22nd Jan 2025. 9.07am

Regency View:

BUY Auction Technology Group (ATG)

- Growth

Regency View:

BUY Auction Technology Group (ATG)

Bidding on success: Auction Technology Group’s growth story

With the FTSE 100 surging to all-time highs this week, we’re shifting focus to a compelling turnaround play that holds significant upside potential.

Auction Technology Group (ATG), a leading player in the online auction space, has been quietly recalibrating its strategy and positioning itself for a resurgence. After facing a challenging period, the company’s latest performance and growth initiatives suggest it’s now primed to capitalise on a rapidly expanding market. Let’s explore why ATG presents an exciting long-term investment opportunity.

Driving the digital auction revolution

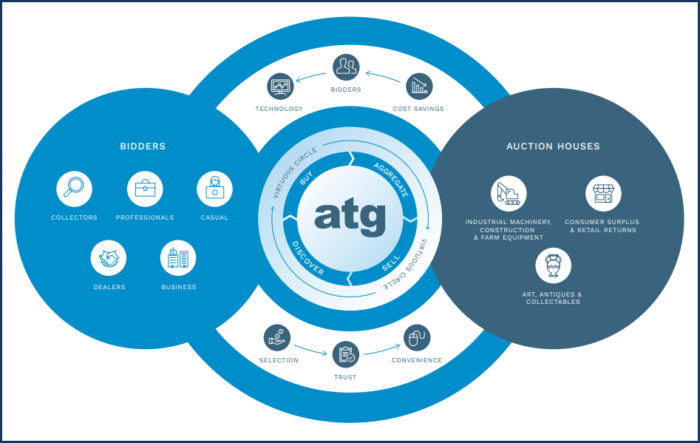

ATG is an online marketplace that connects buyers and sellers across a range of auction sectors, including arts and antiques (A&A), industrial equipment, and consumer goods. The platform allows auctioneers to list items while buyers can bid on everything from rare art pieces to machinery.

The company generates revenue from marketplace activity, with substantial contributions from complementary services like atgPay (payment processing), atgShip (shipping solutions), and atgAMP (marketing services). These additional revenue streams not only enhance the user experience but also help diversify ATG’s income, reducing reliance on auction commissions alone.

Their platform operates on a high-margin, low-touch business model, leveraging technology and network effects to scale efficiently. With an expanding international reach, ATG is well-positioned to become a dominant force in the online auction market.

Key growth drivers: Why ATG is a strong long-term investment

Several key drivers make ATG an attractive long-term investment.

1. The rise of online auctions

As global consumer behaviour shifts further towards digital platforms, the online auction market continues to grow, with ATG well-placed to capitalise on this trend. The company’s stronghold in the arts and antiques sector, which increasingly sees online participation, represents a major driver of growth.

2. Technological innovation at the core

ATG’s focus on technological advancement is another critical strength. The launch of tools like atgShip and atgPay not only generate new revenue streams but also reduce friction for both buyers and sellers, boosting platform adoption and conversion rates.

3. Strategic acquisitions fuel growth

In 2023, ATG acquired EstateSales.NET (ESN), a leading platform for estate sales. This acquisition has already delivered impressive results, contributing a 24% year-on-year growth to ATG’s revenue. The integration of ESN into ATG’s operations strengthens its market position and provides access to a broader customer base.

4. Network effects and customer retention

As more auctioneers join the ATG platform, the range and volume of items available for sale increase, which in turn attracts more buyers. This creates a powerful network effect that drives growth. ATG’s ability to retain customers through seamless, value-added services will be key to its long-term success.

Solid financials: A snapshot of ATG’s performance

For the year ending 30 September 2024, ATG posted a 5% increase in revenue, reaching $174.2 million. This growth was driven by a 3% organic increase in marketplace revenue, supplemented by the ESN acquisition. Adjusted EBITDA rose 2% to $80.0 million, demonstrating solid operational performance despite some challenges with commission revenue.

The company’s strong free cash flow conversion of 82%, up from 78% the previous year, is an encouraging sign of operational efficiency, indicating ATG can fund future growth initiatives without excessive reliance on external financing.

Basic earnings per share (EPS) increased to 19.7 cents from 16.8 cents, reflecting higher operating profit, though partially offset by a lower income tax credit. Adjusted diluted EPS saw a slight dip to 38.6 cents from 39.8 cents, largely due to a higher effective tax rate, but still showcasing an overall solid performance.

Technicals and valuation: The case for ATG’s upside potential

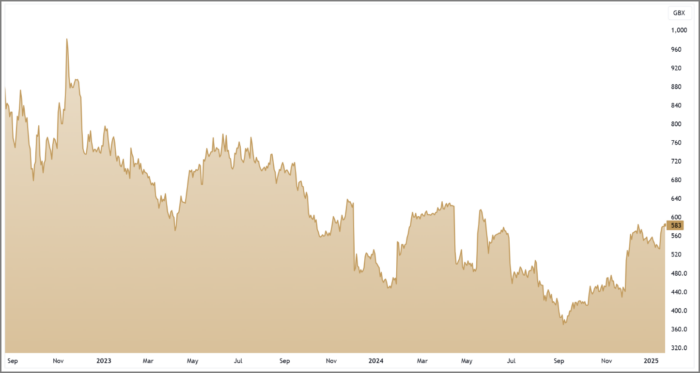

From a technical perspective, ATG’s share price has shown a notable recovery in recent months, suggesting the stock may be entering a new phase of growth. After bottoming out in September, the stock surged in November following a better-than-expected trading statement, signalling the end of its long-term downtrend. Since then, the shares have been steadily recovering. A brief pullback in December and early January now appears to have set the stage for a continuation of the uptrend.

A key technical signal to watch is the recent golden cross—the 50-day moving average (MA) crossing above the 200-day MA for the first time in over a year. This is often viewed as a bullish signal, indicating that the stock is likely to continue upward. With strong price action and renewed investor interest in ATG’s growth story, the stock could continue to rise as it breaks out of its consolidation phase.

On the valuation front, ATG’s forward P/E ratio of 16.4 is attractive, especially given the company’s robust growth prospects. The low PEG ratio of 0.4 further highlights the stock’s undervaluation relative to its expected earnings growth of 65.8%. ATG’s price-to-sales ratio of 5.02 and EV/EBITDA of 13.63 align well with those of other high-growth companies in their early expansion stages.

ATG’s growth story is just beginning

With impressive financials, a strong market position, and positive technical indicators, ATG is poised for continued upside. The company’s focus on technological innovation, strategic acquisitions, and a growing international footprint positions it to capture a significant share of the expanding online auction market.

As ATG capitalises on its network effects and customer loyalty, it’s clear that the company has the potential for sustained growth. With attractive valuation metrics and a solid growth trajectory, ATG could be a strong addition to any portfolio looking for long-term gains.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.