11th Oct 2023. 9.04am

Regency View:

BUY Associated British Foods (ABF)

- Value

Regency View:

BUY Associated British Foods (ABF)

ABF: Diverse, dynamic, and primed for growth

Diversification helps to flatten the boom bust nature of business cycles.

It’s an approach that Associated British Foods (ABF), the conglomerate with its fingers in many different pies, has embraced wholeheartedly.

ABF’s highly diversified business model positions it as an attractive long-term investment option, and here’s why.

The diversified business model

ABF is no one-trick pony. Rather, it operates in a multitude of sectors, which shields it from the volatile nature of any single industry. The company’s portfolio is a tapestry of diverse businesses, including food, ingredients, and retail.

- Primark: A fashionable growth story

Primark stands as the jewel in ABF’s crown, and its recent trading update only reaffirms its resilience and growth potential.

With an expected 9% increase in like-for-like sales, reaching approximately £9.0 billion, Primark’s success is underpinned by a well-executed pricing strategy.

Starting with affordable prices provides Primark with the flexibility to adjust price tags when necessary, making it particularly adept at navigating the cost-of-living crisis without alienating its customer base.

ABF’s trading update also revealed the positive reception of Primark’s new store openings, defying the trend of many other physical retailers struggling to keep their doors open. This success underscores Primark’s laser-like focus on its product ranges and its ability to offer precisely what consumers want.

Moreover, Primark’s commitment to enhancing the customer experience through digital transformation is evident in its recent website overhaul and the extension of its click-and-collect trial to include womenswear.

Primark’s resilience, growth prospects, and ability to align with consumer demands make it a pivotal component of ABF’s long-term investment appeal.

- Groceries and Sugar: Sweet and savoury success

ABF’s diverse food businesses, including Groceries and Sugar, are also riding the wave of success, as revealed in the recent trading update.

The update highlighted strong sales growth in these sectors, with Groceries and Sugar surpassing expectations. The performance of Sugar, in particular, is noteworthy, with the update signalling a “modestly above last year” outlook for adjusted operating profit. This improvement is attributed to an anticipated better sugar beet crop.

Additionally, the Ingredients Business within ABF continues to shine, with trading performance exceeding expectations. AB Mauri, in particular, demonstrates resilience and growth, benefiting from good cost recovery and robust volumes, especially in the Americas. This impressive performance extends into the fourth quarter of the financial year, reinforcing the Ingredients Business as a bright spot within ABF’s diversified portfolio.

Trading at a tasty discount

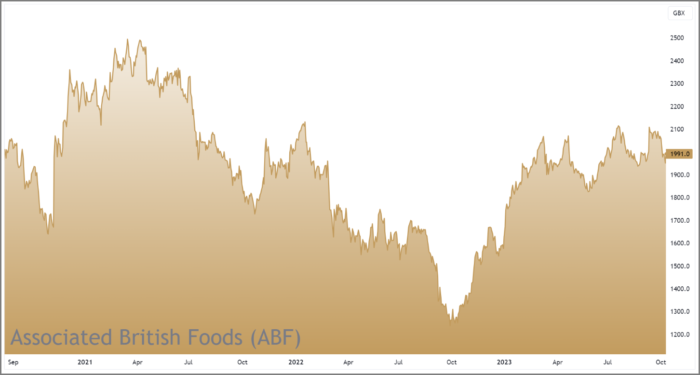

ABF are trading at attractive levels both on the price chart and relative to projected cashflows…

Recent price action has seen ABF pull back to retest a confluent area of support. This support cluster consists of the September and August swing lows, and the 200 Day Moving Average – a level that is closely watched by many institutional investors.

In the context of ABF’s uptrend which has formed since the turn of the year, entering on a pullback to the 200-Day Moving Average looks attractive.

The stock also looks fundamentally undervalued. When ABF’s substantial future cashflows are modelled on a discounted cashflow basis, an estimated Fair Value for the stock is just under £30, more than 50% above current prices.

And whilst the shares trade on a forward price-to-earnings ratio (PE) of 12, which is about average for its sector and peer group, ABF’s earnings-per-share (EPS) are forecast to outpace the PE and grow by 16.5% over the next year.

A £500 million share buyback program and a well-covered dividend yielding 2.79% (forward) make it clear that ABF is dedicated to creating shareholder value.

We’re excited to add ABF’s expertly managed and extensively diversified model to our FTSE Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.