19th Jul 2023. 8.58am

Regency View:

BUY Keller Group (KLR)

- Value

- Income

Regency View:

BUY Keller Group (KLR)

Keller have built an economic moat which stands the test of time

Warren Buffett once said, “In business, I look for economic castles protected by unbreachable ‘moats’.”

This quote reflects Buffett’s focus on investing in companies with robust competitive advantages or ‘economic moats.’ He compares these advantages to castles safeguarded by moats, emphasising the significance of sustainable barriers that shield a company’s profitability and market position from competitors.

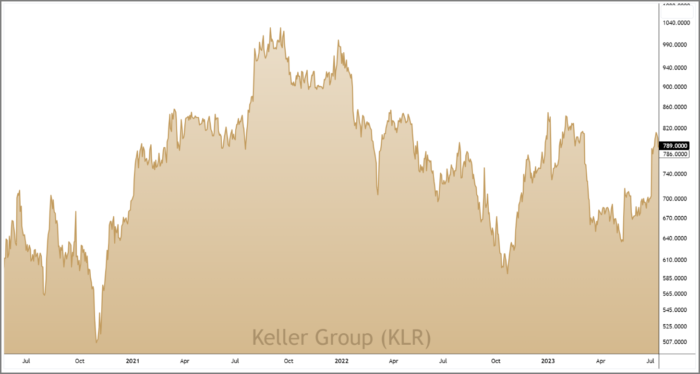

Keller Group (KLR), the world’s top geotechnical specialist, has constructed a Buffett-worthy economic moat. Their moat has been so strong that they have consistently paid dividends to investors every year since their listing in 1994.

Like an impregnable fortress, Keller’s dominant position in the geotechnical sector presents a formidable challenge for new entrants attempting to compete effectively. Their expertise and reputation have solidified their competitive advantage over time, enabling them to maintain their leadership in the industry.

£38bn market offers vast growth potential

Keller specialises in geotechnical contracting, which means they provide engineering and construction services related to the ground beneath our feet.

Keller work on projects like building foundations, ground improvement, and environmental remediation. They help make sure that structures like buildings, bridges, and infrastructure projects have a solid and stable base.

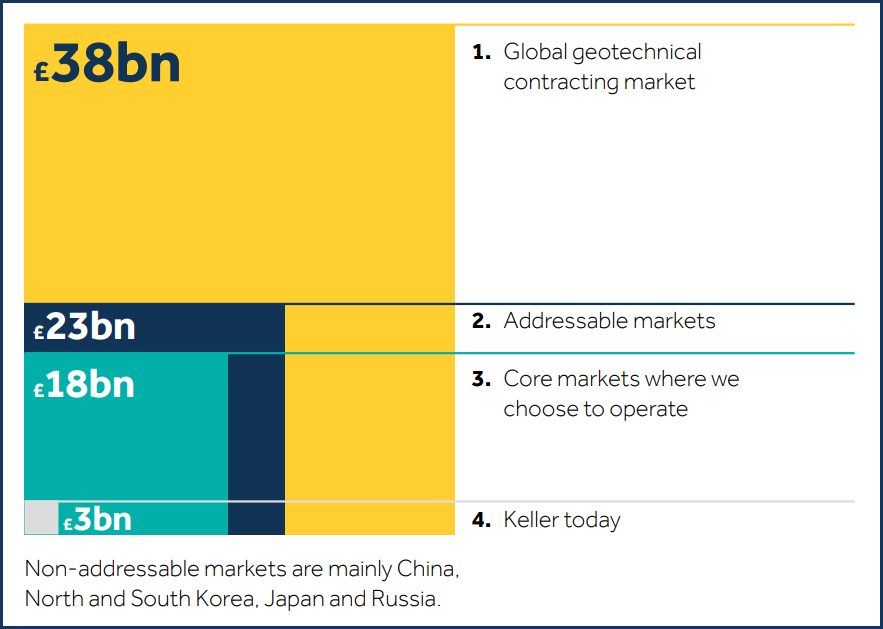

The global geotechnical contracting market is worth a whopping £38bn and Keller’s total addressable market, which excludes China, Russia, Korea and Japan, is worth £23bn. Keller’s current size is £3bn, leaving plenty of room for expansion and capturing more market share.

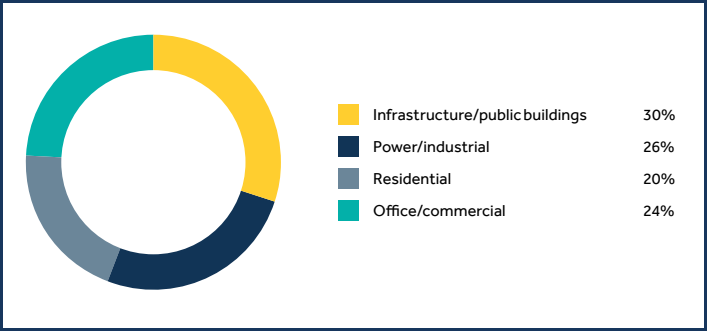

When it comes to the sectors in which Keller Group operates, their work is spread across various industries…

Around 30% of their projects are related to infrastructure, which includes things like roads, railways, and bridges. The power sector, which includes energy-related projects, accounts for 26% of their operations. Residential projects make up around 20% of their work, involving housing developments and residential buildings. The office sector, including commercial and office buildings, comprises 24% of their projects.

Here are some of the key catalysts driving expansion in the geotechnical contracting industry:

Increasing infrastructure investments: Governments and private entities worldwide are investing heavily in infrastructure projects.

Urbanisation and population growth: As the global population continues to grow and urban areas expand, the need for residential and commercial buildings is increasing.

Renewable energy projects: The growing focus on renewable energy sources, such as wind farms and solar installations, requires specialised geotechnical expertise for designing and constructing the foundations and support structures.

Technological Advancements: Advances in geotechnical engineering and construction techniques, such as improved ground investigation methods, geosynthetics, and innovative foundation solutions are contributing to the growth in the industry.

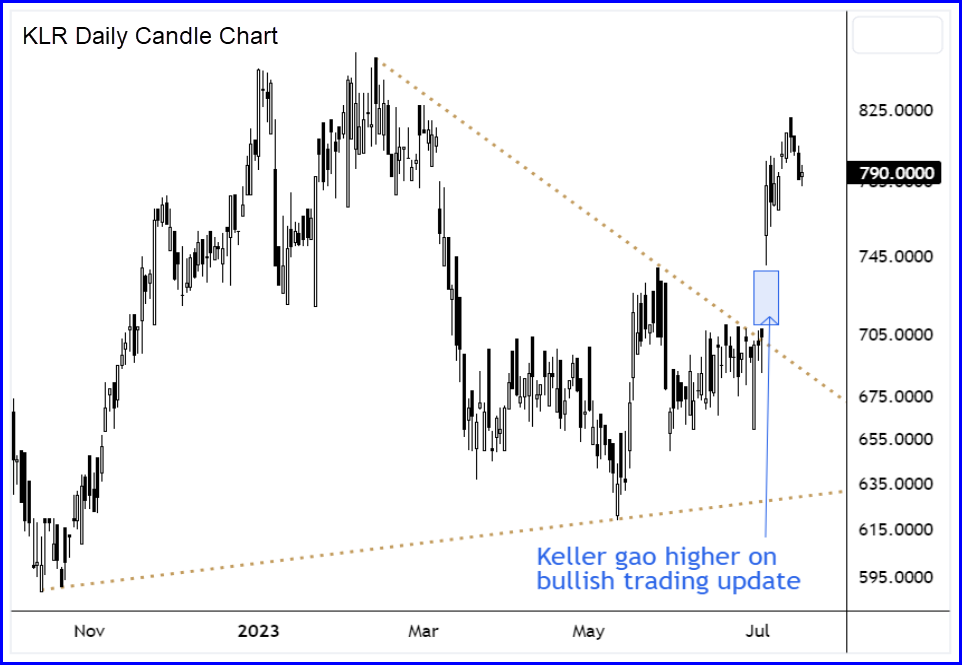

Strong trading update sparks bullish price gap

Earlier this month, Keller released a bullish trading update for the first half of the year, resulting in a significant price gap as the shares surged higher.

During the period, Keller reported that trading remained strong, with expectations of a record-breaking performance.

In North America, the company’s foundations business witnessed operational improvements, leading to a robust recovery in operating margins. In Europe, while cost inflation and supply chain enhancements were observed, recessionary conditions, particularly in North East Europe, presented challenges. Meanwhile, in the Asia-Pacific, Middle East, and Africa (AMEA) region, Keller addressed significant issues in its near-shore marine business through the efforts of a new management team.

Keller’s cash performance surpassed expectations, with net debt/EBITDA leverage ratios projected to align within the desired range. Building on this strong financial performance, Keller plans to increase its interim dividend by 5% as part of its progressive dividend policy.

Looking ahead, Keller anticipates its full year underlying operating profit to exceed previous market expectations, although recent interest rate rises may moderate the increase in earnings. Additionally, the company expects profit to be more evenly distributed between the first and second half of 2023, considering the timing and phasing of certain contracts.

The market responded positively to the trading update, resulting in a price gap and a decisive breakout above a wedge consolidation pattern that had formed since the beginning of the year. This burst of bullish momentum is expected to propel the shares higher as we approach the release of Keller’s Half Year Results on August 1st.

A Warren Buffet-worthy valuation

Keller not only boasts a strong economic moat, but also presents a valuation that would undoubtedly catch Warren Buffett’s attention…

To start, Keller’s forward price-to-earnings ratio (PE) stands at just 6.9, which is significantly lower than the market PE of 10.4. This undemanding valuation indicates that the stock is priced attractively relative to its earnings potential.

Moreover, the forecasted earnings per share (EPS) growth of 31.7% positions Keller with a forward Price to earnings growth (PEG) ratio of only 0.3. A PEG ratio below 1 is generally considered favourable, further adding to the stock’s attractiveness.

When assessing Keller’s valuation from an enterprise value to adjusted earnings perspective (EV to EBITDA), the company outperforms its sector with a ratio of 4.98. This ratio adds weight to the argument that Keller may be undervalued relative to its earnings potential.

Considering these valuation metrics, analysts estimate Keller to have a fair value of £11.13, representing a potential upside of around 30% compared to current prices.

Additionally, Keller has established a reputation for rewarding its investors through consistent and reliable dividend payments. With an impressive track record of 28 consecutive dividend payments, the stock currently offers a forward dividend yield of 4.98%.

In summary, Keller’s valuation metrics, coupled with its strong economic moat and bullish price momentum make it a compelling addition to our FTSE Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.