6th Apr 2022. 8.57am

Regency View:

BUY Qinetiq (QQ.)

- Value

Regency View:

BUY Qinetiq (QQ.)

European defence spend to propel Qinetiq higher

“President Putin created a new reality with his invasion of Ukraine. This new reality requires a clear response.”

The words of German Chancellor Olaf Scholz, speaking at the end of February as he overturned decades of German foreign and defence policy…

A huge, €100bn fund was announced, designed to modernise the German military in response to Russia’s invasion of Ukraine.

The plans mark a watershed moment for Europe. In 2020, just 11% of EU defence budgets were spent on collaborative projects, but with a Russian pariah state now on its doorstep, the EU is set to radically ramp up its collective defence spending.

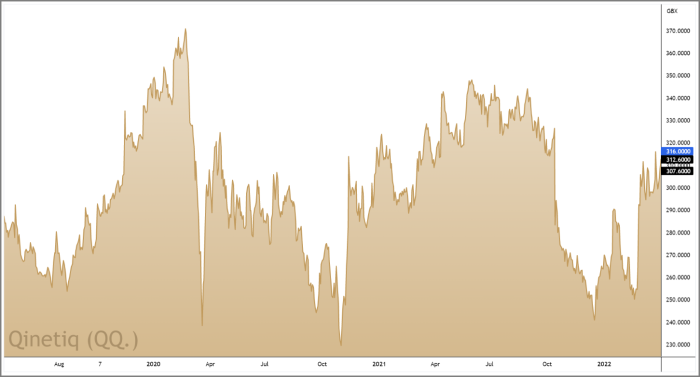

A stock that looks set to benefit from Europe’s call to arms is defence technology company, Qinetiq (QQ.).

The company has a strong order book, high levels of cash generation, and a debt free balance sheet. The stock trades on a very reasonable earnings multiple and Qinetiq has recently been highlighted by CitiGroup as a key beneficiary of the U-turn in German defence spending.

Please note: this report is not about profiting from a tragic and illegal war. It’s about adjusting your portfolio to a new normal – European defence spending is likely to remain elevated for years to come.

Highly diversified product base with ‘sticky’ long-term contracts

Farnborough-based Qinetiq have been at the centre of defence tech innovation for many decades.

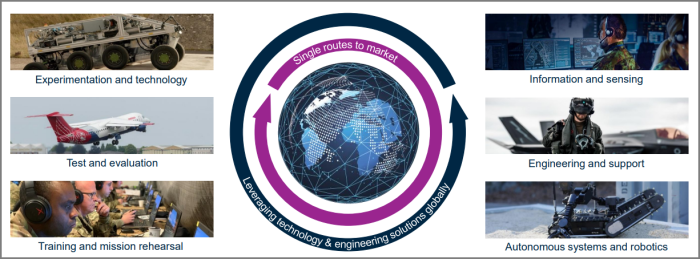

They have built a highly diversified product based across six segments of the £20bn global defence market (see image below).

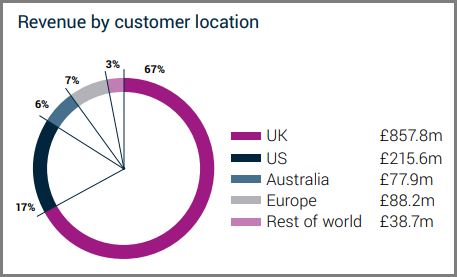

Qinteiq’s current revenue split is dominated by the UK and its strategic defence partners, the US and Australia.

However, Qinetiq does have three sites in Germany with 111 employees offering airborne training, along with a site in Belgium with 156 employees working in partnership with the European Space Agency. These European bases will allow Qinetiq to benefit from the ramp up in European defence spending.

Qinetiq’s quality financials

When we talk about quality, we mean high levels of earnings visibility, cash generation and a strong track record of delivering profitable growth. Qinetiq tick all these boxes…

Qinetiq are consistently profitable, delivering operating profits of £119m (FY21) on revenues of £1.27bn.

And whilst last year, Qinetiq was hampered by supply chain issues and write-downs, this now looks to be behind them…

Qinetiq’s January trading update stated that it had continued to achieve excellent order intake and Full-Year 2022 outlook was in line with expectations…

“With more than 95% coverage of our 2022 financial year revenue under contract, we remain confident of delivering in line with expectations reaffirmed as outlined at our interim results on 11 November” read the statement.

Cash generation is strong and Qinetiq operate a debt-free balance sheet which has a Net Cash position of £185m.

This cash will be needed to fund the acquisitive growth required to fulfil the rising order intake caused by the Ukraine war.

Valuation looks attractive

Given the current tailwinds in the defence sector, Qinetic’s forward valuation looks very reasonable…

The shares currently trade on a forward Price to Earnings (PE) multiple of 12.8 – one of the lowest in the Aerospace & Defence sector.

This modest forward PE multiple also compares favourably to forecast earnings per share (EPS) growth of 22%, a number that is likely to be revised higher this year.

Qinetiq also pay a steadily rising dividend payout of 6.9p per share (1.91%) last year, a payout that is forecast to rise to 7.3p per share for FY22.

Bullish gaps and double bottoms

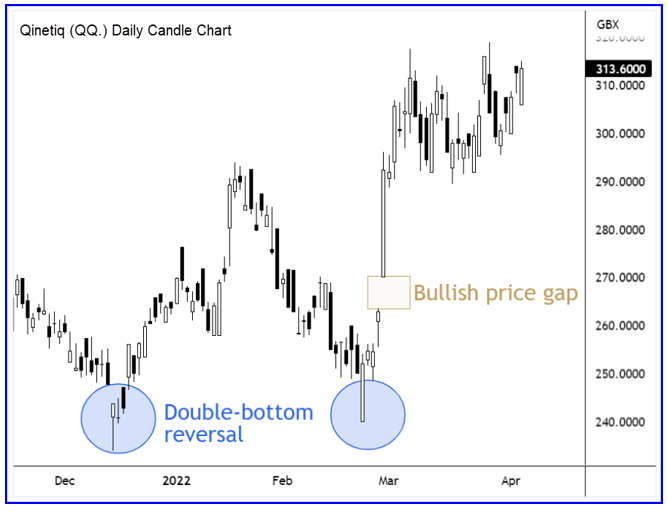

During the last month we’ve seen some clear catalysts emerge on Qinetiq’s price chart…

In late February, the shares bounced from 240p support – forming a double bottom reversal pattern. This was immediately followed by bullish price gap and strong rally in late-February.

The gap signals a burst of bullish momentum which confirms a change in trend.

Price action following the bullish gap has seen prices consolidate in a tight range near the March highs. This signals that short-term probabilities favour upside continuation – creating a clear short-term catalyst for entry.

We back Qinetiq to outperform the market this year, and we expect the shares to rally ahead of their end-April Quarterly Trading Update.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.