Regency View:

Update

Bango’s H1 platform transactions exceed $2bn for first time

Mobile payment platform, Bango (BGO) released a positive trading update last week in which it said it will ‘comfortably’ meet analyst full-year forecasts.

End User Spend (EUS), Bango’s core KPI, increased 16% to over $2bn (1H21: $1.8bn) demonstrating the continued growth of merchants using the Bango Platform to collect payments.

First half revenue increased 9% to $10.8m (1H21: $9.9m) despite significant currency headwinds with major currencies declining against the US Dollar (e.g. Japanese Yen down 15% and Euro down 8%).

Commenting on the first six months of 2022, Bango CEO Paul Larbey said:

“Our strategy of investing for growth is paying off. The increasing competitive advantage of the Bango Platform is securing long term, growing, recurring revenue streams from the world’s largest businesses.”

“With the progress made in the first half, the Board is confident Bango will comfortably meet the full year analyst consensus revenue and adjusted EBITDA forecasts for FY22.”

Ceres says revenue highly dependent on completion China JV contracts

Ceres Power (CWR) released a robust trading update at the end of July in which it provided further clarity on its major Joint Venture (JV) contracts.

The fuel cell developer said revenue and other operating income for the six months to 30 June 2022 is expected to be approx. £10m (H1 2021: £17.4m), with the timing of completion of the China JV contracts with Bosch and Weichai and associated licence fees expected to fall in the second half of 2022.

Cash balances remain strong at £221m for the period end 30 June 2022.

Ceres CEO, Phil Caldwell commented:

“Ceres is placed at the heart of the energy transition, and everything we do is focused on ensuring the success of our partners by deploying our technology in multiple geographies and applications.”

“Whilst short-term revenues are dependent on the timing of significant licensing deals, our focus remains on building long-term value through scaling the manufacturing capacity for our technology and growing the recurring, annual royalty streams we will receive as partners succeed. We continue to make good progress towards this aim both with existing and new partnerships.”

Restore HY profits jump 36%

Restore (RST) released a strong set of half year results at the end of July…

The document management company said it had achieved ‘substantial’ revenue growth of 32% in the first half, driven by strong organic momentum (+19%) and the successful integration of acquisitions made in 2021 and H1 2022 (+13%).

Restore remain confident of delivering its stated objective to reach annual revenues of £450m and double adjusted earnings (EBITDA) to £150m in the medium term.

Restore CEO, Charles Bligh commented:

“In addition to our confidence in future organic growth, we have a well-developed pipeline of acquisition opportunities, and, with our strong balance sheet, we are looking forward to completing further investments in H2 and continuing to deliver great results for our shareholders and customers.”

The shares have drifted sideways this year – in-line with the wider market, but with continued strong results and an upbeat outlook, we expect the shares to retest last years highs in the coming months.

Keywords deliver strong HY organic revenue growth of 22%

Gaming group Keywords Studios (KWS) ‘performed strongly’ during the first half…

Keywords expect to report revenues of approx. €320m representing a c.34% increase on the comparative period (H1 2021: €238.7m). On an organic basis, Keywords revenues are expected to increase by approx. 22% (H1 2021: 22.9%) with “robust demand for all of the Group’s services”.

As of 30 June 2022, the Group had net cash of €121m (31 December 2021: €105.6m) after cash spend on prior year acquisitions in the first half of the year amounting to €13.6m.

Keywords said, “the Group’s cash balance, strong cash generation and the €150m available under its undrawn committed revolving credit facility, leave the Group well placed to pursue it organic and acquisition growth strategy”.

On outlook, Bertrand Bodson, CEO of Keywords Studios commented:

“Given this and the Group’s strong performance in H1, we are confident of delivering a performance comfortably ahead of current market expectations for the full year, albeit with organic growth rates moderating and margins moving to historic levels of ~15% as we invest in the business, transition our people and work from Russia, and as more costs return with the easing of COVID restrictions”.

Mulberry post higher annual profits

Mulberry (MUL) reported a rise in annual profits as shoppers return to stores after pandemic-related restrictions were eased.

The UK-based fashion house reported FY revenue of £152.4m (£115m FY21) and Profit Before Tax of £21.3m, a significant jump from £4.6m a year ago.

Mulberry said FY retail sales in China were up 59% and the first 12 weeks of the new financial year revenue is 5% ahead of last year but warned that current trading could be impacted by lockdowns in China.

CEO, Thierry Andretta commented:

“The strength of our financial results reflects positive customer response to our product as well as the strategic decisions we have made over the past five years, and I want to take this opportunity to thank my colleagues for their commitment and contribution to the business.”

“Whilst the economic and geo-political outlook remains uncertain, we are an iconic international brand with a clear strategy for future profitable, cash-generative growth. We remain well placed to continue to deliver sustainable returns to the benefit of all our stakeholders.”

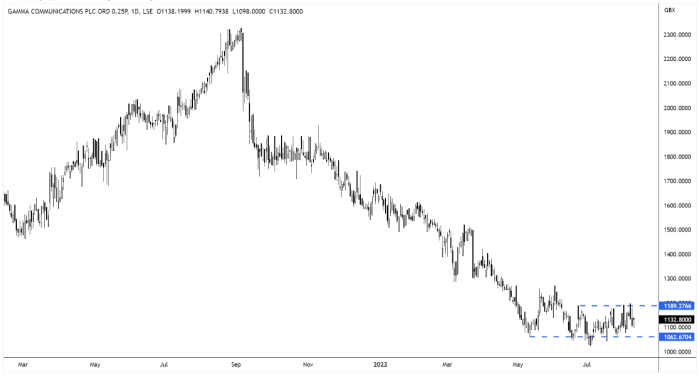

Gamma Communications sees FY earnings at upper end of market forecasts

Gamma Communications (GAMA) released a positive H1 trading update in which it said it expects adjusted EPS for the year ending 31 December 2022 to be in the “upper half of the range of market forecasts”.

The VOIP specialist said its resilient recurring revenue model, combined with selected price increases and strict cost discipline, has helped mitigate inflationary pressures.

Andrew Belshaw, Interim Chief Executive, commented on the results:

“I’m very pleased to report on a strong first half performance. Gamma is leveraging the full breadth of its market-leading product set both through the channel and direct across all of our markets”.

“Although not immune from the macro-economic challenges ahead, our recurring revenue model, strong cash generation and healthy balance sheet enables us to continue to invest in the undoubted market opportunity. Churn and bad debt remains at low levels and these results demonstrate the resilience of the customer base and the importance they attach to Gamma’s products and services”.

“We look forward to continuing this momentum into the second half”.

Atalaya Mining posts 72% drop in second-quarter profit as input costs soar

Atalaya Mining (ATYM) reported a 72% drop in second-quarter profit as input costs soared and warned inflationary pressures are likely to continue.

Q2 adjusted earnings (EBITDA) dropped to €14.7m versus €52m in Q2 2021. The drop was due to significant increases in key input costs such as electricity, diesel, explosives, steel and lime.

In July, Atalaya revised its full-year copper production guidance down to 52,000 – 54,000 tonnes and said that cash costs and all-in-sustaining costs (AISC) will be revised upwards by about 5-10%.

Atalaya CEO, Alberto Lavandeira commented:

“As a result of the ongoing conflict in Ukraine and the inflationary environment globally, our costs have increased materially since last year and it is likely that current conditions will persist for some time”.

Atalaya, which had net cash of €67.6m as of end-June, plans to pay Interim dividend of $0.036 per share.

Sylvania Platinum give Q4 trading update

A 22% drop in platinum group metals (PGM) prices saw Sylvania Platinum’s (SLP) net revenue fall in Q4…

Sylvania said its Sylvania Dump Operations (SDO) recorded $34.9m net revenue for the quarter (Q3: $47.9m), reflecting a 22% lower PGM basket price received during the quarter.

Group adjusted earnings (EBITDA) for the quarter came in at of $16.8m (Q3: $30.0m), and group cash dropped to $121.3m, after payment of the windfall dividend, share buyback and year-end taxes (Q3: $138.0 million).

Commenting on the Q4 results, Sylvania’s CEO, Jaco Prinsloo said:

“I am very pleased with the strong finish to the financial year where the SDO achieved 18,837 ounces for the quarter. The strong performance was achieved on the back of a solid production effort from all operations, especially Tweefontein plant which achieved record monthly and quarterly PGM ounces, improved ROM PGM feed grade received from the host mine at Mooinooi and the contribution of the recently commissioned Lesedi MF2 circuit also added to our performance.”

“Despite the challenges faced over the past few quarters, I am pleased with the significantly improved production performance of the SDO for Q4. The Company was therefore able to achieve a PGM production of 67,053 ounces for FY2022 to meet the mid-range of our earlier stated guidance for the year.”

CML Microsystems enters new FY with healthy order book

In an AGM statement, released yesterday, CML Microsystems (CML) said it entered the new financial year with a “healthy order book and a strong pipeline of future opportunities”.

The chip maker did not give any numbers, but said it had made good progress so far, with trading for the opening four months “comfortably ahead of the prior year comparable period”.

“Our enhanced strategy to widen the addressable market is gathering pace and activities to capture share of new market application areas remains a priority focus. In support of this, several new product releases are scheduled across the coming months that are projected to start contributing to revenues during the following year” read the upbeat statement.

The market enjoyed the comments, and the shares were trading 4% on Wednesday (10th August).

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.