17th Apr 2025. 9.02am

Regency View:

Update

Regency View:

Update

Bango powers Telenet’s new subscription marketplace

Bango (BGO) has announced that its Digital Vending Machine is the technology behind a new entertainment marketplace launched by Belgian telecoms provider Telenet. This platform allows customers across TV, broadband, and mobile to manage their entertainment subscriptions through a single hub. Accessible via Telenet TV, the My Telenet app, and in-store or call centre support, the service brings together a wide selection of bundled entertainment options in one place.

Initially available only to TV customers, the service has now been extended to Telenet’s full customer base of nearly two million. With the rollout of this “Super Bundling” model, users can subscribe to, manage, and cancel entertainment services with greater ease—all consolidated under a single Telenet bill. Telenet says the offering gives them a clear edge in a competitive market by offering convenience, flexibility, and value.

Bango’s simplifies the subscription integration process, enabling Telenet to rapidly onboard major services such as Netflix and Disney+. The system also provides customer insights, helping tailor packages to different user preferences. Bango’s partnership with Telenet underscores the growing appeal of its platform to telcos seeking to boost customer engagement through smarter subscription bundling.

Billington drops after revenue and earnings slide

Billington’s (BILN) share price dropped sharply this week following a disappointing set of full-year results that showed a marked slowdown in revenues and profits compared to 2023.

Revenue fell 14.6% to £113.1 million, while profit before tax declined nearly 20% to £10.8 million, a drop attributed to tougher trading conditions and the natural comedown after an exceptionally strong 2023. Basic EPS fell 21.6% to 66.2p, and the return on capital employed dropped from 50.8% to 36.9%.

Although the business remains debt-free with over £21 million in cash and has raised its ordinary dividend by 25%, the absence of a special dividend – compared to last year’s generous payout – may also have weighed on investor sentiment.

CEO Mark Smith pointed to project delays and pricing pressure across the structural steel sector, particularly in the second half of the year, but said Billington was well positioned heading into 2025 with strong cash reserves and a healthy order book. Nonetheless, the weaker headline numbers were enough to trigger a sharp repricing in the shares.

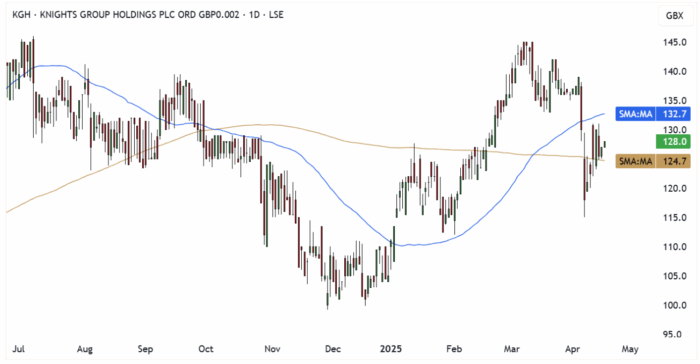

Knights completes IBB Law acquisition

Knights Group (KGH) has confirmed the completion of its acquisition of IBB Law LLP, a full-service regional law firm with offices in Ascot, Beaconsfield, Reading and Uxbridge.

The deal has completed on schedule, following the original announcement made on 3 March 2025.

The addition of IBB expands Knights’ presence in the South East and adds 140 professionals to the Group. IBB also brings expertise in niche areas such as franchising, education, and residential development, complementing Knights’ existing strengths in Corporate, Real Estate and Private Wealth services. Clients and staff alike will now benefit from access to Knights’ wider national platform.

This acquisition supports Knights’ ongoing strategy of driving long-term growth through carefully selected regional deals, enhancing its ability to grow organically by increasing both scale and service breadth.

Renold expects another record year as momentum builds

Renold (RNO) has released a trading update ahead of its full-year results for the 12 months ending 31 March 2025, flagging another year of strong performance. The Board now expects adjusted operating profit and earnings per share to come in ahead of current market expectations—marking the third consecutive year of record results for the industrial chain and power transmission specialist.

Revenue rose to approximately £245.1m, up 3.8% at constant exchange rates, while adjusted operating profit is set to increase more than 6% on the prior year. Operating margins improved to nearly 13%, helped by continued progress in productivity and efficiency initiatives. Order intake reached £250.2m, up from £227.5m last year, with the closing order book holding steady at £83.3m. Although net debt rose to £44.8m, this was largely due to strategic investments including the purchase of land in Cardiff and the acquisition of MAC Chain.

While the global tariff environment remains unpredictable, Renold’s international manufacturing footprint gives it flexibility to manage cross-border challenges. The Group maintains strong customer relationships and believes any additional tariff-related costs will be passed through to customers. Full-year results will be announced on 2 July 2025.

SDI powers up with strategic electric boiler acquisition

SDI Group (SDI) has announced the bolt-on acquisition of Collins Walker Ltd for a net consideration of around £1.85m, expanding its footprint into the fast-growing industrial electric boiler market. Collins Walker, which designs bespoke steam and hot water systems for sectors such as healthcare, distillation and distributed heating, will be integrated into SDI’s Industrial & Scientific Products division. The acquisition adds a profitable, regulation-driven business with strong international revenues and a blue-chip client base.

Collins Walker will operate alongside Applied Thermal Control, an existing SDI portfolio company. The merger is designed to unlock operational synergies through shared back-office functions and increased manufacturing capacity. This move not only strengthens Collins Walker’s ability to scale but also brings intra-group manufacturing opportunities, particularly with LTE Scientific’s autoclave product line. The acquired company reported unaudited FY24 revenues of £0.94m and EBIT of £0.31m.

This acquisition fits neatly into SDI’s proven buy-and-build strategy and is expected to be earnings enhancing in its first full year. With increasing demand for electric solutions driven by Net Zero regulations, SDI’s entry into the electric boiler segment provides exposure to a $255m addressable market. CEO Stephen Brown highlighted the acquisition as a “compelling opportunity” to drive growth through the Group’s established manufacturing capabilities and sector reach.

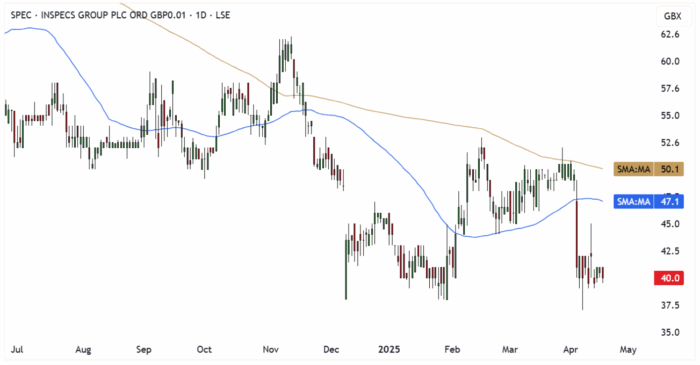

Inspecs eyes growth with efficiency gains and medium-term targets

Inspecs (SPEC) delivered a resilient set of preliminary results for FY24, with revenue down just 2.5% to £198.3m despite softer consumer demand and consolidation in the eyewear sector. Gross margins improved by 130bps to 52.2%, supported by stronger operational efficiencies, centralised procurement, and the completion of its new manufacturing facility in Vietnam. Operating profit edged up to £3.4m, while net debt was reduced to £22.9m.

The Group continued to build strategic momentum, securing distribution for new brands across key US, Canadian and European retailers and completing the integration of its US operations. It also launched Optaro, a smartphone-based video magnifier, and secured pallet programmes with major North American retail chains for delivery in the first half of 2025.

Looking ahead, INSPECS has introduced new medium-term targets, including organic revenue growth 40% above the 3% CAGR market benchmark, double-digit underlying EBITDA margins, and a net debt range of 40–75% of EBITDA. The recently implemented tariffs have introduced some uncertainty, but management expects the impact to be contained through supply chain initiatives and selective cost pass-throughs.

CEO Richard Peck noted that while 2024 was a year of consolidation, the Group has laid strong foundations for scalable growth. Early trading in 2025 is in line with expectations, and the focus remains firmly on driving efficiency and expanding the brand portfolio into global markets.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.