Regency View:

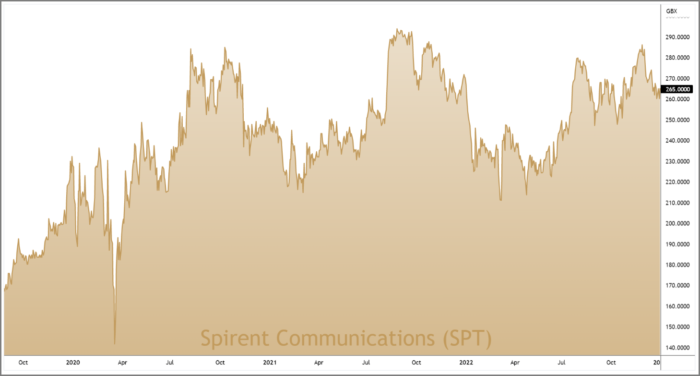

BUY Spirent Communications (SPT)

A key player in the fast-growing 5G security market

The 5G growth story may seem like old news, but it has only just begun…

As little as 3% of the global network has been fully upgraded so far and the number of 5G connections is expected to mushroom from current levels of 600m to a staggering 4.8bn by 2027.

5G is 50 times more complex than 4G and this rapidly growing architecture requires testing and protecting.

The 5G security market services this need, and it is set to grow at a pace of more than 40% (CAGR) over the next five years.

A key player in the 5G security market is Spirent Communications (SPT).

Spirent provides test, assurance and security solutions to telecoms networks and cloud computing giants.

They are very well placed to benefit from the rapidly growing number of 5G connections and Spirent’s high-quality financials make them a compelling long-term investment.

Lab to live – Spirent are world leaders

Watch any advert from a telecoms provider and the buzz words you hear will usually be speed, reliability, connectivity, protection, performance – it all has to work.

Spirent have been hugely successful at taking deep expertise of cutting-edge technologies gained in their lab testing environment and turning them into packaged solutions which enable networks to fulfil their promises.

The business operates two divisions serving more than 1,200 customers across at least 50 countries:

1. Lifecycle Service Assurance

Spirent are world leaders in pre-deployment testing of Wi-Fi and 5G mobile core networks.

Spirent have a range of active test and assurance solutions that automate service turn-up, monitoring and troubleshooting of live 5G, Ethernet and Cloud networks.

This division delivered $125.6m revenue and $21.3m operating profit in the half year to end September.

2. Networks & Security

This division specialises in security testing solutions for high-speed Ethernet and Global Navigation Satellite System (GNSS).

The solutions are designed to accelerate the development and validation of new equipment, networks, and applications for Cloud and mobile.

This division delivered $54.5m revenue and $32m operating profit in the half year to end September.

These two divisions serve far more than just the 5G rollout, they cover multiple interlinking themes.

Themes such as ‘connected everything’, cloud migration, ‘intelligent location’ and pervasive security threats.

These themes will undoubtedly shape the way we communicate for decades to come, making the drivers behind Spirent’s growth story lower risk and highly compelling.

Trading performance weighted to a busy final quarter

In November, Spirent released a solid Q3 Trading Update which puts the company in a strong position heading into their busiest quarter.

Spirent continued to see good order growth and secured a “significant number” of large contracts which will feed into next year’s revenue and beyond.

Spirent’s Lifecyle Service Assurance division won its first major TaaS (Test-as-a-Service) order in India, from one of the largest service providers delivering design-assurance and security support for their new 5G innovation lab.

While Spirent’s Networks & Security division secured its first win for its 800G Ethernet test technology at a leading Hyperscaler, and also benefited from strong growth in the Asia Pacific region.

Group CEO, Eric Updyke indicated that trading performance would be weighted to the final quarter of the year:

“The strong growth in orders to date for Lifecyle Service Assurance is building the pipeline of future years’ revenue, whilst in the nearer term, we are seeing continued success in high-speed Ethernet. We remain confident in our expectations for the full year, with our trading performance weighted to the busy final quarter, as in previous years”.

High-quality financials

Spirent’s key position in long-term growth markets is matched by the stock’s high-quality financials.

More than 90% of operating cashflow flows through to free cashflow and this has created a rock-solid debt-free balance sheet which boasts a net cash position of $189m (TTM).

This means Spirent have plenty of scope to fund acquisitions and it also means the risk of shareholder dilution is minimal.

Spirent have a Return on Equity of 17.4% averaged over five years (CAGR), indicating that management know how to deliver shareholder value.

And a well-covered dividend of 2.41% (forward yield) should complement Spirent’s compelling potential to deliver long-term capital growth.

So, whilst the stock trades on a punchy forward earnings multiple of 17.4, we believe Spirent’s quality more than justifies its premium valuation.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.