8th Nov 2023. 9.08am

Regency View:

BUY Keller Group (KLR) – Second Tranche

- Value

- Income

Regency View:

BUY Keller Group (KLR) – Second Tranche

Keller Group: Seizing the momentum with a second tranche

As the dust settles from a brutal earnings season which has seen stocks heavily punished for missing growth forecasts, Keller Group (KLR) shines as a clear winner.

We snapped up our first tranche of Keller in the summer – click here to read our original report.

In a nutshell, Keller is a global geotechnical specialist, offering engineering and construction services related to the ground beneath us. Our initial recommendation was driven by several factors, including Keller’s resilient position in the £38 billion geotechnical industry, strong earnings momentum, and an appealing forward valuation.

To the above reasons, we can now add a market-beating full-year trading update, further reinforcing our confidence in the stock’s potential. As a result, we are keen to snap up a second portion of Keller shares while they remain attractively priced.

Strong full year trading update

Keller’s recent full-year trading update, for the period ending September 30, 2023, underscores the company’s exceptional performance and its potential to outshine market expectations. The update revealed that Keller is on track for a record year, with the expectation of a materially higher underlying operating profit compared to current market projections.

Group CEO, Michael Speakman, shared his insights on this impressive update. He stated, “The Keller team has built on an exceptionally strong first half to deliver a better than expected third-quarter performance, and consequently we now expect full year underlying profit to be materially ahead of current market expectations.”

These words from the CEO are backed by concrete figures.

North American performance: Keller witnessed more resilient pricing at its Suncoast subsidiary, resulting in a strong performance. Sustained operational improvements contributed to a more progressive recovery in operating margins, surpassing initial expectations. While the pricing benefit at Suncoast is expected to moderate in 2024, the margins are returning to more normalised levels.

European challenges: The European market experienced challenges due to the macro-economic environment, resulting in weak demand in the residential and commercial sectors. Profitability was impacted by competitive pricing, challenging projects, and a tough comparison to the previous year’s large successful projects. Consequently, the anticipated profitability improvement in the second half is expected to be less than initially expected, prompting corrective actions.

Asia-Pacific, Middle East, and Africa (AMEA): Keller Australia delivered strong performance, particularly in the infrastructure sector, returning to profit in the third quarter as anticipated.

Cash generation: The Group’s cash generation for the year-to-date significantly exceeded the prior year’s performance. It has outperformed expectations, resulting in the expectation of a year-end net debt/EBITDA leverage ratio well below 1.0x, well within the target range of 0.5x to 1.5x (2022: 1.2x).

The positive numbers and the CEO’s comments together reflect Keller’s capacity to maintain positive trading momentum, adapt to challenges in various markets, and generate strong financial results.

Shares maintain attractiveness amidst market momentum

The best way to judge if a trading update really beat expectations is by looking at the market’s reaction.

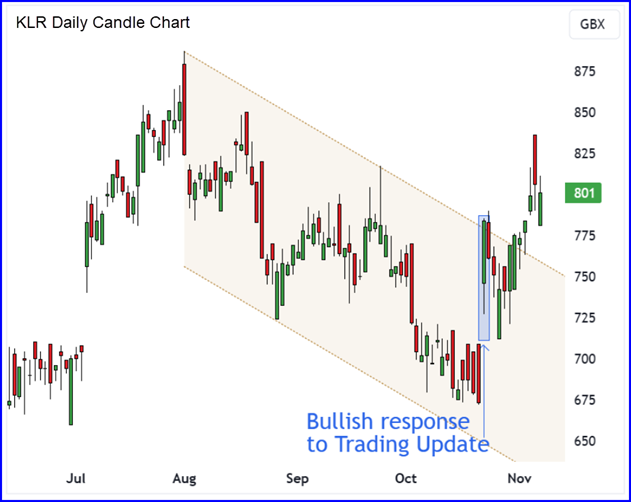

We can see from Keller’s price chart (right) that the market’s reaction was very bullish with prices gapping higher and closing on intra-day highs on the day of the trading update (23rd October).

Price action following the bullish initial response has seen the shares break above the descending channel which had been in place since August – confirming the markets approval.

And whilst Keller’s share price has rallied nearly 20% in less than a month, the stock’s valuation looks very reasonable with the shares trading on a forward Price-to-Earnings (PE) ratio of just 6 and a Price-to-Sales ratio of 0.20.

Earnings per share are forecast to grow at 10.8% over the next twelve months, and Keller pay a market-beating dividend (forward yield of 5.12%).

In short, Keller’s strong performance, backed by a resilient economic moat, market-beating trading updates, and favourable valuation, positions the company as a compelling investment opportunity.

As we move forward, the bullish market reaction and the company’s growth prospects further underscore our confidence in Keller’s potential. The path ahead is paved with optimism, and we remain excited about the future possibilities for this standout company in the geotechnical industry.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.