19th Oct 2022. 8.58am

Regency View:

BUY Flutter Entertainment (FLTR)

- Growth

Regency View:

BUY Flutter Entertainment (FLTR)

Flutter’s US gamble is starting to pay off

In 2018, Flutter Entertainment (FLTR) took a punt.

It paid $158m for a 58% stake in FanDuel, a US business running online sports-based fantasy games for prizes.

Flutter, who own Paddy Power and Betfair, gambled that leadership in the fantasy market could lead to rapid growth if US rules were liberalised to allow locals to bet on sport in a European style.

The deal was viewed by Flutter CEO, Peter Jackson as “an option” on US liberalisation and Peter’s punt is now starting to pay off in a big way.

Rapid US revenue growth

As predicted by Flutter, the US supreme court gave individual states the green light to legalise betting on sports in 2018, and FanDuel haven’t looked back since.

Flutter’s latest set of interim results revealed that FanDuel took over half of the online US sports betting market share in the second quarter.

The number of average monthly players in the first half of the year was up by 49% to 2.2bn – taking total US revenue to £1.1bn a jump of 61% year-on year.

Eyebrows were raised at Flutter’s decision to double down by stumping up a further $4.2bn in 2020 to top up is stake in FanDuel to 95%, but this now looks like a smart move.

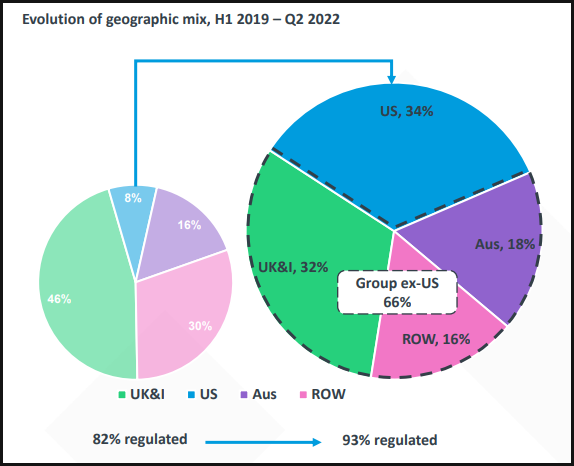

In the last three years, Flutter’s US revenue has jumped from 8% to 34% of group turnover (see image right).

Flutter is pressing home FanDuel’s dominant market position and is experiencing more than 60% cross-sell penetration.

And while US growth is very much about top-line revenue, Flutter expects the earnings profile of this market to swing into positive territory next year as the profits from existing customers more than offset the cost of acquiring new ones.

Global diversification reduces impact of UK regulatory clampdown

The UK government’s upcoming white paper on the gambling sector has cast a cloud over Flutter’s domestic markets.

However, a series of global acquisitions, along with the momentum in the US, have helped to soften the impact of the UK & Ireland’s impending regulatory clampdown.

Flutter acquired Italian market leader, Sisal for £1.6bn this year.

Sisal is showing high levels of momentum with first half 2022 revenues jumping 58% to £402m and adjusted earnings (EBITDA) following a similar trajectory, up 51% to £120m.

Flutter also acquired a majority stake in Junglee, India’s second largest rummy operator.

The deal, worth £48m gives Flutter access to one of the fastest growing gaming markets globally. Disposable income in India has grown by 45% since 2016 and there is positive regulatory momentum in the region.

And in a smaller, but significant deal, Flutter snapped up B2B iGaming software developer Singular. The deal will give Flutter greater access to regulated markets in the Commonwealth of Independent States (CIS) region.

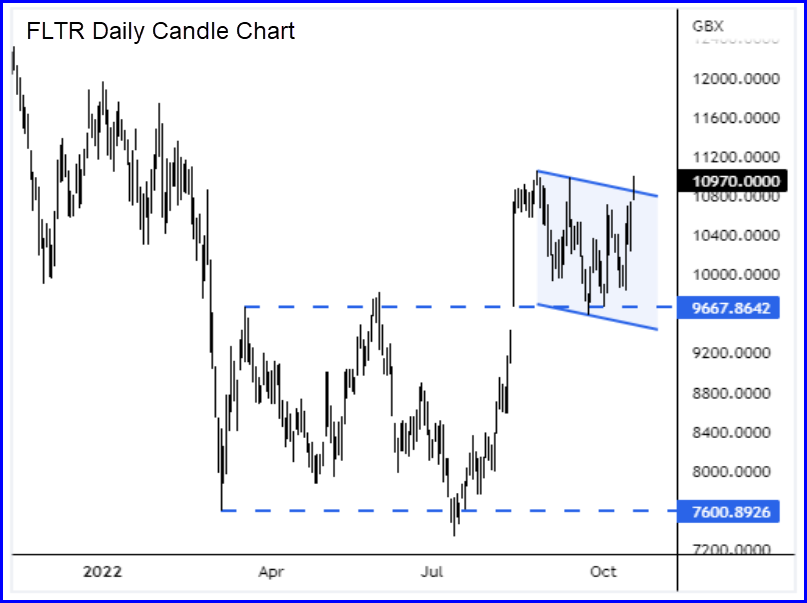

Bull flag follows key breakout

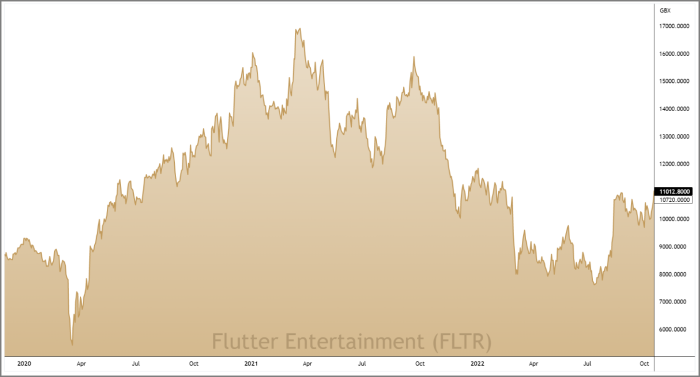

After a torrid 2021 which saw the shares tumble from highs just shy of 17,200p, Flutter’s price chart suggests that a trend reversal is in place.

The shares hammered out a double bottom at 7,628p in the summer, and then burst higher in August on the back of their strong interim results.

The break higher was significant as it broke above a key resistance area created by the March and May swing highs at 9,667. It also printed Flutter’s first ‘higher swing high’ in over a year!

Price action following the breakout has seen the shares consolidate their gains and track sideways, using the broken resistance area as support and forming a bull flag pattern.

This price action signals upside continuation and provides a short-term catalyst to support the timing of our long-term position.

Forecasted uptick in earnings justifies Flutter’s double-digit PE

Despite the sell-off in Flutter’s share price during the last 18-months, Flutter cannot be considered a ‘cheap’ stock, we have plenty of those in our FTSE Investor open positions if that’s what you’re after.

Buying Flutter is about buying a market leader.

A market leader which is on the cusp of a significant uptick in earnings per share (EPS) – Flutter expects to see 106% growth in EPS over the next two years.

This expected ramp up in earnings goes some way to justify the stocks lofty forward PE multiple of 27.

And while Flutter’s balance sheet has much higher levels of leverage than we’d typically go for, we believe its market dominance, cash generation and potential for FanDuel IPO make this less of a concern.

Flutter’s upcoming Q3 2022 trading statement (Wed 9th Nov) and Capital Markets Day (Wed 16th Nov) should provide more colour on the growth plans for its US business. And any mention of a potential FanDuel IPO is likely to be very well received by the market.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.