24th Jan 2024. 9.01am

Regency View:

BUY Qinetiq (QQ.) – Second Tranche

- Value

Regency View:

BUY Qinetiq (QQ.) – Second Tranche

Qinetiq’s January update sparks second tranche buy with fresh catalysts unveiled

As we step into the first earnings season of 2024, our attention is keenly focused on identifying stocks that present compelling positive catalysts.

Among the array of potential opportunities, one standout contender capturing our interest is Qinetiq (QQ.), a stock that has not only been a stalwart in our FTSE Investor portfolio but has recently revealed a host of positive catalysts in its January trading update, prompting us to consider a second tranche buy.

Starting the New Year in style

Qinetiq’s enduring presence in our FTSE Investor portfolio signifies not just a long-term commitment but a strategic belief in the company’s ability to weather market dynamics and deliver consistent value.

The January trading update, however, has elevated our confidence in the stock to new heights by unveiling a series of factors that suggest a robust outlook and potential for sustained growth.

The trading update has acted as a spotlight on Qinetiq, illuminating key catalysts that make a compelling case for a second tranche buy:

1. Operational strength and organic growth: Qinetiq said its operational performance during the quarter comfortably in-line with management expectations. The trading update has brought to the forefront Qinetiq’s impressive organic revenue growth and robust profit margins. These indicators speak volumes about the company’s strategic positioning and its ability to convert operational excellence into sustained financial success.

2. Strong order intake: Qinetiq reported strong order intake, indicating a consistent demand for the company’s defence and security capabilities. The year-to-date orders, totalling approximately £1.35 billion highlight the rising levels of demand in the global defence market following an escalation in geopolitical tensions.

3. Improvement in revenue under contract: The trading update indicated that revenue under contract for the full year has improved to 95%. This figure represents the portion of the expected revenue for the entire fiscal year that is already secured through contractual agreements. The 95% level is higher compared to the same period in the previous year, signifying an enhanced level of revenue visibility.

4. Cash generation and share buyback program: The trading update signalled strong cash generation, with a notably high cash conversion rate above 100%. Leveraging this financial strength, the company has announced a substantial £100 million share buyback program, scheduled to start in February 2024 and expected to conclude over the next 12 months, contingent on shareholder approval. This strategic move reflects the board’s confidence in Qinetiq’s current undervaluation.

5. Strategic diversification: Qinetiq’s foray into strategic areas such as space-related contracts, as evidenced by the $224 million deal for tactical space support, adds a layer of diversification to its portfolio. This strategic move positions the company for growth beyond traditional sectors.

Unlocking value with top-quartile metrics, bullish momentum, and positive catalysts

Qinetiq’s management team believe the stock is undervalued and we would agree with them…

The shares trade on a forward PE ratio of 11.4 which is one of the most attractive multiples in the Aerospace & Defence Sector. The stock is also top quartile for Price to Book Value (1.97) and Enterprise Value to Adjusted Earnings (EV to EBITDA).

Qinetiq pay a reliable dividend which yields 2.53% on a forward basis. And using discounted cashflow analysis, the shares currently trade more than 47% below estimated Fair Value.

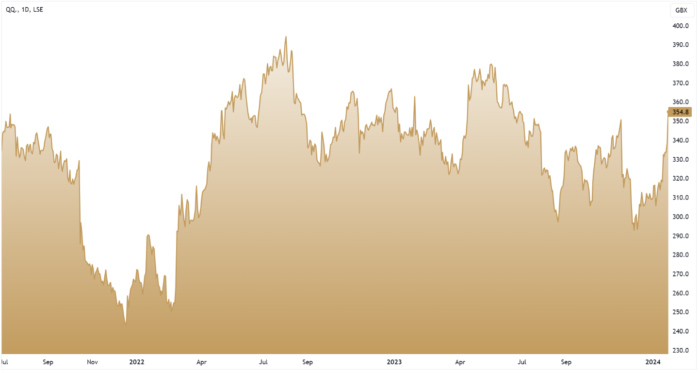

On the price chart, the trading update has been well-received by the market and Qinetiq have plenty of short-term momentum. The shares are up +13.9% since the turn of the year versus a FTSE 100 which has fallen -2.95% – underlining the stock’s relative strength.

The powerful combination of positive catalysts from the trading update, lowly valuation, and bullish short-term price momentum makes Qinetiq a standout stock for 2024.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.