9th Jul 2025. 9.02am

Regency View:

BUY 3i Group (III)

- Growth

- Income

Regency View:

BUY 3i Group (III)

Private equity, public profits: Why 3i Group keeps compounding returns

In a market where most private equity gains are reserved for institutions and the ultra-wealthy, 3i Group (III) offers something different. This FTSE 100-listed company provides retail investors with rare access to the kind of long-term, value-driven returns usually found behind closed doors.

While most large caps chase headlines or lean into short-term narratives, 3i’s strategy is remarkably consistent. It invests in businesses aligned with deep structural trends, builds them over time, and exits with discipline. The result is a track record that few listed peers can match.

Let’s take a closer look at what makes 3i stand out, how its model works, and why the current share price setup could offer an attractive entry point.

What 3i Group actually does

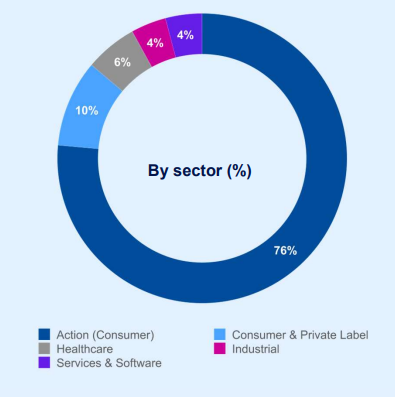

3i is a private equity and infrastructure investment firm. It focuses on acquiring significant stakes in high-quality private companies across Europe and North America, typically in sectors like consumer goods, business services, and industrials. Alongside this core private equity business, it also operates a growing infrastructure segment that targets renewable energy, utilities, and social infrastructure.

What makes 3i different is that it uses its own capital. There are no limited partners and no fixed fund lifecycles. This permanent capital structure allows the company to invest with a long-term mindset, free from the pressure to exit within five to seven years. If a company is compounding value effectively, 3i has no problem holding it for a decade or more.

It is a patient investor with a disciplined process. Each year, 3i typically adds four to seven new companies to its portfolio. It also supports add-on acquisitions within existing holdings, creating scale and strategic depth. When the time is right, it exits with the aim of at least a two-times return on capital.

A thematic approach with a long-term view

At the heart of 3i’s process is a thematic lens. The firm backs companies that benefit from structural trends such as the shift to value retail, the growth of digital business models, or the need for sustainable infrastructure. These themes are not short-term fads but long-duration tailwinds that can support consistent growth.

This approach helps reduce the noise and keeps the investment strategy focused. Portfolio construction is deliberate. The team prefers concentrated exposure to its highest conviction ideas rather than chasing dozens of smaller positions. It also manages the balance sheet conservatively, with low leverage and tight control of operating costs. In fact, 3i’s running costs amount to just 0.4% of assets under management.

Everything in the model is designed for compounding. Operating cash flow and dividends from portfolio companies help fund new investments. Realised gains are recycled. It is a self-sustaining engine.

Financials that speak for themselves

The latest full-year results show just how powerful the model has become.

For the year ending March 2025, 3i reported revenue of £5.16 billion, up 29%. Net profit rose 31% to £5.04 billion. Reported earnings per share climbed to 520 pence, while the dividend increased to 73 pence, up nearly 20% on the prior year. A further rise to 84 pence is forecast for the year ahead.

Operating margin came in at an extraordinary 97.7%, and return on equity stood at 22.5%. Over five years, earnings per share have grown at an annualised rate of nearly 88%. This is rare territory for any listed company, let alone a firm operating in the world of unlisted assets.

Despite the strong growth, the valuation remains undemanding. The shares currently trade on a forward PE of 6.9 with a PEG ratio below 0.7. The dividend yield stands at just over 2%, and with dividend cover north of seven times, there is plenty of headroom for continued growth.

Action: The driving force

The star of the portfolio is Action, a European discount retailer that continues to outperform. So far this year, like-for-like sales are up 6.9%. The company has opened 111 new stores and has built a cash position of over €580 million.

Action has been a key part of 3i’s portfolio for years, and its consistent performance underlines the group’s patient, long-term approach. This is not a flash-in-the-pan growth story but a mature business that keeps expanding profitably. Its success filters straight through to 3i’s net asset value and income stream.

Beyond Action, the recent sale of MPM, a premium pet food brand, demonstrates 3i’s ability to realise value. The disposal brought in an estimated £400 million at a 3.2 times return on capital and an internal rate of return of 29%. It is a strong example of the firm’s value creation cycle in action.

Technical picture supports the thesis

From a charting perspective, 3i is in good shape. The shares remain in a well-established long-term uptrend, with the 50-day moving average comfortably above the 200-day. That alignment is a classic signal of momentum strength.

In April, the shares dipped back to the 200-day average during the broader market sell-off linked to renewed US trade tariffs. But the rebound was fast and decisive, suggesting strong institutional support. The move higher in May pushed the price to new trend highs before consolidating.

Since then, the stock has been forming a wedge pattern, characterised by lower highs and higher lows. This type of consolidation is often a precursor to trend continuation. If the price breaks out of the wedge to the upside, it could offer a clean technical entry for our first tranche.

Designed to compound

What sets 3i apart is not just the quality of its portfolio or its financial metrics but the overall structure of the business. This is a firm built to compound. It avoids dilution. It keeps costs low. It manages risk conservatively. And it has the freedom to hold onto its best assets for as long as the value is still growing.

3i is executing the same disciplined strategy, year after year, with remarkable consistency. For investors looking to tap into private equity returns without the complexity of limited partnerships or illiquid funds, 3i offers a rare and compelling route.

At current levels, with momentum building and the business firing on all cylinders, it is hard to ignore.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.