7th Jun 2023. 8.58am

Regency View:

BUY Ten Entertainment (TEG)

- Value

Regency View:

BUY Ten Entertainment (TEG)

Ten Entertainment score a strike in cost-of-living crisis

Think of companies doing well in the cost-of-living of living crisis, and bowling entertainment centers don’t immediately spring to mind.

Affordable family entertainment is hard to come by right now and this is driving demand for bowling where a family of four can play for less than £20.

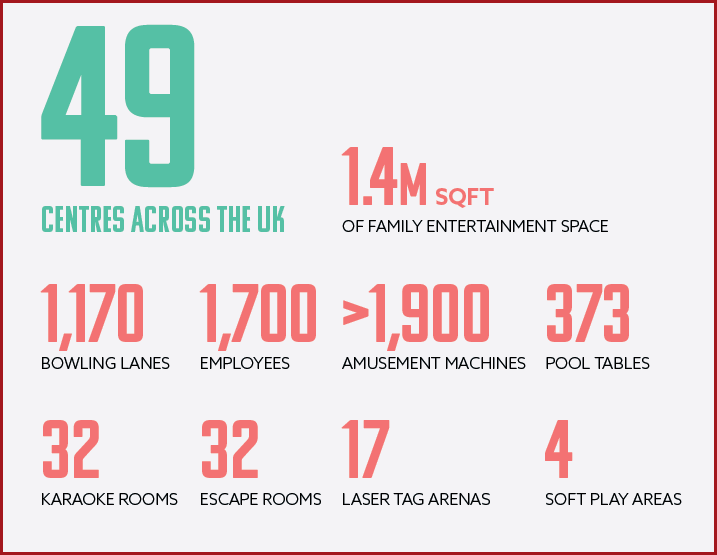

Ten Entertainment Group (TEG), the company behind the Tenpin Bowling brand, operates 49 social entertainment centres across the UK.

Revenue and profits have surged past pre-pandemic levels and the stock looks too cheap to ignore.

Ten’s “affordable treat” is proving popular

Ten Entertainment’s strategy is focused on delivering high-quality social entertainment to friends and families at affordable prices.

They have 1,170 bowling lanes, 17 laser tag arenas, 32 escape rooms, 373 pool tables, oh and don’t forget the 32 karaoke rooms!

Around 44% of revenues come from bowling, 28% from food & drink, and 28% from other entertainment activities.

It’s a simple business model, but Ten Entertainment have perfected it – achieving a consistent return on investment (ROI) north of 30% and 11% CAGR sales growth over five years.

“Our model has broad appeal across the generations and for a wide range of customers, and our value-for-money proposition makes a visit to Tenpin an affordable treat” says CEO Graham Blackwell – who has 30 years experience in the bowling industry.

Low bowling prices have helped to drive footfall up by 42% against pre-pandemic levels. Ten Entertainment’s average realised price per bowling game in 2022 was £5.13, compared with £5.21 in 2019. And higher volumes helped push Ten Entertainment’s adjusted cash profit margin up to 31%.

Recent Full Year 2023 Results saw Ten Entertainment report the highest ever sales and profit in its history…

Group revenue to 1st Jan 2023 topped £126m, a 50.6% jump compared to 2019. This sales growth has converted into impressive profit growth with adjusted profit before tax hitting £26.1m – up 84.1% compared to 2019.

The business generates plenty of free cash flow (£27.2m FY23) and this has seen the balance sheet recover from the pandemic, ending the year with no bank debt and over £10m of cash.

Ten Entertainment have had a “strong start” to this year, with like-for-like sales growth of +2.7% in the first 10 weeks of 2023. And, having opened two entertainment centres in 2022, they expect to open four more this year.

Adding small-cap value to FTSE Investor

With a market cap of just under £200m, Ten Entertainment is much smaller than our average FTSE Investor open positions.

This difference in profile adds diversity and, whilst the stock is small in stature, we believe it’s big on value…

For a cash generative business that has a strong track record for delivering year-on-year growth, Ten Entertainment look very reasonably priced.

The shares are currently trading on a forward price to earnings ratio of just 8.6. This is attractive relative to the likes of Hollywood Bowl, which have a forward PE of 13.8, and the wider entertainment sector which has an average PE of 12.

Ten Entertainment’s price to free cashflow is a very reasonable 7 and its enterprise value relative to adjusted earnings (EV to EBITDA) is 6.22 – one of the most attractive in its sector.

The stock also trades at a 20% discount to an estimate Fair Value of £3.38 per share.

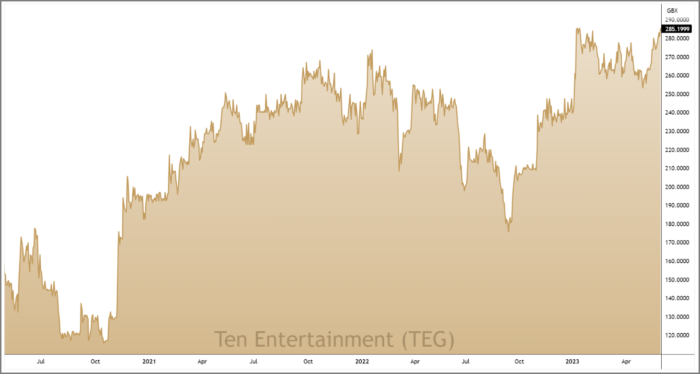

And unlike your typical value stock, Ten Entertainment has decent momentum on its price chart, with the stock trending higher since the turn of the second half of last year.

Recent price action has seen the shares consolidate sideways and form a classic ‘bull flag’ pattern – signalling trend continuation (see chart right).

Ten Entertainment also pay an attractive dividend which currently yields 5% on forward basis. And this year’s dividend is covered more than 3 times by future earnings, indicating that there’s significant scope for this payout to increase.

Current forecasts have the dividend rising to 12p per share in FY24 and 13.2p per share in FY25.

In summary, with the cost-of-living crisis set to continue well into next year, we expect Ten Entertainment to outperform other leisure stocks. And with strong levels of cash generation and an undemanding valuation, Ten Entertainment has the potential to deliver.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.