30th Aug 2023. 9.01am

Regency View:

Buy Babcock International (BAB)

- Value

Regency View:

Buy Babcock International (BAB)

Turning the ship around: A bright future for Babcock International

In the ever-evolving landscape of defence and engineering, Babcock International (BAB) is setting sail towards a promising horizon under the leadership of its new CEO, David Lockwood, and CFO, David Mellors.

The duo has successfully navigated turbulent waters before, notably orchestrating a triumphant turnaround at defence firm Cobham. With their track record, it’s no surprise that the tide is changing for Babcock.

Powering the engines of progress

So, what exactly does Babcock do? In essence, they are the backbone behind the scenes, ensuring that critical defence and civil systems stay in top-notch shape.

They provide through-life technical support and engineering expertise to a range of sectors, including naval, land, air, and nuclear operations.

Their fingerprints are on everything from naval ships to specialised equipment like liquid gas handling systems. Their integrated technology solutions, from secure communications to electronic warfare, bolster national security in an increasingly interconnected world.

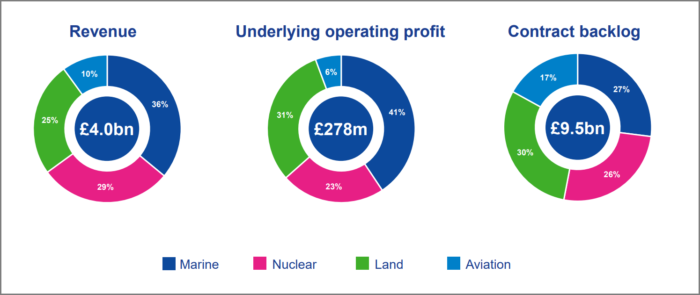

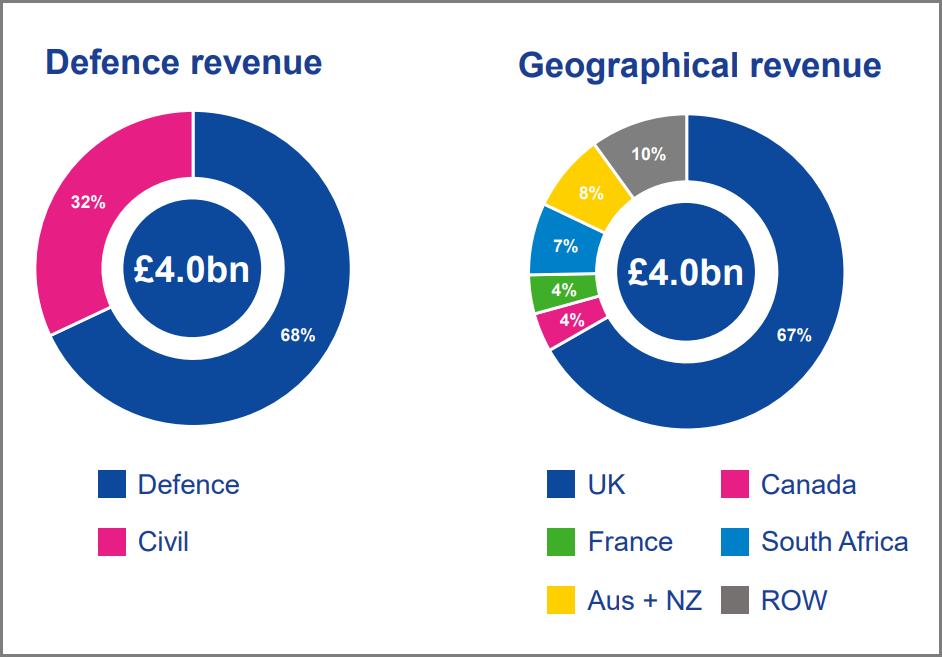

More than two thirds of Babcock’s revenues come from the defence sector with a roughly equal split between naval, land, and nuclear sectors and a smaller contribution from the aviation sector.

In terms of geographic diversification, Babcock is anchored to the UK which contributes 67% of revenues with the remainder coming predominantly from Australia, South Africa, Canada and France. This home-ground advantage roots their growth strategy close to home.

A rising tide lifts all ships

The tide of global defence spending is undoubtedly a rising force. Across the globe, governments are responding to escalated perceived threats by amplifying their investments in defence. This surge in expenditure is unprecedented and speaks to the urgency of fortifying security measures.

Research by Janes forecasts global military spending to crest at around $2.18 trillion (£1.77 trillion). This projection entails an impressive nominal surge of 8.6%, translating to a robust real growth rate of 5.1%. This leap forward stands in stark contrast to the lacklustre average annual real growth rate of a mere 0.7% over the last decade.

Babcock finds itself at the forefront of this surge in global defence spending. It’s order book stands at £9.5bn and recent contract wins include:

- A contract with the MoD to support urgent operational requirements for Ukraine’s military land assets.

- Multi-year refit of the second of the UK’s Vanguard Class nuclear submarines, HMS Victorious.

- A large contract to manage and operate Skynet, the MoD’s military satellite communications system.

- 10-year multi-million contract for the global support of air transit and aircraft operation equipment by the Aeronautical Maintenance Department (French Ministry of Armed Forces).

- A 12-month contract extension to continue to support Skysiren, the UK’s implementation of the US defence Integrated Broadcast Service.

Recent results highlight progress

Recent financial results have highlighted the progress which has been made by CEO David Lockwood and CFO David Mellors.

“When we started our transformation, my first goal was to stabilise and strengthen the balance sheet and I’m delighted to say that work is complete” said Mr Lockwood in July.

“Babcock is now a higher-quality, lower-risk and more predictable business, with a clear focus on execution” he added.

It’s hard to disagree with Babcock’s chipper CEO, the company reported full year (FY23) revenue growth of 8% to £4.4bn.

Underlying operating profit, excluding certain losses, surged to £278m, a 17% increase compared to the previous year – driven by strong performances across all sectors.

Babcock’s underlying operating margin, excluding specific losses, has increased from 5.8% to 6.3%. This signifies a notable improvement in their operational efficiency and financial performance, reflecting David Lockwood’s goal of enhancing profitability and driving growth.

Additionally, the company’s commitment to reinstating dividends in the upcoming fiscal year reflects a tangible vote of confidence in their future prospects.

Babcock’s share price builds momentum

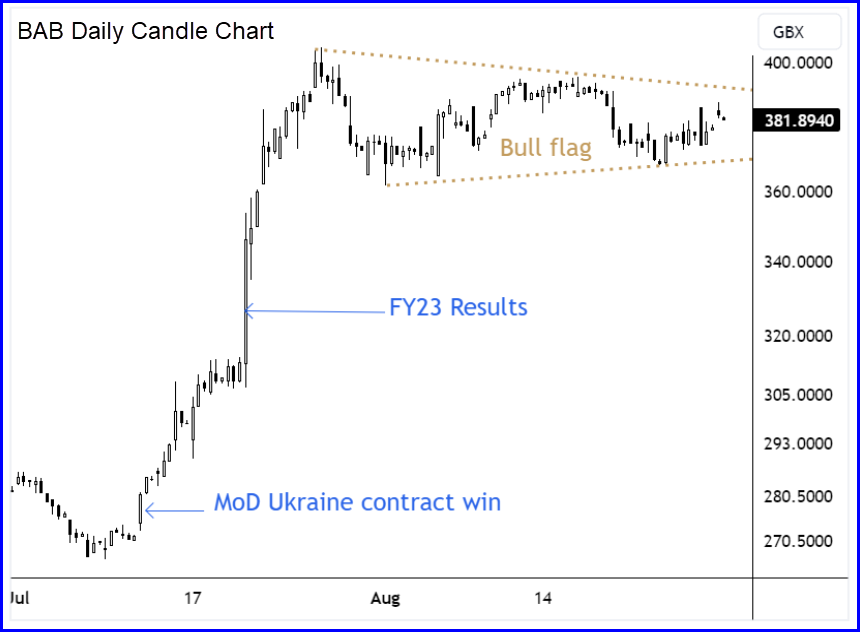

Babcock’s recent contract wins, and strong full year numbers propelled the shares higher during July.

This burst of bullish momentum has been followed by a healthy period of mean reversion in which the shares have consolidated sideways within an ever-tightening trading range – forming a bull flag pattern.

Despite the summer rally, Babcock’s share price continues to trade on a very reasonable valuation. Investors are being asked to pay 9.8 times forward earnings – which makes Babcock one of the cheapest stocks in its peer group.

The undemanding PE ratio of 9.8 also compares favourably to forecast growth in earnings per share (1-year rolling forecast) of 81.9%. This puts the stock on a forward price to earnings per share growth (PEG) ratio of just 0.2 – where anything less than 1 is considered to offer growth at a reasonable price.

Babcock also score well across a number of other value metrics including; Price to Free Cashflow (14.1), Price to Sales (0.43) and Enterprise Value to Adjusted Earnings (6.32).

And based on forecasted cashflows, Babcock currently trade at a 31.5% discount to estimated Fair Value.

In summary, we believe Babcock offers plenty of value to investors seeking exposure to the thriving global defence sector, with their strategic leadership, strong financial results, expanding order book, and recent contract wins positioning them well for a successful second half of the year.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.