26th Apr 2023. 8.58am

Regency View:

BUY Airtel Africa (AAF)

- Growth

- Value

Regency View:

BUY Airtel Africa (AAF)

The fast-growing telecom with fintech potential

Airtel Africa (AAF) has been on our watchlist since we launched FTSE investor this time last year.

Airtel have a dominant position in the fast-growing African telecom market, which is benefiting from long-term trends such as increasing mobile penetration, data usage, and mobile banking use.

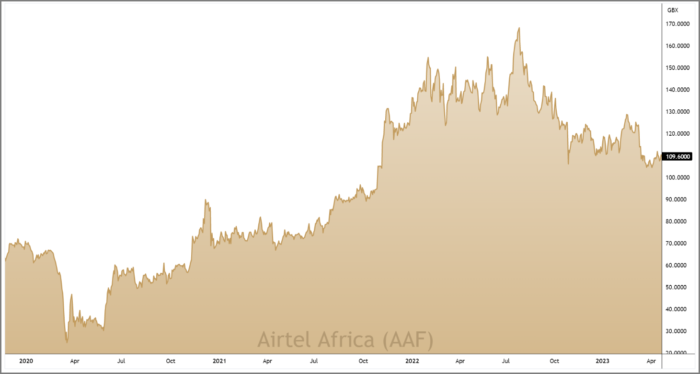

We’ve sat patiently and watched as Airtel’s share price pulled back some 35% from last summer’s highs.

And now, with the shares at a key level of support and changing hands on a very modest single-digit PE ratio, we believe the time is right to snap up our first tranche.

Africa: The land of opportunity

Airtel is the second largest telecom operator in Africa. They provide mobile data, voice and banking services to more than 120m customers across 14 sub-Saharan countries.

The African telecom market offers a very different growth profile to the likes of Europe, the US and even Asia.

Africa’s high population growth and low mobile and broadband penetration has seen demand for Airtel’s services surge in recent years.

Airtel has grown its customer base from 89m in 2017 to 128m in 2022 and there remains a massive amount of customers left to acquire.

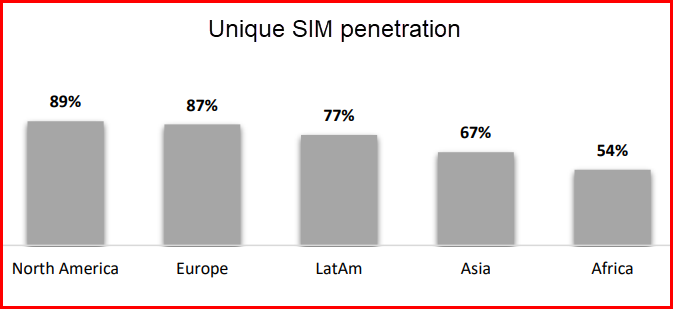

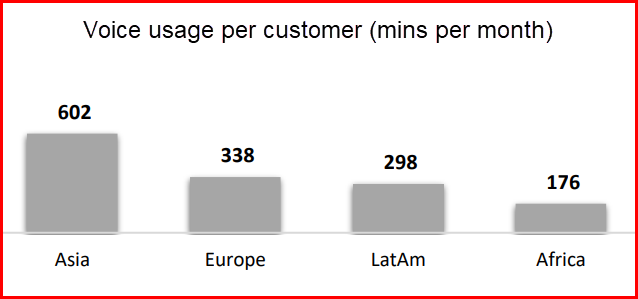

Mobile penetration and voice usage in Africa is significantly below other emerging markets.

Unique SIM penetration in Africa is just 54%, compared to 74% in Latin America, and voice usage per customer is 176 mins versus 298 mins in Latin America.

Mobile data usage represents an even bigger growth opportunity…

Less than a third of Airtel’s customer base are currently using data services and this is due to a low level of smartphone penetration (39% in Airtel’s markets, versus 76% in Brazil).

The average Sub-Saharan African smartphone user only uses 2.9GB of data per month. This is the lowest amount of data usage in the world, with Latin America being 3 times higher.

By 2027 data usage in Sub-Saharan Africa is forecasted to be 11GB per month, which is a staggering growth rate of 25% (CAGR).

Mobile money has rapid growth momentum

Less than half of adults in Africa have a bank account and this has made mobile money services very popular.

Mobile money allows you to do everything a bank does, such as send and receive payments, checking and saving services, and loans, but through your mobile provider.

Like data usage, Africa’s demand for mobile money is set to grow in-line with smartphone penetration and the stats surrounding the Airtel Money platform are phenomenal…

Airtel Money’s annualised transaction value in the second quarter of its current financial year surged 37% to $86bn and mobile money revenue growth during the half year jumped 29.5% to $332m.

“I am particularly excited by the performance of our mobile money business” commented Airtel CEO, Segun Ogunsanya in February.

This side of the business still generates much less revenue than Airtel’s traditional telecom services, but the potential for sustained levels of rapid growth make mobile money Airtel’s most compelling division.

Low valuation compensates for elevated risks

Airtel’s pure exposure to the developing world brings additional risks for investors.

Political instability is part and parcel of investing in Africa. Nigeria is Airtel’s largest market by revenue and, whilst it is one of the more developed African nations, its democracy is considered fragile.

With political risk comes elevated currency risk, and with a proportion of Airtel’s costs in US dollars the risk of local currency devaluation is high.

However, we believe Airtel’s current valuation more than compensates investors for these risks.

Investors are being asked to pay just of seven times future earnings. This looks very reasonable given Airtel’s stable revenue growth and forecasted growth in earnings per share (EPS) of 19.5%.

And if we analyse Airtel’s valuation using a discounted cashflow model it generates an estimated Fair Value of £5.96 per share – indicating that the stock is significantly undervalued.

Airtel also operate a “progressive dividend policy” which aims to “grow the dividend annually by a mid-to-high single digit percentage”.

Next year’s dividend is forecast to be 6.19 cents per share (covered more than twice by forecast earnings), which puts the stock on a forward yield of 4.74%.

We believe these attractive income and growth characteristics help to offset the higher levels of risk that come with investing in emerging markets.

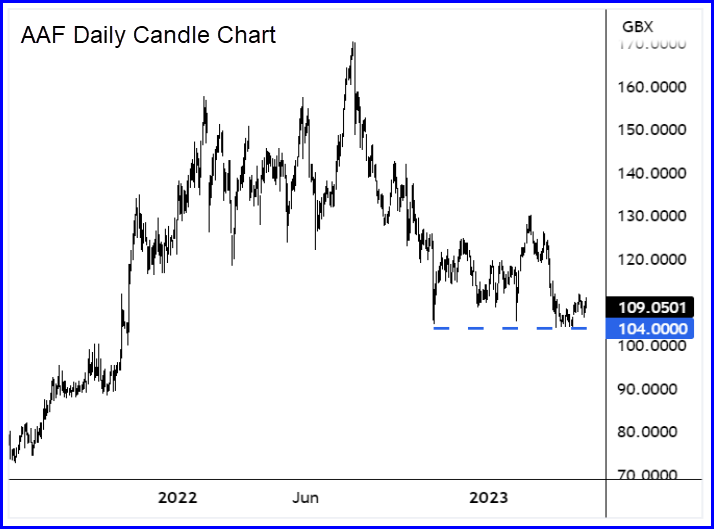

Shares trade at key support ahead of full year earnings

Technical timing can make the difference between good and great returns.

Airtel’s price action over the last year has seen the shares undergo a deep pullback from highs of 170p.

Deep pullbacks take time to reverse, but a series of sharp bounces from 104p indicate that the shares have ‘hammered out’ a key level of support.

This support level at 104p should be viewed within the context of Airtel’s long-term uptrend and it increases the probability of this technical level holding.

Airtel’s last major bounce from 104p support came in February following their Q3 results.

And with the shares trading at similar levels as we head into the release of Airtel’s Full Year 2023 earnings on Thursday May 11th, we believe the risk / reward looks attractive.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.