Regency View:

BUY JD Sports (JD.)

JD Sports ready to run higher with regulatory woes behind them

The best investors are opportunists.

They’ll observe from afar as the storm rages and then step in before the dawn, being ‘greedy while others remain fearful’.

JD Sports (JD.) has certainly been through a storm during the last year…

A protracted battle with the Competition & Markets Authority (CMA) has left the sports fashion retailer battered and bruised.

Now, with the shares more than 40% below their January highs, and a new CEO set to take the reins in September, we’re seeing signs that the storm is passing…

Boardroom bloodletting

Take on a regulatory body and it rarely ends well.

JD Sports acquisition of smaller rival Footasylum back in March 2019 for £90.1 million looked doomed from the start.

The deal was immediately the subject of investigations from the CMA, and a ruling which blocked the deal on competition grounds was partially overturned on appeal.

During the ongoing investigation the two companies were ordered not to exchange sensitive information without prior consent.

However, in February, the CMA said JD Sports and Footasylum had exchanged commercially sensitive information when exec chair Peter Cowgill was caught on camera meeting his Footasylum counterpart, and former JD Sports CEO, Barry Bown in a car park in Bury in the summer of 2021.

JD Sports were fined £4.3 million and ordered to sell Footasylum, a divestment they subsequently completed this month – booking a staggering loss of nearly 60% on an investment made just three years ago.

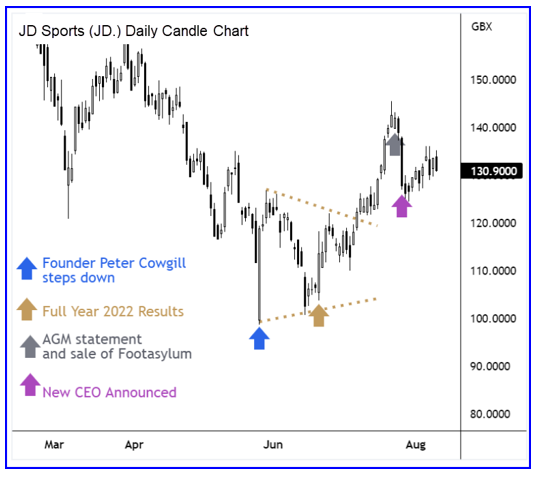

The Footasylum fiasco caused a significant cull in the boardroom which included the departure of several non-exec directors and the eventual resignation of founder, and former CEO, Peter Cowgill in May.

Schultz to start in September

JD Sports long and drawn-out search for a new boss came to an end last week, with former B&Q CFO, Régis Schultz announced as Group CEO set to start his new role in September.

The appointment of Schultz, along with the Footasylum sale, brings some much needed clarity and signals a new dawn for JD Sports…

And whilst there are question marks around Schultz lack of sports retail or US retail experience, a turnaround job is not required, he is joining a company at the top of its game…

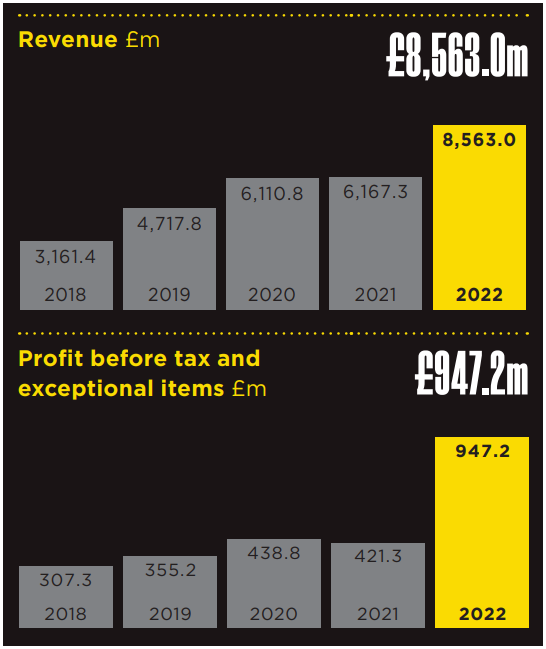

In June, JD Sport released a strong set of Full Year 2022 numbers with record headline profit before tax of £947.2m, more than double the previous record of £438.8m.

There were impressive performances from recent acquisitions with revenue surging sevenfold to £390m at Shoe Palace, while footwear business DTLR generated £383m in revenue since in the 46 weeks post-acquisition period.

Sales in UK and Ireland were up by £508m to £2.3bn and gross margin rose by 110 basis points to 49.1%, boosted by performance in the US where margins jumped by 310 basis points to 49.8%.

And in an AGM update in July, JD Sports said it sees 35% to 40% of this year’s profits being generated in the first half as trading patterns normalise, implying confidence that sales will prove resilient during the Back to School and Christmas selling seasons.

JD Sports also said it “expects annual profit to be in line with last year’s record performance”.

Bad news baked in

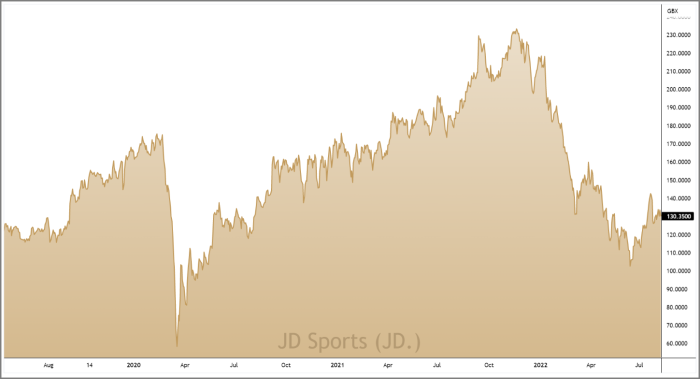

JD Sports shares price has been locked in a strong downtrend since the turn of the year and prices now trade more than 40% below their January highs.

To avoid ‘catching a falling knife’ it’s wise to wait for evidence that the ‘band news is baked in’, and we’ve started to see this in recent weeks…

Following the announcement of Peter Cowgill departure, the shares have started to carve out a series of higher swing lows – jumping higher on the release of Full Year 2022 numbers in June.

With evidence that buying appetite is starting to outweigh supply, we can now make an honest assessment of JD Sports forward valuation without worrying that we’re fighting the market.

Value & Growth

JD Sports current valuation offers investors growth at a reasonable price.

First and foremost, the stock has a Return on Equity of 23.1% – top quartile in its sector and the wider market, indicating that management know how to use shareholders’ equity to generate profits.

The shares are trading at around ten times forward earnings, which looks reasonable given forecast earnings per share growth of 24.9% – giving JD Sports a forward Price to Earnings Growth ratio (PEG) of 0.5 (where anything less than 1 is attractive).

And the stock also scores well across several other value metrics:

Price to Sales is just 0.78 and Enterprise Value to Adjusted Earnings (EV to EBITDA) is 5.14 – top quartile versus whole of market.

Cash generation is strong with 80% of operating cashflow feeding through into the bottom line, and the stock has an attractive Price to Free Cashflow of 6.6.

In terms of balance sheet health, JD Sports is higher geared than we would typically go for (net gearing 54%), but net debt has fallen for its third consecutive year and cash has exceeded net debt on the balance sheet for the first since FY 2019.

On balance, we believe the bad news is baked into JD Sports’ share price, and the stock looks well positioned to outperform during the second half of the year.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.