue it generates.

In FY23, 96% of Bytes £129.6m gross profit was generated from existing customers, up from 93% the year prior. Bytes also recorded an impressive 8.5% increase in average gross profit per customer, reaching £21,800 (FY23).

Here’s how Bytes achieves this high level of recurring revenue:

1. Cloud software subscription:

Bytes offers cloud software accessed through subscription models. This approach ensures a regular inflow of revenue as customers renew their subscriptions, generating consistent income streams over time.

2. On-premise software licenses:

In addition to cloud-based solutions, Bytes provides on-premise software licensed under annuity-based models. This form of licensing guarantees ongoing revenue as clients continue to utilise the software, contributing to the company’s recurring income.

3. Ongoing IT services:

Bytes’ IT services, including managed services, security support, software asset management, and consulting, form a crucial part of their overall business model. These services involve ongoing engagement, enabling Bytes to maintain enduring relationships and recurring revenue streams.

The combination of cloud subscriptions, software licenses, and ongoing services creates a robust foundation of recurring revenue. This financial stability not only enhances Bytes’ growth prospects but also underscores its ability to weather market fluctuations and technological shifts.

Quality worth paying for

Bytes high level of recurring revenue generated from its low overhead software-as-a-service (SaaS) model means the company boasts operating profit margins north of 27%.

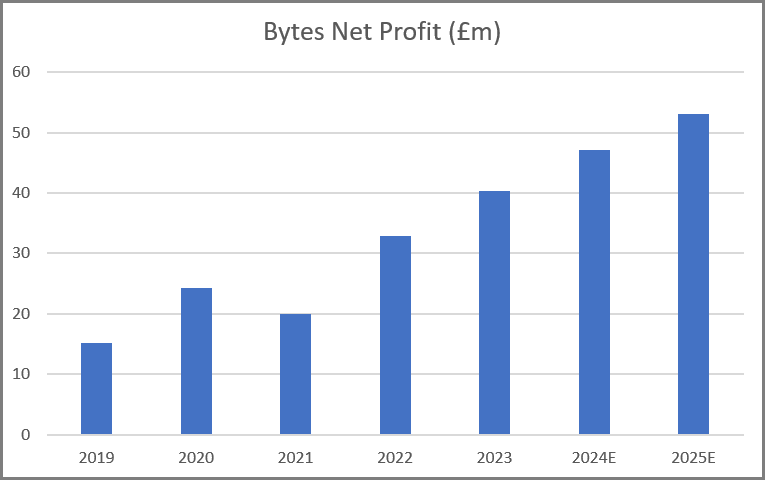

This combination of stable, high margin revenue has seen net profit grow at a compound annual rate of 38% (CAGR) over the last five years. This in turn has create a debt free balance sheet with a net cash position of £73m (FY23).

A high-quality financial profile of this nature comes at premium price and Bytes trades on a forward price to earnings (PE) ratio of 24.7. Whilst this valuation is high relative to the wider market, it looks very reasonable relative to a UK Software industry average PE of (35.6).

It is also worth noting that Bytes operate a progressive dividend policy which distributes 40% of post-tax pre-exceptional earnings to shareholders. The shares currently trade on a forward dividend yield of 2.49% – one of the best in its peer group.

This appealing combination of financial strength, growth prospects, and shareholder-friendly policies make Bytes a compelling investment.

Bull flag forming

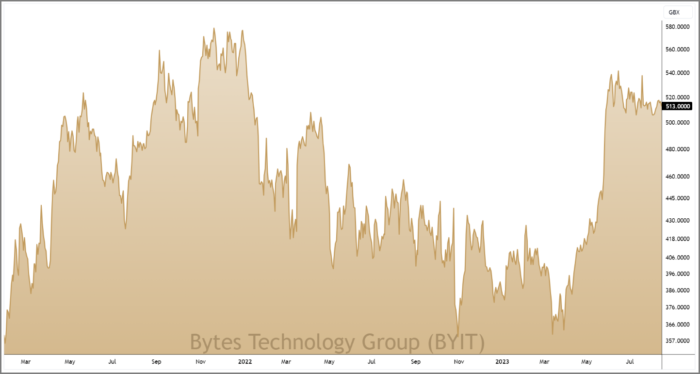

Technical timing is an important final piece of our investment strategy and Byte’s recent price action has formed a bullish price pattern known as a ‘bull flag’.

The foundation of this pattern is a strong momentum-driven rally and we can see from Bytes price chart (right) that the shares had plenty of upwards momentum from March to June.

To form the ‘bull flag’ the market needs to consolidate near highs within a tight channel and Byte’s share price has done this in almost textbook fashion.

Short-term probabilities of the ‘bull flag’ favour a break higher in-line with the dominant trend. Hence this pattern has created a short-term catalyst from which we would expect to achieve a favourable entry.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.