7th Aug 2025. 9.01am

Regency View:

Update

Regency View:

Update

Ceres powers ahead with Doosan partnership

Ceres Power continued their slow road to recovery following the announcement of a key milestone in their partnership with Doosan Fuel Cell. The joint announcement revealed that Doosan had commenced mass production of fuel cell power systems using Ceres’ solid oxide technology.

This marks a pivotal moment for both companies, as it is the first time that one of Ceres’ strategic licensing partners has entered mass production. The fuel cells, stacks, and power systems being produced are set to target rapidly growing markets, particularly in AI and data centres, as well as commercial power sectors. These industries, which have seen surging demand, present significant opportunities for the widespread adoption of clean energy technologies.

The mass production facility, located in South Korea, is poised to produce a combined 50MW of electrical power each year. This development comes on the back of Doosan’s commitment to the project, which saw the completion of its state-of-the-art factory in 2022. By manufacturing these advanced fuel cells at scale, Doosan is positioning itself at the forefront of the clean energy revolution. The first products are expected to reach the market by the end of 2025, with initial sales directed towards the South Korean market. Notably, this partnership represents a significant step for Ceres, as the company looks to commercialise its technology, which boasts higher efficiency and lower costs than traditional energy solutions.

The applications of Ceres’ fuel cells are particularly timely, given the growing energy needs driven by the AI revolution, which has dramatically increased power demands, especially in data centres. Ceres’ solid oxide fuel cell technology, with its robustness and efficiency, is positioned to meet these challenges head-on. Beyond AI, the technology also holds promise for stabilising renewable energy grids, providing auxiliary power solutions for marine shipping, and offering reliable energy systems for buildings and microgrids. Both Ceres and Doosan are keen to lead the way in these markets, aiming to accelerate the global transition to a decarbonised future with eco-friendly solutions.

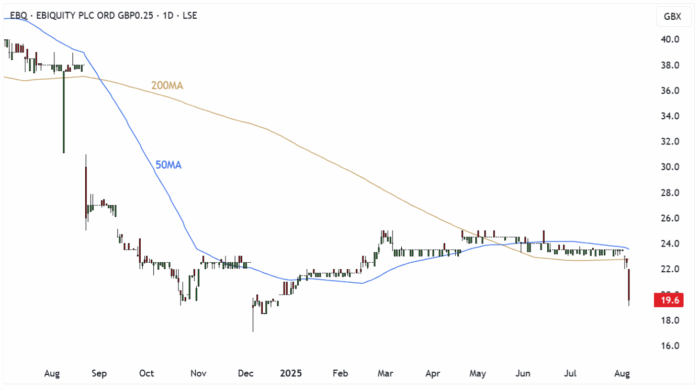

Ebiquity sees strong growth in operating profit despite flat revenue

Ebiquity (EBQ) a UK-based media investment analysis firm, reported a solid 10% increase in adjusted operating profit for the first half of 2025, as it continues to demonstrate resilience despite challenging market conditions.

The company saw adjusted operating profit rise to £2.6 million, up from £2.3 million in the same period last year, while its adjusted operating margin also improved to 6.8% from 6.2%. Although group revenue remained flat at £37.9 million, it grew by 1% on a constant currency basis, and excluding North America, the company experienced a 5% revenue increase, or 6% on a constant currency basis.

The growth was driven by a strong performance in the UK & Ireland and Continental Europe operations, particularly within its Contract Compliance service line. However, the company’s North American business was significantly impacted by market challenges and economic uncertainty, which resulted in subdued client spending. To help tackle these issues, Ebiquity appointed Michele Harrison as Managing Director of the Americas in June, tasking her with driving regional growth and capitalising on emerging opportunities.

Ebiquity’s financial position remains stable, with net debt reduced to £15.0 million, down from £15.6 million in December 2024, and cash balances at £8.9 million, excluding restricted cash. With its second-half weighted business model, the company expects to meet full-year market expectations, remaining optimistic about its outlook despite current headwinds in North America.

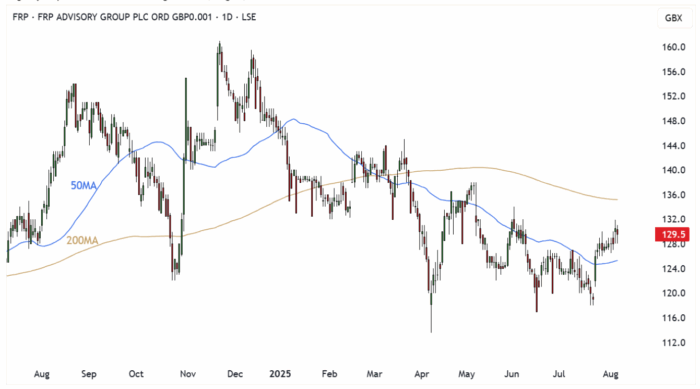

FRP Advisory shows resilient growth with strong full-year results

FRP Advisory (FRP) has rallied higher from recent lows following the release of its robust full-year results for the year ending 30 April 2025. The national business advisory firm saw a 19% increase in revenue, reaching £152.2 million, driven by a combination of strong organic growth and the successful integration of acquisitions. Adjusted underlying EBITDA grew by 11% to £41.3 million, while adjusted profit before tax rose by 10% to £37.1 million.

These impressive figures reflect the strength of FRP’s strategy, the quality of its service pillars, and the company’s ability to adapt to the challenges posed by economic uncertainty and geopolitical instability. The firm also maintained a healthy balance sheet, with net cash of £33.3 million, up 12% from the previous year, further solidifying its position for future growth.

In addition to financial growth, FRP Advisory expanded its team by 21% in the last year, bringing on 138 new colleagues across various service lines. The company’s UK footprint now spans 31 locations, alongside two international offices, with a significant increase in its partner base to 108. This expansion reflects the firm’s ongoing commitment to scaling its operations to meet rising demand. The firm’s restructuring team remained a key player in the UK administration market, while the Corporate Finance and Debt Advisory teams continued to contribute to FRP’s high profile in the UK M&A space. The successful completion of strategic acquisitions and lateral hires has helped position FRP as a leader in its field, while also ensuring strong internal career progression, as evidenced by the promotion of seven colleagues to partner status.

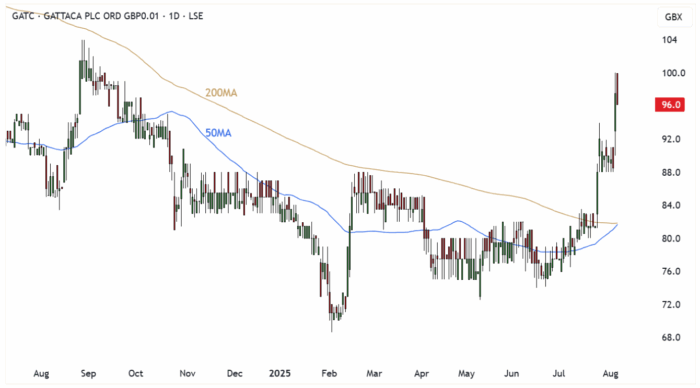

Gattaca’s bullish momentum accelerates following strong results and acquisition

Bullish momentum behind Gattaca’s (GATC) share price has increased in recent weeks, following the release of a trading update for the year ended 31 July 2025. Despite some challenges in certain service areas, the company delivered a solid performance, with Group continuing Net Fee Income (NFI) expected to reach £38.8 million, slightly below last year’s £40.1 million but still in line with market expectations.

The firm saw resilience in contractor numbers, even as utilisation rates dipped during holiday periods, and a decline in permanent NFI reflected the overall subdued demand across the market. However, Gattaca’s improved margin conversion, thanks to cost control and productivity enhancements, has helped the company forecast a Group underlying profit before tax between £3.1 million and £3.3 million, exceeding prior expectations.

In addition to a solid performance in FY25, Gattaca made a strategic move by acquiring Infosec People Limited, a specialist cyber security recruitment firm. The acquisition, valued at £2.1 million, provides Gattaca with a foothold in the rapidly expanding cyber security sector, which continues to see growing demand. Infosec, with a net fee income of £1.5 million for the year ended March 2025, brings valuable expertise and an established client base in critical national infrastructure, defence, and beyond. This acquisition adds a new dimension to Gattaca’s offerings and strengthens its position within high-demand markets, where security and information protection have never been more vital.

The company’s strong balance sheet, with net cash standing at £15.7 million as of 31 July 2025, supports its ongoing dividend policy and positions Gattaca for continued growth. Despite challenging market conditions, the Board remains confident in the company’s outlook for FY26, with expectations of an underlying profit before tax of £4 million. CEO Matthew Wragg highlighted the firm’s strategic focus on improving consultant productivity, enhancing operational efficiencies, and capitalising on high-potential markets such as cyber security, which is expected to drive further growth. With this solid foundation and a clear focus on its core markets, Gattaca is well-positioned to navigate the challenges of the year ahead.

Somero faces slowdown but remains confident in long-term outlook

Somero Enterprises has provided an update ahead of its H1 2025 results, with trading expected to be lower than in the same period last year due to ongoing market pressures and global uncertainty.

Despite long-term demand drivers in non-residential construction, including onshoring, data infrastructure, and power generation, the slower pace of project starts, particularly in the US, has led to caution in investment decisions. International markets have also slowed, as they await clarity on potential trade deals. As a result, Somero now expects revenues and EBITDA for FY 2025 to fall below previous guidance.

In response to the softer trading environment, Somero has implemented cost reduction measures amounting to US$6.0 million on an annualised basis, including workforce reductions and tighter cost controls. The company expects H2 2025 to be stronger, supported by the launch of new products such as the Hammerhead and the next-generation S-15EZ Boomed Screed, which are anticipated to boost performance. These products are designed to meet the needs of both small to medium-sized and larger-scale projects, prioritising productivity, affordability, and enhanced performance.

Despite near-term challenges, Somero’s Board remains confident in the company’s medium and long-term prospects, driven by a growing pipeline for large, high-specification buildings. With a strong balance sheet and a proven ability to navigate difficult conditions, Somero is well-positioned to capitalise on market recovery. The company is finalising a new strategic framework, which will be shared alongside H1 2025 results in September.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.