3rd Sep 2025. 8.59am

Regency View:

BUY Atalaya Mining (ATYM)

- Growth

- Value

Regency View:

BUY Atalaya Mining (ATYM)

Atalaya Mining: Copper with a European backbone

With copper prices pushing towards the $10,000 mark on the London Metal Exchange, the timing is right to highlight a European miner that is quietly outperforming…

Atalaya Mining (ATYM) has reported record earnings, stronger free cash flow and a dividend increase, all supported by rising production and lower costs. Management even revised guidance higher at the half year stage, a rare move in the mining sector. Now added to the FTSE 250, Atalaya is stepping onto a bigger stage with solid momentum behind it.

A copper producer in the heart of Europe

Atalaya’s flagship asset is Proyecto Riotinto, a cornerstone of European copper supply in Spain’s Iberian Pyrite Belt. Concentrate from the mine heads to nearby smelters, keeping transport distances short and costs efficient. The objective is straightforward: deliver reliable copper production in Europe and do so at competitive costs that generate cash through the cycle.

The company has built a reputation for consistency. Grades have improved, throughput is high, and costs have eased as production has scaled. In a commodity business control is limited, but Atalaya has doubled down on what it can influence: more tonnes, a better mix, tighter discipline. That creates resilience when copper prices soften and leverage when they rise.

There is also a bigger story at play. Europe is pushing hard to secure domestic supply of critical raw materials, and copper is front and centre in that agenda. Atalaya is one of the few scaled producers already in position to deliver.

The stock will be familiar to our AIM Investors customers. We highlighted Atalaya some years ago and took a healthy profit before stepping aside. Since then the business has made a successful transition to the main market, gaining scale and a higher profile with institutions. It is a clear example of why we track the whole market: to capture progression stories like this. We now believe Atalaya is a strong addition to our FTSE Investor open positions.

Growth projects taking shape

Growth at Atalaya is not just a slide in the investor deck. It is happening in the field. San Dionisio secured environmental approval in May, and development work is now underway. Higher grade feed from San Dionisio will be blended with ore from Cerro Colorado, increasing contained copper and improving economics.

Elsewhere, Masa Valverde is taking shape as another future source of high grade ore, with recent drilling pointing to copper zones that could be fast tracked into production. Touro in Galicia has been granted strategic industrial project status, helping smooth the permitting process. Meanwhile the innovative E LIX plant is ramping up, designed to unlock more value from polymetallic ore and reduce reliance on third party processing. Together, these projects map out a clear path to higher production and better payability.

Earnings with muscle

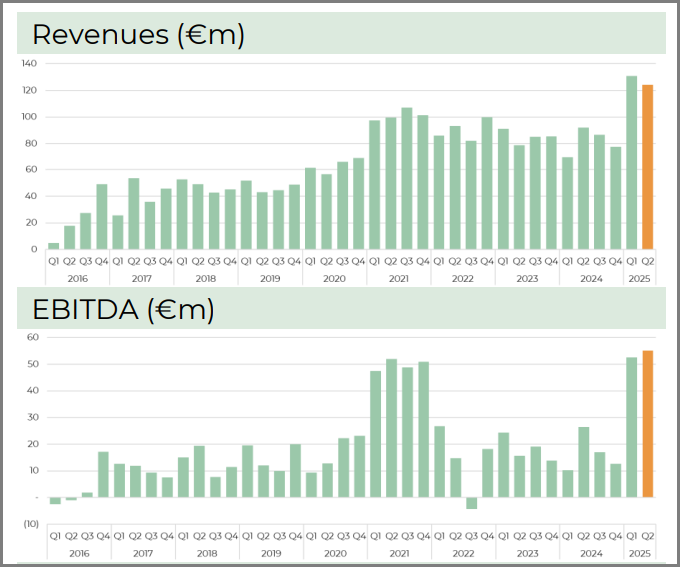

Atalaya’s recent results were very strong. Revenues reached €124.1 million in the second quarter and €254.8 million in the half year. Earnings hit €55.1 million for Q2 and €107.6 million for the half, both new records. Profit after tax was €29.6 million in Q2 and €60.1 million for H1, translating into a sharp step up in earnings per share. The balance sheet has strengthened further, with net cash of €70.1 million at the end of June compared with €35.1 million at the end of last year.

Costs are moving in the right direction. Cash costs averaged $2.2 per pound in the half year, while all in sustaining costs were $2.8. That reflects higher volumes, stronger by product credits and lower treatment charges. Management has raised production guidance and lowered cost guidance, a sweet spot for investors.

Atalaya’s valuation still looks more than reasonable. The forward price earnings multiple is about 11, with forecast earnings growth of nearly 33.8% and a dividend yield above 1.4%. Returns are healthy with return on equity of 11.5% and operating margin above 17.5%.

Our discounted cash flow model places intrinsic value more than six times above the current price. Models are guides not guarantees, but when combined with rising earnings, net cash, and lower costs, the margin of safety becomes hard to ignore.

Strength in the structure

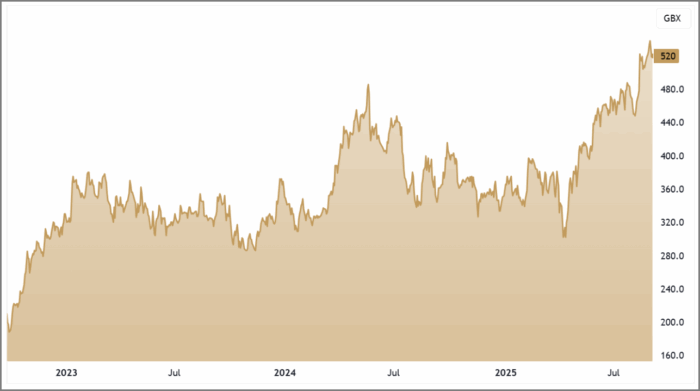

Atalaya’s shares have been climbing for six months, comfortably above the 50 day moving average, which has pulled away from the 200 day in a classic sign of strength. Each bullish gap higher has added another step to the structure, laying down layers of support beneath the current price.

The most recent gap followed August’s trading update, with volume surging to confirm the move. That created a burst of momentum that is likely to reverberate for months, while also providing another anchor of support. The shares are now consolidating just above the breakout area, with the broader structure pointing to continuation rather than fatigue.

With fundamentals improving and technicals aligned, Atalaya’s chart remains one of the stronger trends in the mid cap resources space. Pullbacks are being absorbed, momentum is steady, and the uptrend looks set to extend as long as copper holds its ground.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.