Regency View:

BUY Ashtead (AHT)

Ashtead’s sell-off looks overdone

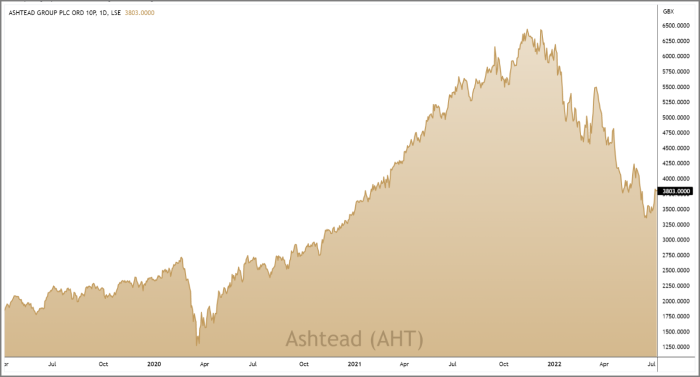

If anyone ever needed proof that, in the short-term, the stock market is an irrational beast, just look at Ashtead’s (AHT) share price…

Ashtead, being a US-focused equipment hire specialist were very much in the sweet spot during the post-pandemic stimulus-fuelled US construction boom.

Investors piled into the stock, creating a monster bull run which saw Ashtead’s share price appreciate five-fold between March 2020 and December 2021 as Ashtead’s Sunbelt Rentals US brand gobbled up market share.

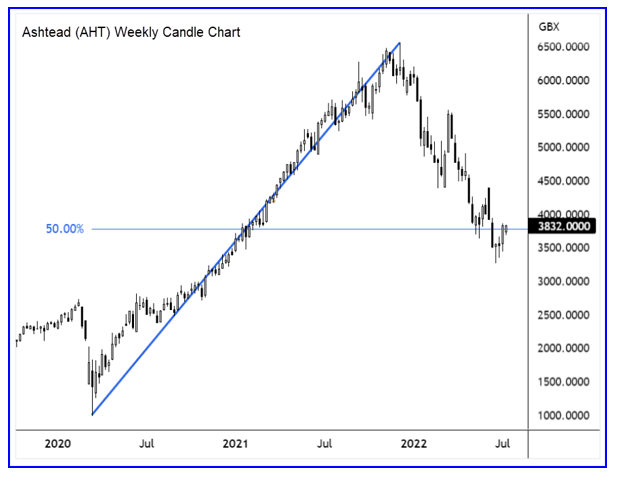

And just as the heard clamoured for stock during the bull run, fears that a cycle of inflation-fighting rate hikes will spark a global recession has seen Ashtead’s share price half in value from those Dec21 highs.

If we remove the hysteria of the global recession headlines and look at the numbers, the halving of Ashtead’s share price looks like an overreaction…

Revenue and profits are still growing strongly

Last month, Ashtead published their Full Year 2022 Results and Q4 Trading Update which showed that revenue and profits are still growing strongly…

Headline revenue increased 18% to a new record of $7.96bn and pre-tax profit surged 35% to $1.67bn.

And if we look at Ashtead’s US numbers, it’s largest market – accounting for more than 80% of group revenue, we’re seeing no signs of a slowdown…

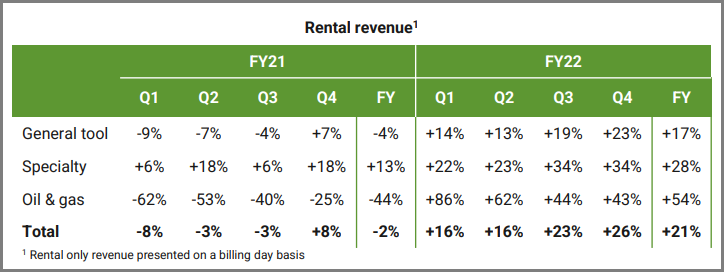

Total US rental revenue jumped 21% for FY2022, when this is broken down into quarterly performance, we can see that there has been no slowdown in General Tool and Specialty markets.

The only tempering in growth has come from Oil & Gas which was growing at break-neck speed during the first two quarters of Ashtead’s financial year.

Market-leading position makes Ashtead better placed to cope with headwinds

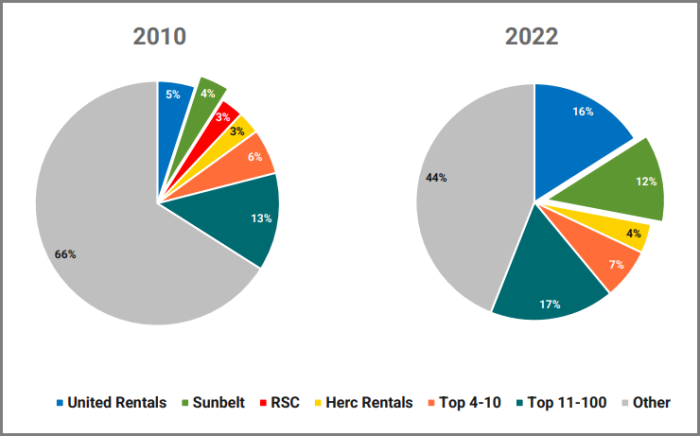

Sunbelt has seen its US market share triple in the last decade from 4% in 2010 to 12% in 2022 – making it the second biggest player in the US market behind US Rentals.

Subelt’s US market share is forecast to exceed 20% in the coming years and this market-leading position is allowing Ashtead to cope with inflationary pressures better than many analysts expected…

Operating margins (FY22) have remained steady at 45% and Ashtead have managed to increase rental rates and reduce costs through scale and efficiencies.

And the global supply chain problems are a tailwind for tool hire because rental companies can provide equipment quickly.

Biden infrastructure bill to support double-digit US rental revenue growth

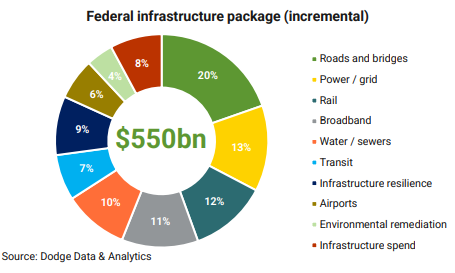

US President Joe Biden passed huge infrastructure bill last year which includes $550bn (£451bn) in new spending on roads, bridges, tunnels, airports and broadband.

Analysts at Morgan Stanley believe Biden’s bill will support double-digit US rental revenue growth over the next two years. And in Ashtead’s recently published full-year numbers, they are seeing ‘mega-sized’ projects powering the construction landscape…

Ashtead said projects over $400m represent ever increasing proportion of total spend. Mega-sized projects now account for over 30% of the US market today compared with just 13% in 2000 – 2009 – playing into Ashtead’s market-leading position.

Specialty Tool arm growing fast

Ashtead has used the goldilocks post-pandemic market conditions to invest heavily in the business and ensure they are better prepared for a construction slowdown than during the last recession…

They have invested $2.4bn in the business and $1.3bn in bolt-on acquisitions – broadening its end markets. Construction now accounts for around 45% of the business, compared with around 65% in 2007.

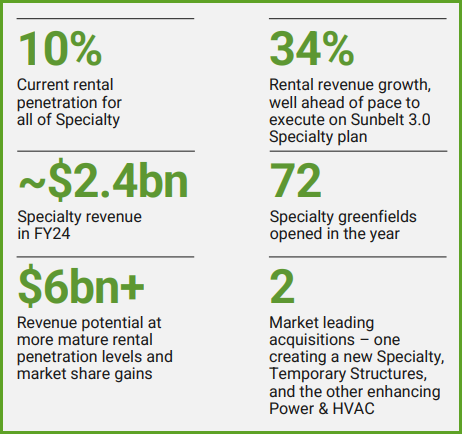

A great example of this has been their investment in the Specialty Tool market…

Specialty Tool revenue is up 28% year-on-year, and this segment now generates around 30% of US revenue.

Demand for specialty tools is typically ‘non-discretionary’ meaning that it will provide some insulation from the cyclical construction market and Ashtead have plans to growth its Specialty Tool arm rapidly…

Ashtead opened 72 specialty greenfield sites last year and made two market leading specialty tool acquisitions – one creating a new specialty, ‘Temporary Structures’, and the other enhancing its Power & HVAC offering.

Ashtead expect Specialty Tool revenue to hit $2.4bn by FY24 and see a $6bn annual revenue potential over the longer-term as it gains market share.

Leverage is high but not excessive

In terms of valuation, Ashtead is a high-profile, highly leveraged growth stock and this naturally comes with a high Price to Earnings ratio…

The shares currently trade on a forward PE of 12.4 which is mid-market, but by no means excessive given Ashtead’s market-leading position.

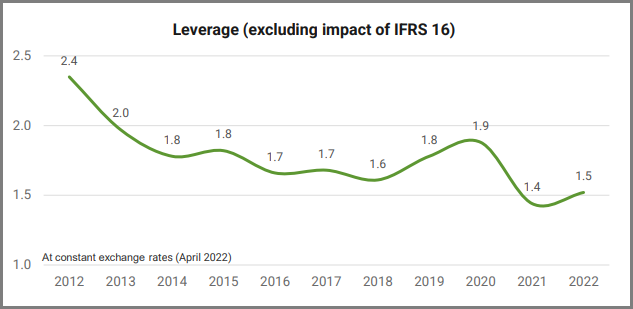

Net debt levels are high relative to other sectors, but Ashtead have a strong track record of using debt to leverage growth. And if we look at net debt to adjusted earnings (EBITDA) leverage, we can see that it’s been falling during the last decade and Ashtead said “leverage is in the lower half of its target range”.

Based on Ashtead’s record set of FY22 numbers and current growth projections, we believe the halving in its market value over the last year is an over-reaction – creating the opportunity to snap up a high-quality growth stock at a very reasonable price.