18th May 2022. 9.01pm

Regency View:

BUY Vodafone (VOD) (example)

- Income

Regency View:

BUY Vodafone (VOD)

Locking-in a large dividend

Vodafone (VOD) is often lumped in with BT when it comes to analysis, but in reality, it has much higher levels of geographic diversification, making it, in our opinion a superior stock…

BT’s fortunes are largely tied to the health of UK plc, whereas only 15% of Vodafone’s revenue comes from the UK with the rest generated in continental Europe and Africa.

Vodafone’s African business has exciting growth potential while the overall business generates, substantial and stable cashflows, making its 6.4% dividend yield look very attractive.

In this report, we’re going to look at why now is a compelling time to lock-in Vodafone’s large dividend.

High-growth Africa and high-margin Germany

The African mobile telecom market is much larger and substantially higher growth than the mature European market…

In the last year, African mobile customers increased 37% to 184.5m – this is more than double the size of Europe’s 66.4m mobile contract customers.

Alongside its African mobile contracts, Vodafone also has a payment platform called M-Pesa which allows its African customer base to manage business transactions and regular payments. In 2021, M-Pesa users in Africa, jumped from 48.3m to 52.4m – hitting its 50m target three years ahead of schedule.

In Europe, the jewel in Vodafone’s crown is the German market which accounts for 30% of group revenue.

The German market has profit margins of 43%, double that of the UK’s 21%. However, UK profit margins may be set to receive a boost should the high-profile merger of Vodafone UK and Three UK go through.

So, whilst Vodafone is by no means a growth stock (headline revenue has remained flat for the last five years), it has a geographically diversified base of cash generative business which serves to protect its status as a generous income investment.

Preliminary Results prove ‘resilient’

Yesterday, Vodafone released an in-line set of Preliminary Results for full year 2022…

Full year revenue rose 4% to €45.6bn reflecting growth in Europe and Africa Service revenue. And Total Service revenue edged 2.6% higher to €38.2bn.

Underlying cash profits rose 5% to €15.2bn which was “in-line with previous guidance”.

Nick Read, CEO, highlighted the group expects to deliver a “resilient” performance in the new financial year, including underlying cash profits of €15 – €15.5bn, but warned that Vodafone isn’t immune to the wider macroeconomic challenges.

The results come just days after Emirates Telecommunications Group Company (‘Etisalat’) became Vodafone’s largest shareholder with a 9.8% stake…

Etisalat cited Vodafone’s “geographically diversified business” and “attractive valuation” as reason for the purchase. It also confirmed it doesn’t want a board seat and has no current interest of making a takeover bid.

Market-beating dividend yield

Vodafone’s prelims also confirmed a final dividend of 4.5 cents was announced, taking the full year payment to 9 cents (7.487p per share).

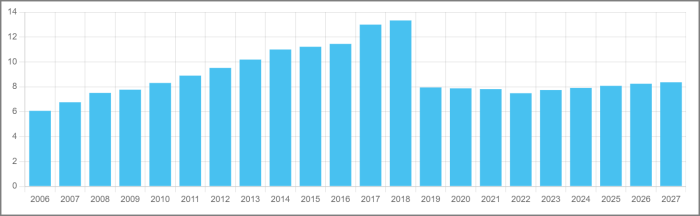

Our dividend history and projection chart shows that Vodafone’s generous dividend is forecast to steadily rise over the next five years.

Dividend cover is forecast to remains around 1.2 x earnings and free cash flow is projected to rise in 2024 – giving Vodafone a free cash flow yield of 13.2%

The shares currently trade on a forward Price to Earnings (PE) multiple of 11.4, which looks attractive when compared to forecast earnings per share (EPS) growth north of 20% and market-beating dividend yield of 6.4%.

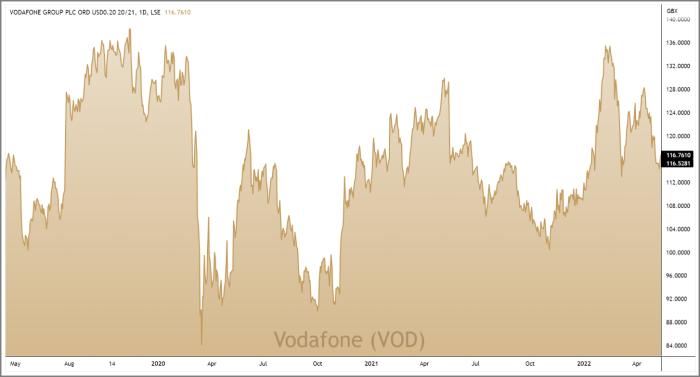

Share price responds to key support

Those of you who follow our research closely will know that we like to have a short-term technical catalyst that is aligned with our long-term view.

We’re largely buying Vodafone for its income characteristics, but there is short-term bullish catalyst in place…

Vodafone’s recent price action has seen the shares retest a key level of support created by the March swing lows at just above the 112p marker.

During the last week, we’ve seen buyers step in at support and several ‘long-tailed’ candles have printed on the daily candle chart (right) – indicting that a new inflection point is forming.

With the shares responding to key support, and a sturdy set of prelims behind them, we believe the time is right to lock-in Vodafone’s generous dividend.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.