20th Feb 2025. 8.58am

Regency View:

Update

Regency View:

Update

Beeks builds momentum with new exchange win

Beeks Financial Cloud (BKS) has delivered a strong first half of FY25, with revenue climbing 22% to £15.8m and underlying profit before tax rising 31% to £1.8m. The company also reported a positive free cash flow position, maintaining net cash of £6.6m despite a delayed payment of £1.2m arriving in early January. The momentum in its Exchange Cloud offering remains a key driver of growth, with contract approvals and extensions strengthening its foothold in global financial markets.

A major highlight is Beeks’ new partnership with Grupo Bolsa Mexicana de Valores (BMV), the second-largest exchange in Latin America. In collaboration with IPC, a provider of electronic trading solutions, Beeks will deploy its infrastructure across primary and disaster recovery sites in Mexico City. This will enable BMV to offer scalable co-location services, lowering barriers for market participants and driving innovation. The infrastructure is set to go live in the second half of 2025, adding another multi-year recurring revenue stream for Beeks.

This latest win cements Beeks’ reputation as a leading provider of secure and scalable cloud solutions for financial institutions. With four major exchanges now onboard and discussions ongoing with others, the company is well-positioned to build on its success. The Board remains confident in meeting FY25 expectations, supported by a solid business model and increasing adoption of its Exchange Cloud services.

GlobalData moves to Main Market and launches £50m buyback

GlobalData (DATA) has announced plans to transition from AIM to the London Stock Exchange’s Main Market, aiming to enhance its corporate profile and attract a broader investor base. The company believes this move will increase recognition among institutional shareholders and provide greater access to capital. A timeline for the transition will be provided in due course.

Alongside this, GlobalData has approved a £50 million share buyback programme, building on previous buybacks that returned £30 million to shareholders. The programme, managed by Investec Bank, is set to run until August 2025 or until the full amount has been repurchased, with shares being cancelled to reduce overall share capital.

Additionally, GlobalData has extended Chairman Murray Legg’s tenure for up to three more years, despite exceeding the nine-year recommendation under the UK Corporate Governance Code. The Board believes his leadership is vital as the company executes its Growth Transformation Plan, with all directors, including Legg, standing for annual re-election at the upcoming AGM.

FRP Advisory expects strong full-year results, increases dividend

FRP Advisory (FRP) has reported a strong performance for the nine months ending 31 January 2025, with trading across all five of its service areas exceeding Board expectations. The firm’s ability to provide a diverse range of advisory services has driven profitable growth, and its pipeline remains robust. As a result, the Board is confident that full-year results will surpass current market forecasts, with a trading update expected in mid-May.

In line with its commitment to returning value to shareholders, FRP has declared a Q3 interim dividend of 0.95p per share, an increase from 0.9p in the prior year. The dividend will be paid on 13 June 2025 to shareholders on the register as of 16 May.

With a strong balance sheet and sustained demand for its advisory services, FRP remains well-positioned for continued growth. The company’s ability to navigate different stages of the corporate cycle has reinforced its resilience, supporting both financial performance and shareholder returns.

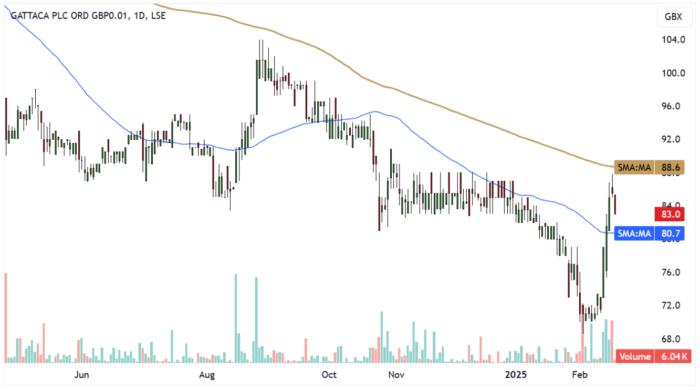

Gattaca maintains resilience amid market challenges

Gattaca (GATC) reported a solid performance for the six months ending 31 January 2025, with net fee income (NFI) of £18.8m, down 3% year-on-year.

Contract NFI declined slightly due to seasonal factors, while permanent NFI fell 10% year-on-year but showed a 3% sequential improvement from the second half of 2024. Statement of Work (SoW) NFI also saw a small decline, impacted by delays in public sector spending. The company has streamlined its operations, reducing total headcount by 12% while focusing investment on sectors with growth potential.

Despite a reduction in net cash to £16.7m, primarily due to lower trade creditors, Gattaca remains confident in its outlook. The company has reaffirmed its FY25 adjusted profit before tax guidance of £3m and expects to declare an interim dividend alongside its results. Days sales outstanding remain stable, reinforcing the group’s financial discipline.

CEO Matthew Wragg highlighted the resilience of Gattaca’s core sectors and the company’s commitment to long-term growth through strategic investments and operational efficiency. While the broader market remains challenging, Gattaca is focused on high productivity, cost management, and maintaining strong client engagement. The company will release its interim results on 2 April 2025.

Jet2 slide as cost pressures and booking trends raise concerns

Jet2’s (JET2) share price dropped sharply this week following its latest trading update, which, while showing solid profit growth for the current financial year, also flagged growing cost pressures and shifting booking trends. The airline and holiday provider expects an 8% to 10% rise in profit before tax for the year ending March 2025, underpinned by a 14% increase in winter seat capacity and resilient demand. However, a later booking trend—seen over the summer—has continued, leading to a 2.2 percentage point drop in the average load factor.

Looking ahead, summer capacity for 2025 is set to rise by 8.5%, boosted by new bases at Bournemouth and London Luton. But the late launch of Luton sales means initial bookings have been weaker, and both new bases are expected to be modestly loss-making in their first year. On top of this, cost headwinds are mounting. Inflationary pressures in hotels, airport fees, and aircraft maintenance are adding to expenses, while regulatory-driven wage increases and the mandated use of sustainable aviation fuel will push costs up by over £45 million next year. Delays in Airbus A321neo deliveries are also likely to increase operational costs during peak travel periods.

CEO Steve Heapy struck a confident tone on long-term demand, reaffirming Jet2’s commitment to its customer-first approach. However, with rising costs and continued uncertainty around booking patterns, profit margins could come under pressure in the year ahead—something investors appear to be pricing in.

Serica Energy faces production delay at Triton FPSO after storm damage

Serica Energy (SQZ) has suspended production from the Triton FPSO following damage caused by Storm Éowyn in late January. The storm triggered an automatic shutdown when sea spray activated the fire and gas detection system. While production briefly resumed on 28 January, subsequent inspections revealed minor damage to a cargo tank. Further complications arose when operator Dana Petroleum identified an integrity issue with the inert gas line required for purging the tanks, delaying necessary repairs. Serica is working closely with Dana to resolve the issue, with production now expected to restart in mid-to-late March.

In parallel, work continues on Triton’s second gas compressor, which remains on schedule for completion by the end of Q1. The joint venture has also received the final draft of an engineering study assessing the potential to extend the FPSO’s operational life until 2040. The report confirmed that, with continued maintenance and upgrades, Triton could remain productive well into the next decade. However, the planned summer maintenance shutdown, originally scheduled for 40 days, is now under review.

Despite the Triton setback, Serica reported strong production from its Bruce Hub assets, capitalising on robust gas prices, with February’s NBP prices averaging 134p/therm. January’s total production averaged 37 kboepd, while February has so far averaged 27 kboepd. As a result of the ongoing Triton issues, the company is reviewing its 2025 production guidance. CEO Chris Cox expressed frustration over the disruption but reaffirmed Serica’s commitment to working with the operator to improve Triton’s long-term reliability.

Totally faces NHS 111 contract loss but maintains confident FY25 outlook

Totally has announced that its NHS 111 National Resilience support contract, valued at around £13 million, will not be renewed by NHS England and will end on 15 February 2025. This decision aligns with NHS England’s shift away from providing resilience services at the national level. While the contract’s expiration will impact the 2026 financial forecast, the company remains confident that its FY25 performance will align with expectations of £85 million revenue and £3.5 million EBITDA, as the business continues to perform well in other areas.

The company plans to redeploy its workforce and pursue new contracts to offset the loss of the NHS 111 contract, although exceptional costs are anticipated. Totally highlighted its success in supporting NHS 111 providers, answering over one million patient calls, and ensuring the NHS’s ability to deliver safe, responsive services. Despite the contract loss, Totally continues to work with NHS commissioners, including Ambulance Trusts, to meet the demand for telephony, online, and clinical assessment services.

With ongoing support for NHS 111 services and a strategic focus on independent providers’ role in the NHS’s future, Totally looks forward to contributing to the NHS’s long-term planning and addressing increasing demand in urgent care. The company’s strong performance in other areas positions it well to navigate the challenges ahead, including potential new business opportunities.

TPXimpact faces market slowdown, but confident outlook for future growth

TPXimpact’s (TPX) share price gapped lower last week after the company released a Q3 trading update that failed to meet the market’s expectations.

Despite confirming that Q3 performance had aligned with management’s forecasts, the company highlighted several headwinds in its Digital Transformation business, which have dampened investor sentiment. While TPXimpact reported securing £65 million in new business in the first nine months of the year, including £30 million in Q3 alone, the company’s outlook for the remainder of FY25 has been significantly impacted by broader macroeconomic conditions. These conditions, particularly the uncertainty surrounding the post-election budget and the delay of the comprehensive spending review, have resulted in delays to large public sector digital transformation programmes and a slowdown in new business wins.

The market had hoped for a stronger return to growth in Q4, but TPXimpact now expects its Digital Transformation business to face a lower-than-expected acceleration in volume. As a result, the company has revised its full-year revenue expectations, forecasting an 8-10% decline in revenues compared to FY24. While the company’s Adjusted EBITDA margins are projected to improve by 1-2% year-on-year, driven by the restructuring efforts earlier in FY25, the reduced growth outlook has left investors cautious. The delay in public sector spending decisions, coupled with constraints such as the increase in employer National Insurance Contributions, are creating a more challenging environment for the company as it heads into FY26.

However, despite these short-term challenges, TPXimpact has maintained its optimism regarding long-term growth prospects. The company’s new business pipeline remains strong, and it expects market conditions to normalise once the comprehensive spending review is completed in mid-2025. TPXimpact is also confident in the ongoing demand for digital transformation services, particularly as the government focuses on improving public services and driving efficiencies through technology. With its simplified business model, strong customer relationships, and in-demand capabilities, TPXimpact believes it is well-positioned to capitalise on future growth opportunities once the broader economic climate improves.

Wynnstay posts solid results despite challenging conditions

Wynnstay’s (WYN) 2024 final results reflect a year of tough market conditions, but they still managed to deliver strong cash flows and a robust balance sheet.

Revenue fell to £613.1m from £735.9m the previous year, primarily due to commodity deflation, which accounted for a substantial portion of the decrease. Gross profit remained stable at £79.2m, while adjusted operating profit dropped by 23% to £7.9m, impacted by higher administrative expenses and lower activity in Feed and Grain. Despite these challenges, the group’s net cash position improved to £32.8m, reflecting good cash generation.

On the operational side, Wynnstay reorganised its business into three segments: Feed and Grain, Fertiliser and Seed, and Depot Merchanting. The Feed and Grain segment saw a decline in profits due to a poor harvest and lower poultry feed volumes, while Fertiliser and Seed profits were hit by prolonged wet weather. However, Depot Merchanting delivered solid results, with margins improving despite higher costs. The group also launched Project Genesis, a three-year transformation programme aimed at enhancing operational efficiency and driving future growth.

Looking ahead, Wynnstay is cautiously optimistic about FY25, expecting an improved performance due to operational improvements and the early benefits from Project Genesis. With farmgate prices supporting farmer sentiment and the group’s strong cash flow generation, Wynnstay is well-positioned for a recovery in the year ahead, despite ongoing uncertainties around government policy transitions.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.