29th Jun 2022. 8.54am

Regency View:

BUY Photo-Me International (PHTM)

- Growth

Regency View:

BUY Photo-Me International (PHTM)

Please note: Photo-Me International has subsequently changed its name to ME Group (MEGP)

Photo-Me’s pricing power makes them one to watch

In the stock market, nothing creates a buzz quicker than a series of increased earnings forecasts.

As management ratchet up expectations, investors play a game of catch-up which creates price momentum.

And at a time when 90% of businesses are facing severe headwinds and tempering expectations, Photo-Me (PHTM) is creating quite a stir…

The global vending machine business has the pricing power to combat inflation and since January 2021 analysts have increased their earnings per share (EPS) forecasts for 2022 and 2023 by around 22%.

Photo, wash, print and feed ME!

Photo-Me’s model is beautifully simple – put vending machines in prime locations with high footfall and pay the site owners a revenue-based commission depending on country, location, and type of machine.

Scale is important, and Photo-Me have over 45,000 vending units spread across 20 countries covering the UK, continental Europe and Asia Pacific regions.

They’re aiming to become a European leader and plan to install 100 machines per month by 2023.

To keep running costs down, Photo-Me own, operate and service their equipment in-house and have three R&D centres situated in France, Vietnam, and Japan, supported by a team of more than 50 engineers.

Photo-Me’s core business is Photo.Me – photobooth vending machines with integrated biometric identification solutions.

The photobooth business contributed £123.2m (57%) to the Photo-Me’s £214.4m Full-Year 2021 revenues and around 56% of group earnings.

While the photobooth market was severely and widely impact by the onset of the pandemic in 2020, the recovery in revenue has been ‘strong than anticipated. Photobooth revenue grow grew by 15.2% last year (FY21) driven by a swift bounce back most of Photo-Me’s key markets, particularly in France and Japan.

Alongside its Photobooth business, Photo-Me has a laundry business called Wash.ME which accounts for around a quarter of group revenue…

Wash.ME comprises of unattended revolution laundry services, launderettes, business to business laundry services. This side of the business has undergone a restructuring in recent years with the group selling off its Revolution Max business last year.

Despite the restructuring, Wash.ME delivered total revenues of £54.2m last year (FY21) – growing 14.6%.

The cashflow from Photo-Me’s long-established photobooth and laundry operations has been used to develop new and complementary products to drive future growth, these include:

Print.ME – digital printing kiosks which account for just over 5% of group revenue.

Feed.ME – Food vending is Photo-Me’s newest business area which accounts for 4% of group revenue. Feed.ME currently offer self-service fresh-fruit and vegetable juice machines, and pizza vending machines.

Trading update creates burst of bullish momentum

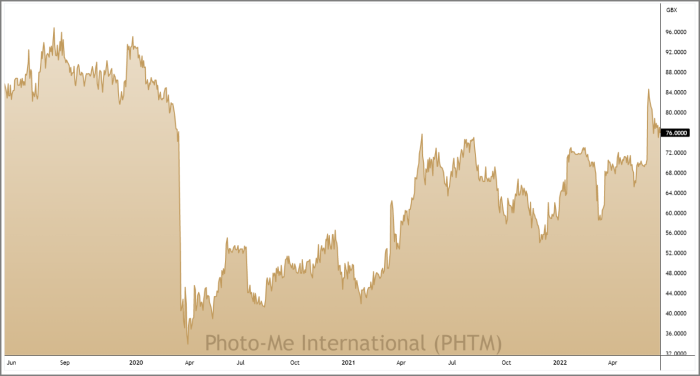

There’s a lot to like about Photo-Me’s price chart…

The shares have been carving out a steadily steepening series of higher swing lows for the last year – creating a series of upward sloping trendlines which signals that momentum is increasing.

Recent price action saw the shares gap higher on their bullish early-June trading update…

The trading update stated that the group has “significant pricing power” and forecast for the year ending 31 October 2022 were raised with Photo-Me expecting to show revenue up “at least +20% over FY 2021” and “adjusted PBT in the range of £47 million to £50 million”.

The trading update was music to the inflation-fearing markets ears and prompted a ‘break-away’ price gap which has created a burst of bullish momentum on Photo-Me’s price chart.

Importantly, the break-away gap also saw the shares break and close above key resistance 76p – this is an area that the shares have failed to break through on five separate occasions last year.

As is often the case with major breakouts, we’ve seen prices pullback and retest the breakout area. We would not expect the broken resistance to provide support moving forward.

Strong balance sheet makes Photo-Me a high-quality proposition

We believe Photo-Me is more than just a ‘hot-stock’…

A restructuring of the business in 2019 has created a strong, debt free, cash-rich balance sheet (£99.4m net cash FY21).

Around half of its operating cashflow flows through into its bottom line and profitability is increasing.

Current forecasts indicate that earnings per share should double this year and grow at a pace of around 12% thereafter – making Photo-Me’s forward price to earnings multiple of 8.3 look very reasonable.

The stock has a market-beating enterprise value to adjusted earnings (EV to EBITDA) of 4.55 and a return on capital employed (ROCE) north of 18% – indicating that the business can grow profitably.

Overall, Photo-Me look well positioned to grow in this inflationary environment and we expect their momentum to continue.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.