Regency View:

BUY DS Smith (SMDS)

A perfectly packaged value play

When hunting for value stocks, we’re essentially looking for two things; endurance and discount…

By endurance, we mean a cockroach-like ability to withstand market shocks and a confidence that the company can maintain a market-leading position for many years.

As for discount, whilst this may sound self-explanatory, we’re looking for more than just a cheap forward earnings multiple, we require a strong body of evidence that the stock is intrinsically undervalued.

Ticking both the endurance and discount boxes is packaging giant DS Smith (SMDS)…

The company is a market-leader in sustainable packaging with large exposure to the e-commerce industry – making it well positioned to stand the test of time.

The shares currently trade at a heavy discount to Fair Value and offer attractive levels of income.

Proven pricing power

With inflation running at 40-year highs in the UK, Europe, and US, ‘pricing power’ or the ability to pass on rising input costs to the end consumer is a hot commodity right now…

As a maker of corrugated cardboard packaging, DS Smith has not been immune from inflationary forces, but it has been able to raise its prices to offset higher costs and demand has remained robust.

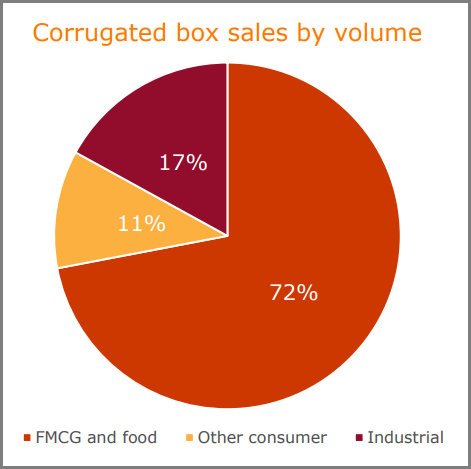

More than 70% of DS Smith’s revenue comes from Fast Moving Consumer Goods (FMCG) and food – these are products with high and stable or ‘sticky’ consumer demand such as soft drinks and confectionery.

In a recent trading statement, DS Smith said that “virtually all input costs, including energy, have increased significantly”, but box volumes are still expected to grow 2% for the full year (FY23) – underlining just how sticky demand is for its packaging.

DS Smith have also managed to successfully navigate the energy crisis through a long-term hedging programme with the group 90% hedged against the price of natural gas for FY23 and approx. 80% hedged for FY24.

And despite an anticipated softening in demand for its industrial packaging (which accounts for less than a fifth of group revenue), DS Smith’s FY23 outlook remained unchanged with revenue expected to hit £7.8bn, up from £7,2bn FY22 and earnings per share (EPS) forecast to jump from 23.1p FY22 to 34.8p FY23.

Sustainability is a long-term growth driver

DS Smith is well-placed to leverage its position as a leader in sustainability…

By next year, DS Smith will be producing 100% reusable and sustainable packaging, up from current levels of 98%.

They are also planning to expand on their integrated ‘closed loop’ services which collects customers used cardboard and turns it into their new packaging within just 14 days.

And by 2025 DS Smith will take 1 billion pieces of problem plastics off supermarket shelves.

Demand for sustainable packaging is being driven by the end consumer, the investor and the regulator.

According to Zion Market Research, the Sustainable Packaging Market was worth around $265.9bn in 2021 and is estimated to grow to $358.3bn by 2028, with a compound annual growth rate (CAGR) of approx. 5.10% over the next decade.

Shares move into key support zone

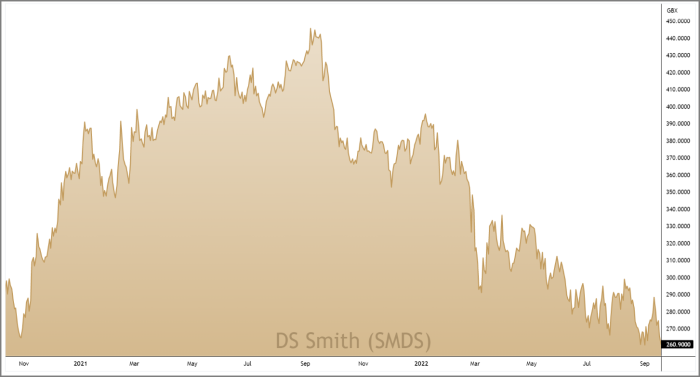

DS Smith’s share price has had a torrid start to the year with prices down -30% year-to-date and more than -40% from their September 2021 swing highs.

This sustained sell-off has been driven by investor’s attempts to price-in the impact of a global downturn in demand following a raft of rate hikes from central banks on both sides of the Atlantic.

However, we’re now seeing signs that the sell-off is overdone…

When viewing DS Smith’s share price on the weekly candle chart across a 10-year period (see chart below), we can see that the shares are approaching a key support zone between 266p-234p.

This zone represents a cluster of key historic turning points for the stock, and it’s an area that is likely to attract buyers.

We are also seeing ‘bullish divergence’ on the RSI indicator – this occurs when the price is making lower swing lows, but the RSI is making higher swing lows.

This signals that the shares are starting to become ‘oversold’, and whilst technical indicators of this nature are not hugely significant when investing long-term, it adds weight to our case that DS Smith is undervalued.

DS Smith’s discount to Fair Value

DS Smith’s share price doesn’t just look cheap on the price chart, its fundamental valuation catches the eye across several metrics…

The shares are trading on a forward price to earnings multiple of 7.5, which is one of the cheapest in the Containers & Packaging sector.

This forward valuation looks very reasonable relative to double-digit forecast EPS growth (27.5%) and a market-leading forward dividend yield north of 6%.

The dividend is well-covered by futures earnings (forecast dividend cover 2.13 FY23) and DS Smith’s pay-out is expected to rise steadily over the next five years.

Cash generation is strong with around 40% of operating profits dropping through into free cashflow, and debt on the balance sheet has started to decline from elevated levels due to the acquisition of Europac.

On an intrinsic value basis (calculated by projecting future cash flows and then discounting them to today’s value), DS Smith’s share price is trading at an estimated 40% discount to Fair Value.

Whilst calculating a stocks Fair Value is imperfect and full of account assumptions, this discount appears very large for a stock that is a market leader, has stable demand and clear long-term growth drivers.

In short, we believe DS Smith is a stock that you can tuck away and forget about, safe in the knowledge that you snapped them up at historically low levels.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.