2nd Apr 2025. 9.01am

Regency View:

BUY Bytes Technology (BYIT) Second Tranche

- Growth

Regency View:

BUY Bytes Technology (BYIT) Second Tranche

Bytes Tech: Growth drivers galore

Bytes Technology (BYIT) has found its rhythm again after a period of underperformance, with the latest trading update injecting fresh momentum into the stock.

Having recommended our first position back in 2023, we believe it’s time to consider adding to our position as Bytes gears up for a strong year. The recent trading update has highlighted several key growth drivers, underpinned by strong financials and a bullish technical setup. Let’s dive into why Bytes is once again a compelling buy.

Delivering double-digit growth

Bytes has proven itself as a resilient player in the IT services sector, once again delivering double-digit growth across its key financial metrics. Gross invoiced income has comfortably surpassed the £2 billion mark for the first time, reflecting not just robust demand but a solid execution of its business strategy. Operating profit also grew in the mid-to-high teens, further demonstrating the company’s ability to scale profitably.

The momentum in gross profit growth has been particularly encouraging, with the acceleration in the second half balanced across both corporate and public sector clients. This diversified performance underscores the strength of Bytes’ business model and its strategic positioning within the software and IT services market.

Financial flexibility underpinned by strong cash flow

One of the most attractive aspects of Bytes Technology is its strong cash flow generation. Cash conversion remained robust throughout FY25, exceeding the company’s 100% target, and the year closed with a cash balance north of £110 million.

This healthy cash position provides significant financial flexibility. Whether Bytes chooses to reinvest in growth, pursue acquisitions, or return capital to shareholders, the balance sheet strength is a reassuring signal for investors. In an industry where staying ahead of the curve often requires substantial investment, Bytes has the means to continue building on its success.

Well positioned in high-growth sectors

If you’re looking for a company poised to ride the wave of tech innovation, Bytes is hard to ignore. AI, cloud computing, and cybersecurity are some of the most dynamic sectors right now, and Bytes has its foot firmly in all three.

The company’s longstanding relationships with major vendors, including Microsoft, give it a distinct edge. The demand for AI-driven solutions and secure cloud infrastructure continues to grow, and Bytes is actively positioning itself as a key enabler of digital transformation for both corporate and public sector clients. As more companies integrate AI into their business models, Bytes’ focus on these areas is likely to pay off handsomely.

Leveraging the Microsoft incentive plan

Bytes’ close alignment with Microsoft has always been a strategic advantage, and the recent update to the Microsoft incentive plan has the potential to unlock new growth avenues. The incentive plan, which Bytes has embedded into its strategic roadmap, is set to boost demand for software and cloud solutions.

Given Bytes’ track record of adapting to changes in vendor programmes, this new incentive structure could be a timely catalyst. It positions the company to capture even more value from its cloud services, an area expected to see sustained demand as organisations of all sizes ramp up their digital transformation efforts.

A growing customer base and deepening relationships

Bytes continues to expand its customer base while increasing the share of wallet from existing clients. This dual growth approach is crucial, as it demonstrates both the ability to attract new business and the skill to deepen existing relationships.

This strategy has been particularly effective in serving both corporate and public sector clients, where Bytes’ strong customer service ethos helps maintain high levels of client engagement. The combination of customer expansion and deeper relationships should support consistent revenue growth moving forward.

Valuation & Financials: Still room to grow

When price action and fundamentals align, it’s usually worth paying attention—and Bytes Technology has plenty going for it on both fronts. The company’s financial metrics paint a picture of quality and efficiency. A return on capital of 76.2% and a return on equity of 75.5% speak to how effectively Bytes turns investment into profit, while an operating margin of 30.3% highlights just how profitable its operations are.

The forward P/E ratio of 19.6 suggests that the market isn’t getting carried away with Bytes’ growth story, which is reassuring given the recent trading update. Plus, a dividend yield of 3.44% provides a bit of a cushion while waiting for capital appreciation. It’s the kind of setup where you can see the appeal: strong profitability, solid yield, and a valuation that still leaves room for upside.

What really makes Bytes stand out is the combination of financial quality and exposure to high-growth tech sectors like cloud, AI, and cybersecurity. This isn’t a stock riding high on hype alone. It’s backed by numbers that suggest staying power and a strategy that keeps it relevant in an evolving industry.

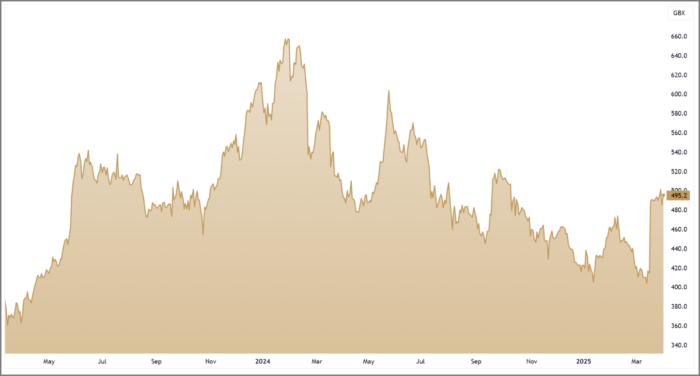

Technical analysis: Bullish gap and consolidation

The trading update has not just driven interest in the fundamentals but also provided a clear technical catalyst…

Following the announcement, the shares gapped higher, breaking back above the 200-day moving average—a key bullish signal that often marks a shift in sentiment.

Since then, the stock has been consolidating near recent highs – forming a classic bull flag pattern. Consolidation after a gap higher indicates that buyers are holding their ground and the 200-day moving average is now acting as support.

We would expect to see a bull flag breakout in the coming sessions – making the current setup an attractive entry point for those looking to build on an existing position.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.