14th Nov 2024. 8.59am

Regency View:

Update:

Regency View:

Update:

Craneware sees strong revenue growth

Craneware (CRW) delivered a strong performance for the latest period, with revenues rising by 12% year-on-year to £100 million, driven by robust demand for its healthcare software solutions.

Adjusted operating profit also increased by 15%, reflecting efficient cost management alongside higher sales. The company has benefited from its expanding client base, which includes leading healthcare providers in the U.S., contributing to recurring revenue streams.

The healthcare sector’s ongoing push for cost optimisation has positioned Craneware as a reliable partner, and the company’s strong backlog suggests a promising pipeline for the coming quarters.

Looking ahead, Craneware is set to build on its momentum, with strategic investments in product development expected to drive further growth. The company is forecasting an additional 10-12% growth in revenue for the next fiscal year, which would push total revenue beyond £110 million. Its high customer retention rate and focus on expanding its software solutions provide a solid foundation for sustained profitability.

Nexteq faces market setback despite long-term potential

Nexteq (NXQ) reported a 6% revenue increase to £45 million for the period, but its net profit margin was squeezed to 8%, down from 12% a year earlier, primarily due to rising operational costs and investments in new product development.

Despite this, the company’s diversified portfolio and expanding partner network remain key growth drivers. Nexteq’s software solutions are gaining traction, particularly in emerging markets, where demand for its products is expected to accelerate. The company is working to improve its cost efficiency and streamline operations, with plans to reduce overhead costs by 5% over the next year.

Looking forward, Nexteq aims to boost its operating margins back to double digits by focusing on its core product lines and leveraging new technological investments. The company is expecting revenue growth of 8-10% for the next year, driven by new product launches and expanding sales in underpenetrated international markets.

Despite short-term margin pressures, the company’s strategic initiatives, such as its push into automation and artificial intelligence, offer significant upside potential. We remain confident in Nexteq’s ability to return to growth and improve its profitability over the medium term.

Sylvania Platinum jumps on solid performance

Sylvania Platinum (SLP) reported a 15% increase in revenue to $100 million for the last fiscal year, driven by a 10% rise in the average platinum group metal (PGM) prices.

The company’s operational performance also improved, with production increasing by 8% year-on-year to 75,000 ounces of PGMs, and adjusted operating profit rising by 18%.

Sylvania’s strong operational efficiency, combined with favourable market conditions, has contributed to a healthy bottom line, with net profit reaching $15 million, a 20% increase from the previous year. With PGM prices expected to remain strong, Sylvania is well-positioned to capture additional value in the coming year.

Sylvania is targeting further growth by expanding its production capacity and exploring new PGM assets. The company is forecasting a 12-15% increase in production next year, targeting 85,000 ounces of PGMs, driven by ongoing efficiency improvements and strategic investments in its assets.

With PGM demand expected to remain robust, particularly from the automotive sector, Sylvania’s strategy of increasing output while keeping costs under control is likely to drive continued growth.

Synectics expands AI capabilities and secures major National Grid contracts

Synectics (SNX) has made significant strides with the launch of Synergy DETECT, a new AI-powered tool within its Synergy software suite.

This addition expands the product offering to twelve AI-driven tools, enhancing real-time threat detection and analysis capabilities. Fully customisable to meet specific security needs, Synergy DETECT helps organisations anticipate and respond to threats proactively, positioning Synectics as a leader in the growing market for AI-driven security solutions.

In addition to the product launch, Synectics has secured new contracts under its ongoing framework agreement with National Grid, valued at approximately £2.2 million. These contracts, which expand the company’s services to 12 more UK sites, increase Synectics’ presence to 32 sites within National Grid’s estate. The work will be managed by Ocular Integration, Synectics’ division specialising in critical infrastructure security.

These developments highlight Synectics’ continued growth, driven by innovation and strong customer demand for advanced security solutions. With a proven track record and expanding contract wins, Synectics is well-positioned to capitalise on the increasing need for AI-powered and scalable security systems across key sectors.

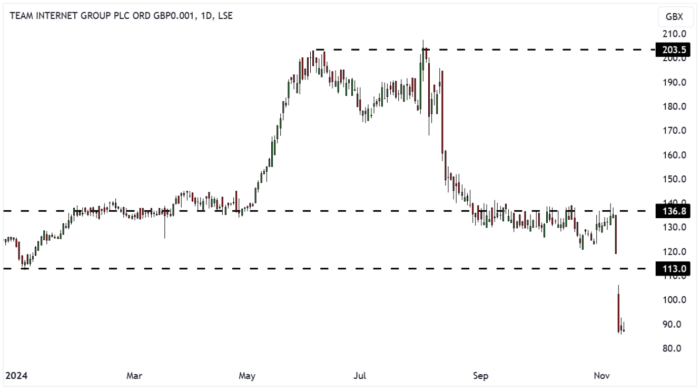

Team Internet faces setback as new technology ventures struggle

Shares in Team Internet Group (TIG) have taken a tumble in recent sessions following disappointing quarterly results and concerns over its slow progress in expanding into new technology markets.

Despite reporting a modest 7% increase in revenues to $55 million, the company’s net income saw a 4% decline, largely due to rising operational costs and underwhelming returns from its new technology investments.

The company’s core domain and hosting services continue to generate steady income, but the slower-than-expected growth in its expansion into new areas like cloud services and digital security has led to investor concerns about its long-term growth trajectory.

In addition to the underperformance in its new technology ventures, Team Internet faces increased competition in the highly competitive domain services sector, which is putting pressure on its margins. To counter this, the company has been focusing on enhancing its product offerings and building a more scalable platform, but these efforts have yet to materialise into significant profitability gains.

Despite the current setback, Team Internet’s solid customer base and ongoing investments in improving customer experience and operational efficiency remain a positive factor. The company has announced plans to streamline its operations further, targeting a 3-5% reduction in costs over the next year, which could help improve its profitability in the near term.

Looking ahead, Team Internet is banking on the continued expansion of its technology services, particularly in international markets, to drive future growth. The company expects revenue growth of 8-10% for the next year, primarily through new product launches and market penetration.

Water Intelligence expands with strategic Dallas acquisition

Water Intelligence (WATR) reported strong revenue growth of 18% to $70 million, driven by the successful reacquisition of its Dallas franchise and an uptick in demand for water leak detection solutions.

Adjusted operating profit also grew by 20%, reflecting the scalability of the company’s business model and the strategic investments it has made in expanding its market presence. The Dallas-Fort Worth metroplex continues to be a key growth area for the company, with Water Intelligence benefiting from synergies between its Dallas and Fort Worth locations. The appointment of Will Knell as CEO of American Leak Detection (ALD) adds further depth to the leadership team, ensuring continued focus on operational excellence and growth.

Water Intelligence is forecasting 12-15% revenue growth for the next year, driven by further expansion in North America and additional acquisitions. The company is also planning to relocate the headquarters of ALD to Dallas in 2025, which is expected to strengthen its position in the U.S. market.

With its strong balance sheet and a clear strategic plan, Water Intelligence is well-positioned to capitalise on the growing demand for water infrastructure services, particularly in the U.S. where aging infrastructure and increased focus on water conservation continue to create opportunities for growth.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.